EU ban on export may be lifted in 4 to 6 weeks; 'War' will create pressure on the waste paper supply chain

EU ban on export may be lifted in 4 to 6 weeks; ‘War’ will create pressure on the waste paper supply chain

- If the market does not see a correction in the price sooner than later, then the Indian Kraft paper mills will most likely see further shut downs and/or lesser production

Find the exclusive Straight talk with Mr. Marc Ehrlich, CEO, VIPA Group over the global waste paper crisis, trend, and future anticipation in Indian perspective.

21st March 2022 | The Pulp and Paper Times:

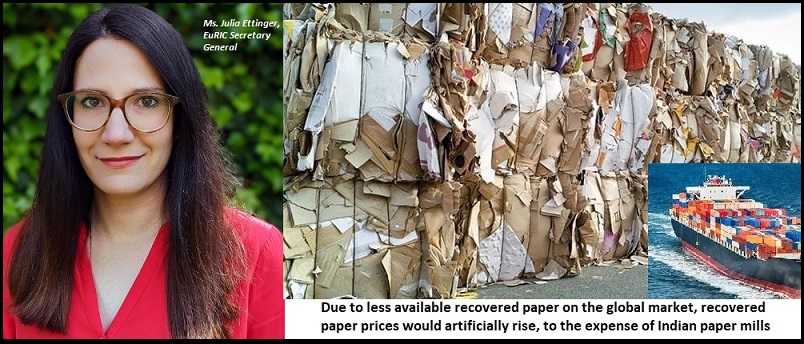

Q: What is the status on the EU Ban to export of waste paper to India?

This will take at least another 4 to 6 weeks to sort out due to Legal Procedures which need to be completed before the EU can pass the amendment.

Q: US OCC is already crossed to $400 MT to Indian Port, how do you predict the future scenario?

The prices are at an all time high due to consistent local demand by the mills in the US and Europe and shortage of fibre. High freights are not helping the situation either. Mills have however been able to pass on these costs to their end customers and we believe this situation will continue for a couple of months more at least.

Q: Will the Russia and Ukraine war will create pressure on the waste paper supply chain in Europe, if yes, may the price of OCC further escalate?

Yes, If the war continues any longer, we see several issues which will directly and indirectly affect the waste paper supply world over. Majorly this would be two issues- Shipping freights and equipment availability.

Shipping – Movement of vessels will be re-routed with avoidance of war zones. Which will cause delays. Containers at some ports of Ukraine might be stuck indefinitely. Which will cause a shortage in space and further have a cascading affect, similar to what we have observed during the first lockdown due to the Pandemic. Containers in Russia might be stuck due to the sanctions levied by different countries on them presently. Leading to equipment shortage. And the increase of crude oil is already being felt in the transportation industry.

Q: Do you think the next three months will be crucial form Indian paper mills in terms of procuring the Imported OCC?

If the market does not see a correction in the price sooner than later, then the Indian Kraft paper mills will most likely see further shut downs and/or lesser production. The demand for the Kraft Paper seems to have softened and hence these mills are already working In the red zone. In addition, there is a tremendous shortage of fibre locally adding to the higher demand for imported OCC.

Q: High shipping costs are also one of the prominent reasons behind waste paper procurement. Indian paper mills are cutting down their production 2 to 3 days in a week, How do you see this situation, when it will get back on track?

Shipping prices have seen a 300% increase from some parts of the world during the second wave of the Pandemic already. Imports from certain countries like Australia have already been stopped to India. With the third wave coming to an end, we were hoping for some drop in shipping freights but due to the war and its unpredictability, and very high fuel costs, it seems we are left in a conundrum of sorts.

Web Title: EU ban on export may be lifted in 4 to 6 weeks War will create pressure on the waste paper supply chain

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit)