CRISIL: High raw material prices to weigh on margins, domestic paper packaging firms anticipate 5-7% sales growth in FY24-25

CRISIL: High raw material prices to weigh on margins, domestic paper packaging firms anticipate 5-7% sales growth in FY24-25

- Paper packaging volume to grow, but profitability to plumb lows, High raw material prices to weigh on margins; modest leverage to support credit risk profiles

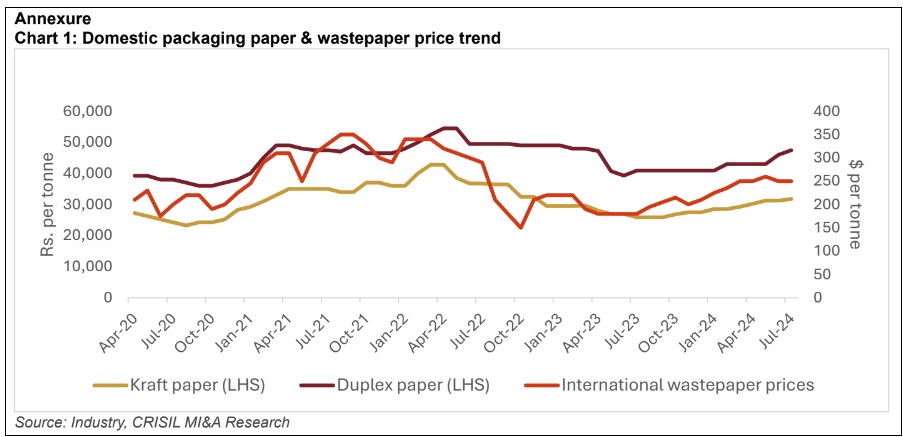

- Kraft paper prices have increased by only ~10%, while the industry has witnessed a significant ~25% increase in the international wastepaper price to ~$230 per tonne

- Demand is expected to improve from both, rural consumers, as a better monsoon benefits agricultural output and incomes, and urban markets, because of higher disposable income

The Pulp and Paper Times:

Domestic paper packaging companies are likely to see sale volumes grow 5-7% on-year this fiscal, up from ~3% last fiscal, due to improving demand from end-user industries. This modest uptick in growth will be gradual and more visible in the second half of this fiscal.

Realisations on the other hand, may not keep pace with raw material prices, driving down paper packaging companies’ operating margins by around 100 basis points to their lowest level of ~8% this fiscal, as compared to a decadal average of 11-13% and ~9% last fiscal.

That said, capital expenditure (capex) is expected to remain modest, and will be largely for debottlenecking and modernisation, given the adequate capacity. This will keep debt under control, aiding the overall credit risk profile.

A CRISIL Ratings analysis of 72 paper packaging companies, accounting for about half of the sector’s volume, indicates as much.

Packaging paper, mainly comprising kraft paper and duplex board, is used to pack pharmaceuticals, e-commerce goods, consumer durables, fast-moving consumer goods (FMCG) and readymade garments.

Says Aditya Jhaver, Director, CRISIL Ratings, “We believe the volume growth this fiscal will be led by increased consumption in the FMCG, pharmaceuticals and consumer durables segments, which together comprise 55-60% of the demand for paper packaging. Demand is expected to improve from both, rural consumers, as a better monsoon benefits agricultural output and incomes, and urban markets, because of higher disposable income.”

Kraft paper prices have increased by only ~10% between October 2023 and July 2024, while the industry has witnessed a significant ~25% (Compared to April-September’23 prices) increase in the international wastepaper (the key raw material) price to ~$230 per tonne due to higher freight costs and supply delays amid geopolitical uncertainties.

Says Gaurav Arora, Associate Director, CRISIL Ratings, “Paper packaging companies may pass on these higher wastepaper prices only gradually to end-user industries, given the modest recovery in demand and high competition from cheaper imports. However, moderation in coking coal price (~15% of total cost), will offer some respite, thus limiting the extent of profitability decline to ~100 bps this fiscal.”

Amidst weakening of profit margins, players have opted to not scale up capacities, as a result, utilisation is expected to improve to ~90% this fiscal from ~85% last year. Thus, leverage of paper makers rated by CRISIL Ratings as denoted by the debt to Ebitda (earnings before interest, taxes, depreciation and amortisation) ratio will likely remain comfortable at below 2 times (similar to last fiscal).

That said, delayed recovery in end-user consumption or adverse movement in input prices could pose downside risks and will bear watching.

Web Title: CRISIL: High raw material prices to weigh on margins, domestic paper packaging firms anticipate 5-7% sales growth in FY24-25

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)