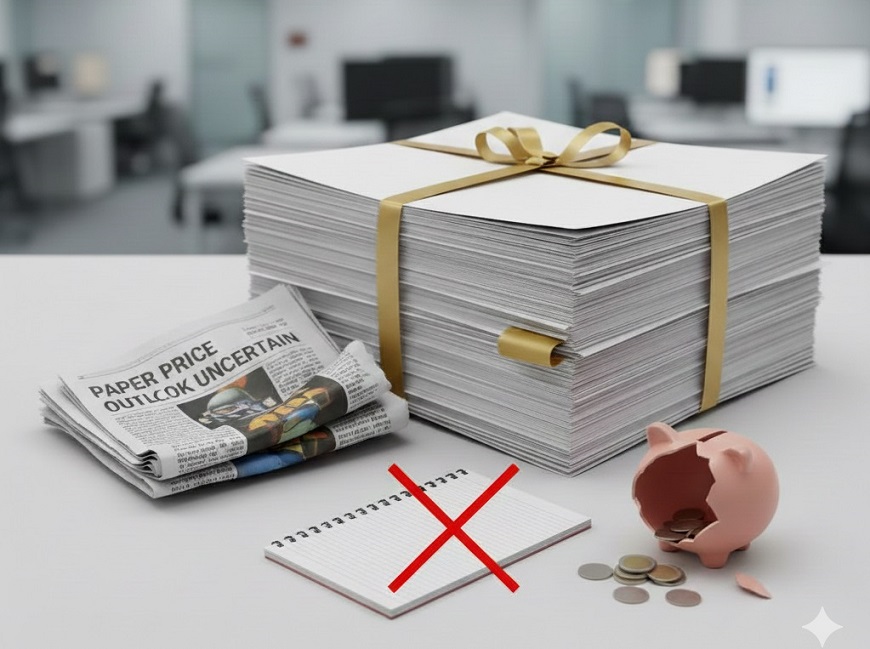

GST 2.0: Paper at par with luxury items, Paper price outlook uncertain; Industry refrains from promoting paper sale for notebooks to prevent ITC reversal

GST 2.0: Paper at par with luxury items, Paper price outlook uncertain; Industry refrains from promoting paper sale for notebooks to prevent ITC reversal

- Inverted Duty Structure Puts Indian Paper Mills at Risk, Say Industry Leaders

- “GST 2.0 Has Disappointed Us”: JK Paper President Flags Serious Anomalies in New Tax Structure

- Some notebooks and exercise books manufacturers are thinking to buy at full rate of tax and increase the price in the market so that there are no complexities

The Pulp and Paper Times

The paper industry continues to operate in a challenging environment, characterized by elevated input costs, particularly for wood, and subdued realizations amid persistent inflow of low-priced imports. These pressures have impacted margins across the sector despite steady demand and improved sales volumes. The situation has been further compounded by recent changes in the GST rates, with tax on paper and boards rising from 12% to 18%, while converted products such as mono-cartons and corrugated boxes have been reduced to 5%. And in relation to the paper industry, notebooks and paper for notebooks have been made nil rated, resulting in an inverted duty structure.

This has led to higher working capital requirements, blockage of input tax credit, and increased vulnerability of domestic manufacturers to cheaper imports that are not subject to similar embedded taxes.

In an exclusive talk, Mr. A. S. Mehta, President and Director of JK Paper, said, “At the outset, GST 2.0 reform has disappointed the Paper Industry as we were expecting the overall rate of GST on paper would come down from 12 to 5%, whereas to our utter surprise it has been increased from 12 to 18%. It is a matter of surprise as the Govt. has kept paper at par with luxury items like vehicles, AC, etc., whereas in a country like ours, paper is a basic need. The GST Council’s decision to create a dual structure will invite a lot of litigation as well as enhance the nil rate of GST in the market.

“The two-tier GST structure has certainly created anomalies. For example, while notebooks and exercise books are taxed at 5%, the writing and printing paper used to make them attracts 18%. This mismatch creates both compliance challenges and competitive distortions.

The industry is engaging with policymakers to highlight these inconsistencies. Over time, it is expected that the slab structure will be rationalized to reflect the full value chain fairly. Until then, companies like BILT must work within the framework, ensuring compliance while protecting customer interests,” Dr. Alok Prakash, Executive Director & CEO of M/s Ballarpur Industries Ltd. (BILT), told The Pulp and Paper Times.

“Yes, there will be some disruption in the market, and we are seeing the same, and it will continue to do so till the Govt. takes urgent immediate action. I also hear that some notebooks and exercise books manufacturers are thinking to buy at full rate of tax and increase the price in the market so that there are no complexities by the Regulators and the Inspectors from the GST Dept.,” Mr. Mehta said.

On paper price increase because of the inverted duty structure, Mr. Pavan Khaitan, VCMD of Kuantum Papers, said during the Q2FY26 conference call, at the moment, there is no scope for any kind of price increase. And in fact, what is happening is that the government is pushing the entire industry to pass on the entire benefit of the GST reduction. So, they are also sort of trying to monitor that we pass on this entire benefit to the customers. So, it is not going to be easy passing on increases, even though there is going to be an impact of higher cost of input tax credit that we will need to reverse. So, that is something that we are still debating on, how we take impact of that and sort of take a call accordingly.

Mr. Mehta further stated that it is going to be very difficult to ensure that the paper is used only for the purpose of note and exercise books when it is supplied at NIL rate of GST. It may take some more time before there will be some amount of maturity in the process and the systems to get used by the manufacturer of the note and exercise books.

“We are trending very good on volumes going forward. It is just that the market landscape will need to change for us. We have taken the cautious call of not really promoting paper sale for notebooks.

“All we are doing as a strategy is that we are concentrating on sectors which do not require us to push out paper for notebooks, therefore preventing our sort of input tax credit reversal as well. And I think a big step in this direction will actually come when we upgrade our PM3, which will happen by next year. We, in any case, will be offset by not needing to sell in the notebook segment because our paper qualities on that machine will be such, it will allow us to make more volumes of Maplitho grades and enter an entirely different product segment,” Mr. Khaitan said.

“This is a major anomaly created by the GST Council without realizing the impact on the domestic paper manufacturer. When the paper is sold on NIL rate of GST, the domestic manufacturer will have to reverse the input tax credit, whereas such reversal will not be required for importers or the overseas manufacturers. In view of this, the domestic industry will not be competitive, and it will not get a level playing field. By doing this, again the Govt. is encouraging imports, which will be totally against the theme of ‘Atma Nirbhar Bharat’ and ‘Vocal for Local’,” Mr. Mehta concluded.

Web Title: GST 2.0: Paper at par with luxury items, Paper price outlook uncertain; Industry refrains from promoting paper sale for notebooks to prevent ITC reversal

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)