Shreyans Industries reviews performance and plans capital expenditure to enhance quality and cost effectiveness

Shreyans Industries reviews performance and plans capital expenditure to enhance quality and cost effectiveness

-The demand and overall market for writing and printing paper remained reasonably good almost throughout the FY 23-24.

The Pulp and Paper Times

Shreyans Industries Limited (SIL) is operating with a wide product mix with well accepted quality in the market based on non-conventional raw materials. SIL has reported a major jump in its net profit after tax for FY 23-24. Net profit after tax stood at INR 87.42 crores against INR 73.46 crores of last year.

SIL continued to strive for maintaining market leadership in agro based writing & printing paper category with the support & cooperation of its business associates and committed team of professionals & workforce. The Company initiated certain steps for continual improvement in quality, product development and cost optimization on sustainable basis.

During the year under review, SIL achieved a production of 89466 MTs as against 92996 MTs in the previous year. Total revenue of the Company was INR 734.15 crores against INR 871.04 crores of last year. Profit before interest & financial charges and depreciation stood at INR 132.57 crores. Net profit after tax stood at INR 87.42 crores against INR 73.46 crores of last year. Following the last year's robust performance riding on good demand of paper & higher sales realization, SIL has done fairly well in the current year as well on due to comparatively lower input costs like raw material, fuel and chemicals. The demand and overall market for writing and printing paper remained reasonably good almost throughout the financial year. This helped in sustaining the profitability during the year under review.

“There are a few positive developments for the paper industry in India. Some of the mega trends influencing the paper industry such as rapid urbanization, increase in disposable income and sustainable trends augur well for the paper industry. After recording sterling performance during the last two financial years, we hope to continue the journey in FY 2024-25 too. Implementation of National Education Policy (NEP) 2020 and Samagra Shiksha Scheme along with other measures by Indian Government in field of education should lend considerable boost to the demand for writing and printing paper and consequently expectations of a good year ahead,” the annual report for FY 23-24 said.

PERFORMANCE REVIEW

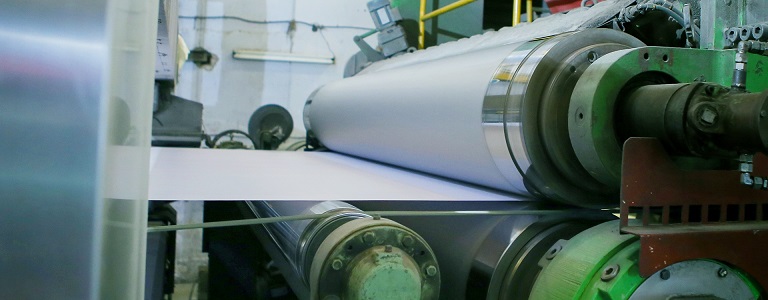

The market for paper remained bullish to stable during the year. The continuous demand for writing and printing paper segment led to sustained price line and consequently better margins. To meet the ever growing and changing requirements of the market for quality, serviceability etc, and to match the industry competition, SIL embarked upon some initiatives for technical upgradation, automation and increase in machine speed for higher productivity in both the Units. The unit wise performance of the Company is described as under:

SHREYANS PAPERS

Total production of paper in this unit was 50883 MTs, which was slightly lower as compared to last year figure of 51721MTs. The minor decrease was due to lower GSM. Capital expenditure includes Steam & Condensate system, Closed hood and pocket ventilation for paper machine. The above major projects are expected to be commissioned in 1st quarter of FY25. This will help the unit to further improve its operations in terms of quality and overall energy efficiency. Besides above, capital expenditure towards balancing facilities and essential.

SHREE RISHABH PAPERS

Total paper production in this unit was 38583 MTs which was lower as compared to last year's production of 41275 MTs. The decrease in production was due to lower GSM. New Rewinding Machine with increased automation features to reduce converting losses & higher finished production was commissioned &started yielding desired results. Besides some other steps were taken for streamlining the working and improve productivity & efficiency from current levels. It is expected to derive benefits of the same in the next financial year.

FUTURE PLANS / PROSPECTS

Proposed capital expenditure have been discussed while reviewing the performance of both the units. Capital expenditure planned will help the Company in improving its operations in terms of quality and operating parameters along with cost effectiveness.

The demand of paper during the year remained fairly good riding over lower prices. However, matching decrease in input costs helped the company in achieving healthy bottom line.

We moved into FY25 under almost similar market conditions. However, a couple of months in summer are usually considered lean from demand point of view. As such, demand for paper has become sluggish, forcing the mills to liquidate stocks at further lower prices. This may not have much bearing on results in the current year because input costs are equally supportive. Barring unforeseen circumstances, it can be cautiously forecasted that the FY 25 should be better for the company. SIL shall continue to focus on improvisation in technology and up gradation of equipments to achieve sustainable growth.

Web Title: Shreyans Industries reviews performance and plans capital expenditure to enhance quality and cost effectiveness

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)