Global pulp industry set to expand: Surge in new market pulp production units promises boost in supply over the coming years

Global pulp industry set to expand: Surge in new market pulp production units promises boost in supply over the coming years

“There are multiple raw materials required and it's not possible to become self-reliant for all of these varieties”

“The producers shall shift more and more towards green energy sources and lots of R&D is going on like hydrogen as alternate fuel, carbon storage, Space Solar Farm project etc”

With 20 years of experience in the pulp and paper industry, Rajat Sarkar is currently working as Research Manager ( Asia Pacific) at ResourceWise, a leading business intelligence consulting firm that supports the industry's best practices with a unique combination of rich marketplace data, powerful analytics, and expert consulting. Rajat leads the data research and validation for the Asia Pacific region, covering India, China, Indonesia, Japan, Korea, and rest of Asia. He ensures the accuracy, reliability, and timeliness of data and insights that inform clients' decisions and actions.

In an exclusive interview with The Pulp and Paper Times, Mr Rajat Sarkar shares his thoughts on several topics, including financial uncertainty in global economy, pulp price scenario, and excess capacity issue in India. Here is the whole interview he gave.

The Pulp and Paper Times

Q: Please give us a small introduction of ResourceWise (RW)

ResourceWise provides data, analytics, and consulting services for a robust range of natural-resource-based commodity industries, including forest products, low-carbon feedstocks and fuels, and chemicals. For decades, our legacy brands have focused on one mission: to help our customers make exponentially better decisions by providing them with the most accurate data and analytics available in the market.

Q: Restricted export, Financial uncertainty in the global economy, coupled with fluctuations in exchange rates and tightening financial market regulations may have an adverse effect on the Pulp and Paper market, availability of financing from banks and capital markets and could reduce the investment appetite of process industry’s customers. How does RW see this situation?

Based on current scenario we can foresee a demand slowdown in the coming few quarters. However, rapid penetration of internet and smart phones has increased online retailing in emerging economies such as China, India, Brazil, Southeast Asian Countries and others. Consumers at an younger age are buying items of daily need online. According to brand equity foundation online shoppers are projected to reach 220 million by 2025.

Paper packaging is lightweight & convenient for logistics. Also, the increasing need for sustainability in retail packaging to reduce the adverse effect of plastic packaging waste will push the demand for paper-based packaging products. Therefore, with rapid online retailing corrugated boxes, packaging coated board and packaging bag demand is expected to increase in next decade.

Q: The paper has already become obsolete in many ways. and transmission and storage of information are done with digital technology. Writing and Printing paper production is gradually decreasing. What is your long-term view over WPP demand and its usage, what growth rate do you assume in this decade?

As mentioned already, due to increased adoption of paper-based packaging materials the wrapping & packaging is projected to lead the paper market. Other significant sectors are sanitary segment backed by rising disposable income and awareness of personal hygiene in emerging economies. Printing & writing segments are declining in developed countries due to increased focus on digitization.

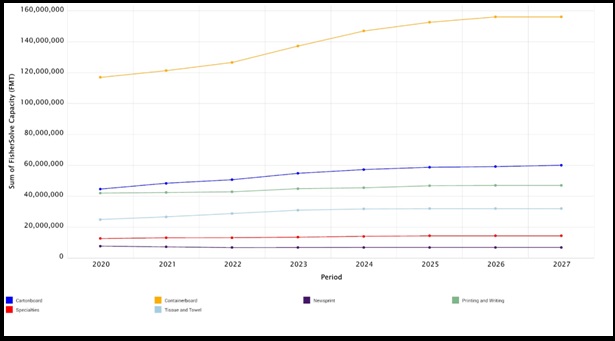

Please refer the growth projections based on announced capacities for different grades over next few years for Asia Pacific. Container board and carton board are two most promising grades amongst all.

Q: Please describe the Pulp prices scenario in the coming months. How will it impact the profitability of paper mills?

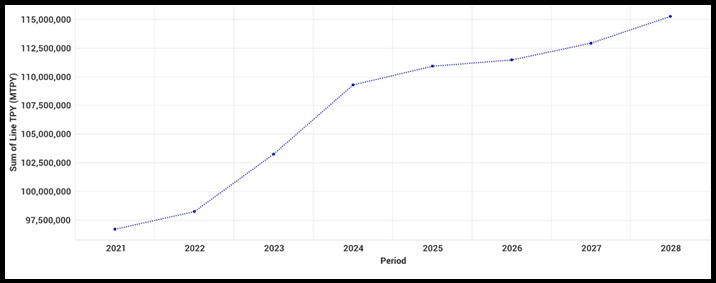

To give a brief overview, currently the pulp scenario is clearer than last 2-3 years as post covid logistical and economic turmoil has subsided. This year the pulp inventory has gone up at many market pulp production facilities due to the oversupply of market pulp, this resulted close down of some renowned pulp production facilities. Based on the current announcements, quite a few new market pulp production units are going to start (refer graph below) in coming years which will even increase the supply of global market pulp.

This oversupply will only ease if the economy of US and China is going back on track and end consumers increase their spending on consumables resulting to overall paper and packaging demand increase. As this is always a cycle, we expect next cycle is going to be better and the demand will surely rise. Till then pulp prices will be competitive as it is now.

Q: Excess Capacity and drop in Exports have made the paper market sluggish. Many new capacities are coming up in Europe and Southeast Asia, which may further impact the market; how do you take this excess capacity issue?

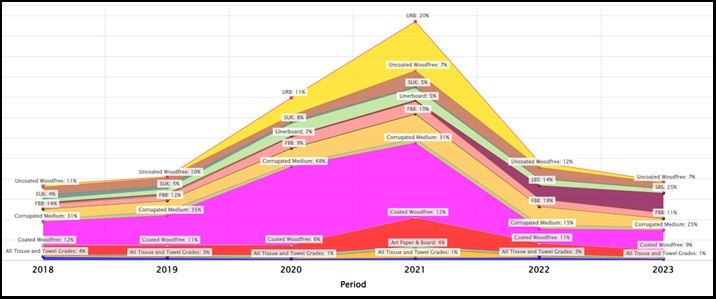

Assuming this is in Indian context. Indian exports is phenomenal in 2020 and 2021 which is because of Covid and restricted pulp and paper production globally. This has to subside which has occurred in 2022. The export is better in 2023 if you consider the volume till November 23. India pulp and paper producers has to work on the quality and quality consistency for making it fit for Global market. We see there is good opportunity in packaging, hygiene and specialty sector, which India has to grab with competitive price and right quality in the years to come.

Q: Staying ahead of the competition in the pulp and paper industry requires insightful decision-making and swift action. How does the Optimization in the Pulp and Paper Industry benefit the paper makers?

Absolutely right. Timely decision making is the key. ResourceWise team can support Indian pulp and paper producers to make strategic decisions supported by deep data and expertise, business intelligence from ResourceWise. These inputs can strategically turn this complex market uncertainty into in-depth insight and provide options for right strategy to choose from. We can help the producers to leverage their strengths and opportunities and mitigate their supply chain, operational and environmental risks.

Q: How does Resource Wise overlook to the sustainability and price movement of Indian Paper Mills ( in WPP) and as well as the market sentiments?

This has to be dealt on case-to-case basis. A general rule is not applicable for every producer and business as the end products, Asset base, target market and market positioning is completely different for different companies. In general writing printing grade will be going to decline over a period of time due to more interest and dependency to digital medium. Specifically for Indian this process will get prolonged as there is strong growth in literacy and paper is used for basic education systems.

Q: The Indian Paper industry has emphasized much on enhanced plantation activities to decrease the security of raw materials and to compete with international businesses. How does RW evaluate pulp or fiber production in India and its efforts to become self-dependent in pulp generation?

It is a very good initiative. We have to understand, for making quality paper and board, there are multiple raw materials required and it's not possible to become self-reliant for all of these varieties. For sure, the dependency can be reduced to a great extent and that will be a great achievement towards business sustainability alongwith generating livelihood for the local farmers.

Q: what is your quick review of the present recovered paper trade market scenario about the demand and supply dynamics of waste paper?

Waste paper demand follows paper demand. If the finished paper demand is high then the waste paper demand shall follow and vice a versa. We would expect to improve the waste paper collection process of India with the improvement in social structure, there is a good potential. Due to awareness and focus on reduced carbon emission, sooner or later US and European paper producers may utilize maximum waste paper to produce finished grades which in turns can create a short fall for countries like India. Increasing self-sufficiency for recycled paper through efficient collection system is the need of the hour.

Q: What major structural changes do you foresee in the forest products industry?

We foresee two major changes. One is the source of energy and the other is optimization of process through artificial intelligence & machine learning. The producers shall shift more and more towards green energy sources and lots of R&D is going on like hydrogen as alternate fuel, carbon storage, Space Solar Farm project etc. to name a few. Similar process is going on through AI and this is already getting implemented and producers are getting benefit of autonomous fault corrections in operation and quality improvement process.

Q: What is RW’s prediction for the overall growth of the Paper industry in the next five years, segment-wise?

The global pulp and paper market was valued at 360 billion U.S. dollars in 2022.The market is projected to register a compound annual growth rate (CAGR) of 0.72 percent from 2022 to 2029 to reach a value of roughly 375 billion U.S. dollars.Please refer the graph in the answer of Q3 for segment wise capacity projection.

Web Title: Global pulp industry set to expand: Surge in new market pulp production units promises boost in supply over the coming years

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)