Newsprint, Pulp, and Waste Paper Scenario in India

Newsprint, Pulp, and Waste Paper Scenario in India

The below article is written by Mr Aseem Bordia, who is the Immediate Past President of the Federation of Paper Traders Association (FPTA) for the year 2022-2023. The views are personal; Mr Bordia shares his views on the export of paper, Waste paper scenario, the Quality of Indian paper products and the present state of the Indian Paper Industry exclusively with The Pulp and Paper Times. Views are personal.

Waste Paper and Pulp Scenario:

According to the IPMA website India is a wood fibre deficient country. The demand for pulpable wood is about 11 million tons presently which shall reach 15 million tons by 2024-25. The availability is 9 million tons. The Waste paper collection/ recovery mechanism is not very strong. The Recovery rate is 38%.

According to the DPIIT Annual Report 2022-23 (Page 109), the sector uses wood, agro residues (such as straw and bagasse) and waste paper (imported as well as domestic) as input substrates for production. Presently in the total production, the share of wood, agro and waste paper-based mills stand at 18%, 7% and 75% respectively. It has been recorded that most of the new green or brown field projects are coming in Packaging Grade Sector and most of them are based on Recycled Fibre, hence, total share of RCF paper-based mills are exponentially increasing.

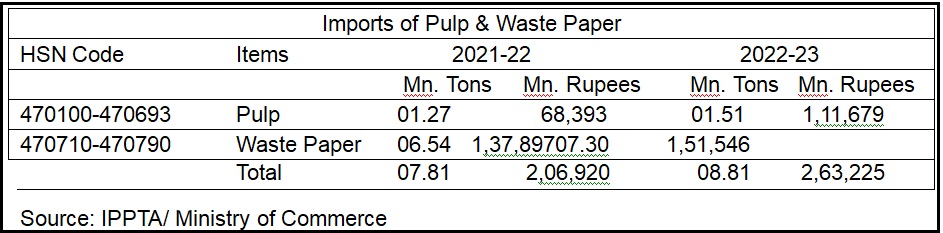

Imports of pulp grew by 18.89% in terms of quantity and 63.29% in terms of value in Rupees in 2022-23 over 21-22. Imports of waste paper grew by 11.62% in terms of quantity and 9.90% in terms of value in Rupees in 2022-23 over 21-22. The trend as reflected by the data of the first quarter of FY 23-24 shows that the imports are increasing for both pulp and waste paper.

It is shocking and surprising that even after 75 years of independence the domestic paper industry has been able to achieve a recovery rate of 38% (as per IPMA website).

The American Forest & Paper Association (AFPA) in a press release of August 08, 2023 state: “Paper and cardboard continue to be some of the most highly recycled materials in the United States. In 2022, the paper recycling rate was nearly 68% holding approximately stable to the 2021 rate. Cardboard boxes, also known as old corrugated containers (OCC), are the most-recycled packaging material in the U.S. In 2022, the recycling rate for cardboard boxes was more than 93%, an increase over last year’s rate.

The paper and wood products industry is inherently circular. Our products are made from renewable resources – trees – and recycled paper. They’re also easily recycled. Our industry voluntarily set a goal to help improve paper recycling back in the 1990s. The recycling rate has doubled since that time. Paper recycling is also successful because of the millions of people who recycle every day and our industry’s ongoing investments.94% of Americans have access to a community paper recycling program.” The success of U.S. recycling program not only allows it to produce paper by recycling but also export waste paper and recycled pulp. U.S. companies exported 7.29 million tons of fibre scrap in January-June period, not including recycled pulp. India’s share was 1.43 million tons, being the highest. (Source: Resource Recycling)

According to the European Paper Recycling Council – Monitoring Report 2021, “In 2021, 71.4% of all paper and board consumed in Europe was recycled. Both consumption of new paper and board and collection of Paper for Recycling (PfR) have increased.”

Indian Newsprint Scenario:

Newsprint paper (ITC: HSN Code 4801) is part of Chapter 48 under the Indian Customs Duty structure, which also includes writing and printing paper. The Government of India has put in place a Newsprint Control Order (NCO) 2004 in place to ensure fair trade and equitable availability of Newsprint to all printers and publishers of newspaper and magazines. The paper trade has no role whatsoever in the marketing and distribution of newsprint.

According to the DPIIT 22-23 Annual Report (Page 109), there are 125 paper mills registered under the Schedule to the NCO with a total installed capacity of 3.30 million tons. However as per Indian Newsprint Manufacturers Association (INMA), currently out of 125 newsprint mills, 46 have stopped making newsprint. Therefore, the present domestic installed capacity of newsprint is 2.2 million tons, whereas production has been reported to be only about 1.0 million tonnes in 2020-21.(Annexure 1)

Central Pulp & Paper Research Institute (CPPRI) in its Annual Report of 20-21(Page 06) shows the production of newsprint from Agro Based as 0, from Wood as 0, and RCF Based as 6,67,726 Tons (0.67 million tons). (Annexure 2)

Indian Paper Manufacturers Association (IPMA) in a slide posted on its website on the ‘Estimated Domestic Market Size and Growth’ shows Newsprint with a market size of 1.273 million tons and a growth rate of (-) 1%. Imports of newsprint in FY21-22 and FY 22-23 has been to the tune of 0.61 and 0.62 million tons only. It clearly shows that even after 75 years of independence nearly 50 % of the requirement of newsprint is met by imports, and even when there is a domestic capacity. (Annexure 3)

It is suggested that the paper mills which have stopped manufacture of newsprint should be deregistered. The units which have not manufactured and supplied newsprint in the last five years should also be deregistered. The imports of newsprint should be totally put under the restricted list as the remaining domestic installed capacity would be more than sufficient to meet the domestic requirement in full.

This would make the newsprint manufacturers and print media ‘Atma Nirbhar’ and also promote the concept of ‘Make in India’. The legacy of continuous and regular imports of newsprint for more than 75 years needs to be brought to an end to make the country self- dependent in newsprint and also conserve the outflow of precious foreign exchange. The domestic units will also get revived and get additional orders to run the unit profitably.

It is also suggested that for the purpose of clarity and transparency, the data of newsprint should be made exclusive of printing and writing. This would go a long way in presenting the true and correct data for writing and printing paper. Newsprint being covered by NCO 2004, whereas writing and printing paper is not.

The installed capacity of newsprint should be treated separate from the remaining installed capacity to prevent corruption of data as the installed capacity in newsprint is shown separately and also added in the total installed capacity.

In today's fast-paced and competitive business environment, making informed choices is crucial for achieving profitable results. Data and statistics alone are not enough. Protection does not help, but competitiveness makes one stronger and resilient. Challenges and opportunities require strategies to grow and succeed.

It is surprising that even after seventy-five years of independence, being recipient of all sorts of governmental support the domestic paper manufacturers who were on a well-trodden path, now suddenly find themselves in an unchartered territory as listless vessels.

Web Title: Newsprint, Pulp, and Waste Paper Scenario in India

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)