Printers demand single slab of 12% GST on all converted/printed products: AIFMP

Printers demand single slab of 12% GST on all converted/printed products: AIFMP

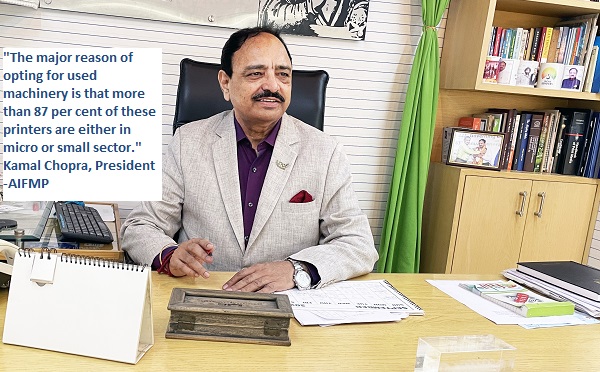

Established in 1953, All India Federation of Master Printers (AIFMP) is sole representative of 250,000 printing companies of India and is the world’s largest printers’ association. Recently, The Pulp and Paper Times takes AIFMP’s reaction over GST increased by GOI on converted and printed products. Here is Mr. Kamal Chopra, President- AIFMP views on GST increases.

30th Sept 2021 | The Pulp and Paper Times:

It is a bit early to give any comments on the recent proposals submitted by the GST council, before a proper notification is issued by the Government. But, still I would like to say that on one side printers are happy that the long standing demand for one trade one tax is accepted by the GST council, but on the other side 18 percent GST on printed products can prove to be a big jolt for the already suffering printing and packaging industry.

Previously, there were 3 GST slabs in printing industry 5, 12 and 18 percent on different kind of products. Printers of the country were facing lot of confusion while calculating GST for different items. Requests were raised at various platforms for simple one GST for all the products of Printing and Packaging industry. With this proposal of the GST council though there may not be any confusion and anomalies while calculating GST for different printing products, but 18 percent will definitely devastate the commercial printers especially Micro and Small printers of the country who are already on the verge of collapse, due to following facts:

• Printing and Packaging industry is an intermediator industry, because supplies are not made directly to the end users, but to the manufacturers/dealers who are preparing the products for the end users. Thus, any increase in the GST rate will increase the manufacturing cost of the products.

• The basic raw material of our industry- Paper is in the slab of 12 percent GST, putting printing and packaging in the slab of 18 virtually mean, payment of 6 percent from the pocket, after claiming the input credit, till the payment is received from the customer. In these days of slow business and delayed payments, sometimes more than 90 days, the additional 6% will be an added burden and difficult for the printer to survive. It may prove to be another death nail, especially for the micro and small printers of the country. When the input tax is 12 percent on our basic raw materials it is justified to equate the output tax at 12 to avoid such anomalies.

• As per the available statistics through PrintWeek survey, a close reading reveals that at least 3,000 print businesses across India could go bust by March 2021. The major reasons for this are insufficient cash flow and decreasing the demand of printing due to internet/digitisation. Printing of stationery, calendars, dairies, and books is already suffering. Some of the state governments has issued instructions for paperless office. Again due to Covid crises, printing of newspapers and news magazines has also suffered a serious setback. It is evident that increase in GST from 12 to 18 in turn increase the prices of books, magazines etc. Thus, it is expected that the demand of printed products will further decrease in case this increased GST is imposed.

As already reported by the media 27.3% companies were on the verge of closure due to decreasing demands. With about 250,000 printers, India is the world’s largest printing industry. Out of these 90 percent printers are either Micro or small and this increase will affect their survival now. It is therefore for the survival of the printing industry in India we wish that there may be only one GST slab of 12 percent on all/any kind of converting/printed products.

Web Title: Printers demand single slab of 12percent GST on all converted printed products AIFMP

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)