GST 2.0: “Market disruption to continue as the government delays action; major impact ahead, some mills may shut,” says A.S. Mehta of JK Paper

GST 2.0: “Market disruption to continue as the government delays action; major impact ahead, some mills may shut,” says A.S. Mehta of JK Paper

-There will be some disruption in the market and we are seeing the same and it will continue to do so till the Govt. takes urgent immediate action

-The major impact will be seen in the coming months as no action has been taken till date by the Govt. on this account. Some Mills may have to shut

-Some note books and exercise books manufacturer are thinking to buy at full rate of tax and increase the price in the market so that there is no complexities by the Regulators and the Inspectors from the GST dept.

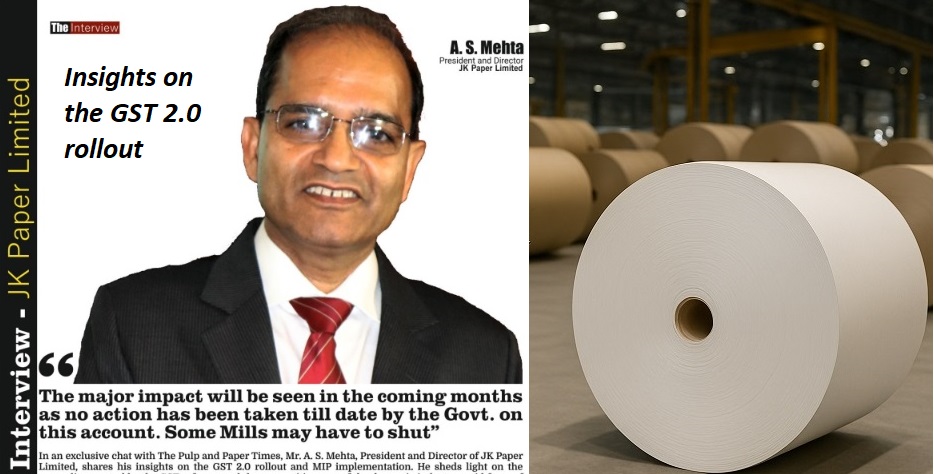

In an exclusive chat with The Pulp and Paper Times, Mr. A. S. Mehta, President and Director of JK Paper Limited, shares his insights on the GST 2.0 rollout and MIP implementation. He sheds light on the anomalies created by the GST reforms and the competitiveness of the domestic industry amid fears of imports of note and exercise books. Here are his full views:

The Pulp and Paper Times

Q: The GST Council’s decision has created a dual structure — Nil GST for notebooks and 18% for other uncoated writing/printing papers. How should mills and dealers practically distinguish between these categories in real-time billing?

At the outset, GST 2.0 reform has disappointed the Paper Industry as we were expecting overall rate of GST on paper would come down from 12 to 5% whereas to our utter surprise it has been increased from 12 to 18%. It is a matter of surprise as the Govt. has kept the paper at par with luxury items like vehicle, AC etc. whereas country like ours, paper is a basic need. GST council’s decision to create dual structure will invite lot of litigation as well as enhance nil rate of GST in the market.

It is going to be very difficult to check misuse of zero rate of GST. In fact, zero rate of GST is only optics because the basic price of the product will increase consequent to reversal of input tax credit by the manufacturer. Infact, note books and exercise books will have higher cost to the extend of 10 to 12% whereas the general impression will be that GST has been reduced to zero % from 12% and the prices will come down.

Q: Leading paper mills have already cautioned dealers against assuming all uncoated paper is Nil rated. How do you see this confusion impacting compliance across the industry?

As I said, it is going to be very difficult to ensure that the paper is used only for the purpose of note and exercise books when it is supplied at NIL rate of GST. It may take some more time when there will be some amount of maturity in the process and the systems to get used from the manufacturer of the note and exercise books.

Q: Do you anticipate market disruptions or arbitrage risks between notebook-grade paper and other uncoated grades because of this dual GST slab?

Yes, there will be some disruption in the market and we are seeing the same and it will continue to do so till the Govt. takes urgent immediate action. I also hear that some note books and exercise books manufacturer are thinking to buy at full rate of tax and increase the price in the market so that there is no complexities by the Regulators and the Inspectors from the GST dept.

Q: GST on Pulp has been reduced to 5% from 12% while GST on wood is still at 18%, do you see that local paper makers will be impacted from imported pulp at a lower rate?

It is not understood as to why the pulp which is made in the country are at 5% and the paper converted out of the local pulp is kept at 18%. This is an anomaly to be corrected because the pulp rate is reduced from 12% whereas the paper rate is increased at 18%. This also resultant into demotivating the pulp manufacturer in the country and making it dependent on the imported pulp. The paper industry has been making Representations to reduce the GST rate on wood from 18 to 12% if not 5% as to remove the inverted duty structure for paper sector. But that has not been addressed.

Q: With Nil GST on uncoated paper for exercise books, notebooks (HS Code 4802) and Nil IGST on imports, how will domestic manufacturers remain competitive when they must embed input taxes into costs while foreign suppliers face no such burden?

This is a major anomaly created by the GST council without realizing the impact on the domestic paper manufacturer when the paper is sold on NIL rate of GST the domestic manufacturer will have to reverse the input tax credit whereas such reversal will not be required for importers or the overseas manufacturers. In view of this, the domestic industry will not be competitive and it will not get level playing field. By doing this, again the Govt. is encouraging the import which will be totally against the theme of ‘Atma Nirbhar Bharat’ and ‘Vocal for Local’.

Q: Could this GST structure encourage more imports of notebook-grade paper into India, affecting local capacity utilization?

As I said in the above question, there will be more encouragement to import of note and exercise books which will impact the domestic paper industry very badly. While there is an increase in import booking which we are seeing in the market but the local industry is not getting orders from the market. The major impact will be seen in the coming months as no action has been taken till date by the Govt. on this account. Some Mills may have to shut. This may also result into import of note books making local players uncompetitive.

Q: Dealers are being advised to align billing, but without clear government guidelines, what common industry framework can be developed to ensure uniform compliance?

There is no clarity on the framework on this compliance issue.

Q: The government has imposed a Minimum Import Price (MIP) on Virgin Multi-layer Paper Board (VPB). If domestic paper makers are getting relief from this cap, what post-MIP impact are you seeing?

The subject of MIP is different and in coming months, there will be some benefit to the domestic industry. It is nothing to do with GST. In fact, the rate of GST on corrugation and carton rates are reduced from 12 to 5% but the GST rate on paper being the source of raw material for them has been increased to 18% so there is case of grave inverted duty structure for corrugation manufacturer and mono carton converting enterprises. They will have major set back as their working capital will be blocked for many months. Also, it will increase their compliance cost. At the same time, the cost will be much higher for them in view of this. Again, this is a major set back because if 90% of packaging grade paper or packaging board is going for 5% output. There is no logic for such structure impacting thousands of MSMEs.

Q: The imposition of MIP has resulted in a price increase of ₹3 to ₹5 per kg in virgin grades. What is your anticipation about future pricing?

I don’t think the prices have gone up Rs.5 on virgin packaging board. Even the current prevailing price are not a viable and there will be some correction the market.

Q: With VPB imports capped, a new player is eyeing the spotlight: White Back Duplex (WBD), which can replace 25–30% of FBB demand. Do you think this trend is emerging?

This is a matter of product development and other product substitution and thus a common practice of creating new product in the market. This is nothing to do with VPB import issue.

Web Title: GST 2.0: “Market disruption to continue as the government delays action; major impact ahead, some mills may shut,” says A.S. Mehta of JK Paper

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)