In 2024, Imported paper would not let us sustain, and we could not sell paper below these prices, says Mr Yogesh Agarwal, BGPPL

In 2024, Imported paper would not let us sustain, and we could not sell paper below these prices, says Mr Yogesh Agarwal, BGPPL

- Numerous variables counterbalance each other, and market is a balance of these variables

- Some companies have already imported wood for $25,000 per BD Metric ton in the last few months of 2023

- No company could sell their paper for an average of $1000 per ton

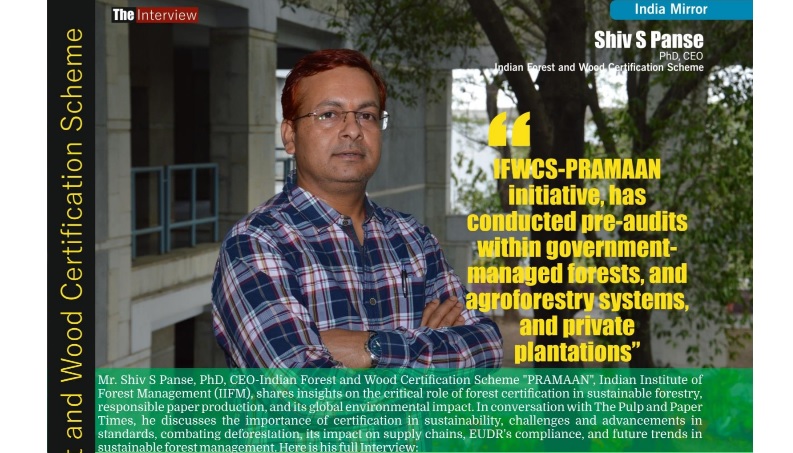

Mr. Yogesh Agarwal, Business Head, Bilt Graphic Paper Products Limited, shares his insights about the organic and inorganic variables that have an impact on paper prices and the industry as a whole. He discusses the cause-and-effect theory and shares how major triggers have impacted the rates of paper in the past and which variables are impacting the prices now.

The Pulp and Paper Times:

Speaking at the Federation of Paper Trading Associations of India's AGM in Delhi, Mr. Yogesh Agarwal, Business Head, Bilt Graphic Paper Products Limited said, "The last three years, although some of you might differ, I think they were on the higher side. We have not seen such a solid run in the paper industry as seen in the last three years. Everyone here has a question about what the year 2024 will be. And how will the year be in terms of price and demand?"

He said, "Whether the market will go up or down is a function of triggers. A trigger is something like cause and effect. Something is happening somewhere, and after 6-7 months, it causes an effect somewhere else. If we talk about the paper industry and try to plot the life cycle of the paper in the last 15 years, then multiple events affected the industry. For example, the global financial crisis in 2008, when the price of writing printing paper significantly reduced from $900 to $600 per ton, witnessed a 40% fall in prices in three months. It was one of the steepest falls in the paper industry."

He added, "The market then recovered and fell multiple times since 2008 in events such as when an earthquake hit Japan, the European debt crisis, China banning the import of waste paper, COVID, and the latest, higher shipping costs. The last one was a market pulp capacity inspection. So the basic idea is that triggers happen; one can witness an almost 30 to 40% change in prices going up or down. Interestingly, when the prices go up or down, the demand or volume remains the same."

Talking about variables, he said, "There are two types of variables: organic and inorganic. Organic variables are GDP growth, rising per capita income and expenditure, education, an increase in literacy levels, population growth, urbanization, and demographics, among others. While inorganic variables are stair-like steps and consist of rising shipping costs, COVID, and others, the organic variable does not change and may not affect the prices. People have to look out for inorganic variables; for example, the Red Sea disruption, which has come into play now, and how it affects prices will be noticeable only after six months. The trap is our cognitive inclination towards perceiving linear patterns, which can sometimes clash with the stair-step nature of crucial data. We are so habituated to organic variables that we cannot notice inorganic variables beforehand. As a marketer, we must spot the trend beforehand, although it may be just ten days before, but as early as we could spot it, we could play the market. But our vision is on what inorganic is happening, so we filter out the noise and ignore the organic variables."

He added, "When we discuss price, we only think about demand and supply, but life is not that simple. Numerous variables are counterbalancing each other, and the market is a balance of these variables. Variables like market pulp prices, raw material availability, inventory levels, cross-currency exchanges, and changing consumer mix, among others, counterplay with each other. The changing consumer mix is a large variable, and it is becoming larger. The large customers keep growing at the cost of the smaller ones, which has an impact on the distribution. It is a post-GST phenomenon; because of GST, things have become more organized. The fundamental purpose of distribution is the aggregation of demand. As the customers start consolidating orders and become larger, the distribution model changes, and the papermills value the distributor and try to adopt the model around them. The notebook converters and other printers can become more cost-effective, and buying paper ₹2-3 is cheaper compared to smaller distributors, and his margins are better."

Mr. Agarwal added, "The shipping industry impacts the paper industry and its prices. When the transportation rates rise from $15 per ton to $200, it usually impacts paper prices. Similarly, coal, the oil cycle, NGOs, the movement of local seasonal transport, equity performance, natural calamities, technology disruption, global mergers and acquisitions, elections and geographic economic sanctions, changing advertising mix, labor strikes, disruption in shipping routes, maintenance costs, aging infrastructure, consumers' willingness to pay a premium for sustainable products, and changes in customer preferences, among others, also affect the prices. There are over 500 variables that can impact the prices."

He added, "To predict the prices in 2024, one has to know all the variables. These variables work in a complex way, and a change in one variable disrupts the whole balance. The market is balanced as an outcome of all these variables. What happens once in a few decades, that is, around 30–50 years, these variables combine in a lethal way, which creates a perfect storm, and it happened in 2021–22. The prices in 21–22 broke the barrier of $1000 per ton, although it has happened before. However, in 21–22, for the first time the level sustained for 6–9 months. It may not repeat, but what will happen will be different."

Talking about the other side of this spectrum, he said, "The average age across the globe is increasing. In India, life expectancy is growing by 4-5 months per year. The median age, which was around 20 years in 1970, has gone up to 30 years in 2023; this is not an organic variable and impacts the paper industry and consumption patterns. How old age changes the demographics of the industry is interesting. The life expectancy increases by 4-5 months in a country like India, which is inorganic; if the same is around one day per year, we can term it organic. Another variable, that affects the prices is the financial independence of women. Women contribute to around 18% of the GDP while constituting 48% of the total population. One cannot discount these variables, though they may seem normal."

He added, "Wood supply in India is a major concern. In 2013, wood prices reached a maximum of ₹13,000 per bone dry (BD) metric ton. Some companies have already imported wood for $25,000 per BD Metric ton in the last few months (2023). The life cycle of wood plays a significant role; last December, the rates were around ₹8500 per ton. This December (2023), they are around ₹13,500–14,000 on average. The marginal cost is around ₹25,000 per ton for imported wood. If we take this cost, the minimum cost of pulp is around $500–$750 per ton. And by adding other variable and fixed costs, it reaches around $700–$950 for paper. Now, if we add around 20% EBITDA to justify our investments, the cost would reach around $875. And if we pick the marginal cost, then it would reach around $1200. So speaking about the future, you will see that no company could sell their paper for an average of $1000. Next year, we will witness such a situation that imported paper would not let us sustain, and we could not sell paper below these prices. So in a way, as manufacturers, we are going to use some music next year. And there is no solution for this situation. It is an Indian phenomenon, not a global one. Across the globe, wood is sold for around $200 per ton, and it is the same in India. When Vietnam sold 15 million tons of wood to China, why is it affordable in India? India has many smaller mills, which are inefficient compared to larger mills overseas. So India faces an advantage in terms of goods but a disadvantage in terms of mill sizes, while in China, this is the opposite. Now, India is both disadvantaged in terms of size and capacity. That is where India is getting stuck. If we can find some solutions, Indian Mills will face some tough calls in this situation. This year, mills have gotten around 30% EBITDA; next year, this may range between 5-25%, and this is where the cost has gone. We have never faced a cost increase like that. Pulp prices have faced these ups and downs, but not wood."

He opined, "If in the last three years, any distributor that has not profited equal to the last 10 years, then that distributor needs to re-study their model. They should not blame the market or the company. Everybody in the supply chain is happy, and it is a win-win situation. The good news is that the market is fair to everyone, and we need to figure out how to take advantage and make a combination of businesses to make a profit."

He concluded, "There is no question about prediction. There are many variables, and it is impossible to predict next year. If anybody predicts it, they do not understand what they are talking about. It is like the future, and no one can predict that. We should be happy if the market falls, as it would be a good thing, and soft players would refrain from playing in that market. If the market continues to grow, then everyone will grow, and it will be difficult to differentiate between soft and strong players. So when difficulties happen and the market falls, always remember that difficulties are for everyone, and it is an opportunity for us to shine."

Web Title: In 2024, Imported paper would not let us sustain, and we could not sell paper below these prices, says Mr Yogesh Agarwal, BGPPL

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)