Vapi's Kraft Paper Mills grapple with Red Sea Crisis fallout, announce price surge across 24BF to 40BF segment

Vapi's Kraft Paper Mills grapple with Red Sea Crisis fallout, announce price surge across 24BF to 40BF segment

- Good chunk of price increase can be expected if the situation continues, we all need to track the situation.

- In Writing Printing, Coated imports have increased making the situation tough for Indian paper mills.

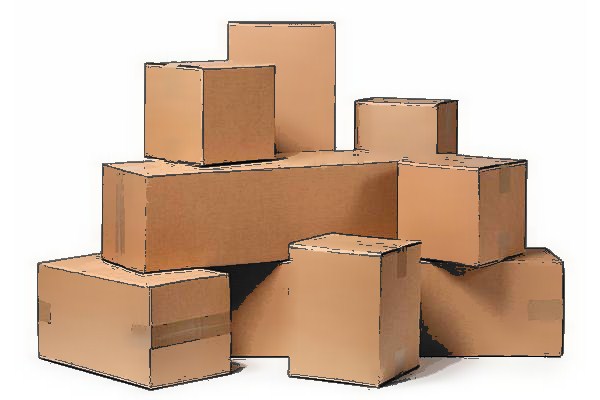

- Vapi based kraft paper manufacturers have announced price increase of Rs.3000/- to Rs.4000/-PMT

The Pulp and Paper Times provides a brief analysis of the Red Sea Crisis and its implications for the paper sector. India is a significant importer and exporter of various paper goods, including pulp, finished paper, waste paper, and other types of paper. This crisis could have an effect on the market's price structure and put the sector in disarray. We conducted in-depth analyses of the Red Sea situation and spoke with a number of prominent figures in the paper sector. here is the opinion of Mr Anil Singh, Chief Marketing Officer, Vishal Group of Companies:

Q: How this suspension of vessels in the Red Sea will impact the Indian Paper Industry?

Our nation Bharat is fibre deficient nation depending on imports of waste from USA, UK etc. Around 70% of paper production is carried out by recyling old waste paper. Paper is an important part of our daily lives and is a necessity for packaging, education and several other sectors. This might affect indian paper industry and globally economy is showing recessionary trends. Weak global demand is the biggest challenge for businesses in 2023, followed by the high cost of borrowing, high input costs. Europe is already affected due to the ongoing Ukraine- Russia war. How the newsprint industry was affected from Mar'22 to June'22 as most of the newspapers are dependent on imported SNP(Standard news print) & GNP(Glazed News print). Red Sea crisis can have far reaching effects if not controlled timely.

Q: Will the price of imported recovered fibre for India see a rise in price in the coming time? Any assumption of price per tonne?

Watepaper has become a major raw material for paper making all over the world. Most new expansion greenfield projects are coming/have come up in packaging grades and are based on wastepaper mainly. Kraft and Duplex paper industry is suffering with over capacity and low demand. In Writing Printing,Coated imports have increased making the situation tough for Indian paper mills. End Consumers (big printers,publishers) have choice to get imported paper due to FTA(Free Trade Agreement) from ASEAN countries with nil duty. Already domestic paper industry was reeling under pressue and suffering due to challenged posed internal and external factors now this red sea thing is bolt out of the blue.

As far as imported recovered fibre is concerned in FY21-22 India has imported 6.54 million tons of waste paper and in FY 22-23 it rose to 7.30 million tons and in current fiscal April'23 to Oct'23 waste paper imports stands at 4.39 million tons. These numbers reflect dependency of Indian paper mills on waste paper. Price increase in Writing Printing, packaging is on the cards and last quarter of financial year being season time for paper industry. Good chunk of price increase can be expected if situation continues, We all need to track the situation.

Q: Domestic waste paper and finished kraft paper/duplex may have a price impact due to this crisis. May the market see the price rise?

Imported waste paper grades like OCC, NDLKC,DSOCC etc rich quality fibre required for manufacturing of high BF kraft paper and premium grades of packaging board supplies to Indian market might be affected if situation doesn't control. Also, sea freight rates are increasing and most of Vapi based kraft paper manufacturers have announced price increase of Rs.3000/- to Rs.4000/-PMT in 24BF to 40BF segment. There may be further increase in this segment if the red sea crisis doesn't get actually controlled. Containers rates hit 10,000$ due to Red sea crisis some shipping lines have increased freight from 50 % to 100% oppurtunistic price gouging. There is positive news by the setting up of multi national security initiative OPG(Operation Prosperity Gaurdian) led by the US but some shippers continue to take detours and levy charges citing safety of their employees. We all know that Indian flagged crude oil tanker was attacked in Red sea. Industry experts need to watch this and take appropriate action timely to serve their customers and continue operations of industry and customer at large.

Q: Do you think this could turn into a win-win situation for some of the big paper mills in terms of price and market monopoly?

Demand for Writing & Printing paper is expected to rise ahead of the general elections in 2024. Chinese paper mills are dumping their excess production in Indian market. Integrated paper mills may rule the roost if situation persists, domestic waste paper suppliers had started increasing their prices making the situation difficult for recyle paper mills.

Q: Any other important comment for the paper industry? or any planning and strategy to be followed.

The Indian paper industry had reported revenue growth of around 30 per cent in FY22-23. For FY24, the paper industry's total volume is expected to rise 5-7 per cent. The packaging paper volume is expected to grow by 8 % in FY23-24 , mainly due to demand from the pharmaceutical ,FMCG sectors and due to environmental, sustainibility concerns of shifting to paper based packaging. Writing and Printing paper volume is expected to grow by around 5 % per cent amid increased digitalisation, and despite being supported by government spending on education and the implementation of the New Education Policy. Indian Paper Mills should upgrade technologically. Corporates, Indian paper mills, and society should come forward with the objective to accelerate recycling in India and improve waste collections like Germany, Japan and move towards circular economy.

Web Title: Red Sea Crisis: Most of Vapi based kraft paper mills have announced price increase in 24BF to 40BF segment

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)