N R Agarwal Industries targets INR 2,200 crore in FY25–26 revenue, producing half a million tons of paperboard at a single-location facility

N R Agarwal Industries targets INR 2,200 crore in FY25–26 revenue, producing half a million tons of paperboard at a single-location facility

- Small paperboard manufacturing units are exiting the business, unable to match declining realizations, improve end product quality or address debt repayment obligations

The Pulp and Paper Times

N R Agarwal Industries Limited was incorporated in 1993. The Company specializes in the manufacture of multi-layer paper boards as well as writing and printing paper. With more than 30 years of experience, the Company has emerged as one of India’s leading producers of recycled paper. The Company is the largest manufacturer of grey and white back duplex boards and a leading name in India’s wastepaper-based paper production.

NRAIL had commissioned a Rs. 850 cr investment programme to increase paperboard manufacturing capacity to 900 tons per day. The investment was the largest in the Company’s existence; the investment also helped create the largest single paperboard manufacturing machine at a single location in India. NRAIL is the largest paperboard manufacturer in India (greyback and white back paperboard varieties) and the largest recycled paper manufacturer. The Company is equipped to produce half a million tons of paperboard starting the current financial year. This investment was made with the objective to graduate the Company into the next league and build a sustainable growth platform for the future.

“The decisive game-changing manufacturing capacity was commissioned during the last financial year. By the close of the last financial year, the new capacity had touched an average capacity utilization of 95%. In a chemical intensive, capital-heavy and process driven sector like paperboard, we believe that this average capacity utilization represents a manifestation of our capabilities – the ability to select the right technology cum scale and the talent to sweat this large asset around the highest utilization levels. This single achievement validated that the Company has done all it could to minimize the effect of operating variables under its control and maximize performance consistency,” Mr. R N Agarwal, Chairman & Managing Director of NRAIL said in the annual report for FY 24-25

“At N R Agarwal, we recognized the need to maximize manufacturing capacity without compromising our desired risk appetite. We were aware of the threats of commissioning a large capacity in the midst of a sectoral slowdown. We remained cognizant of the need to remain liquid and viable following the expansion even when paperboard realizations remained flat,

“We achieved all these imperatives during a challenging FY 2024-25. This is evident in our financials: the Company reported a net profit; in a capital-intensive business we maintained our EBITDA margin in line with the industry average,” Mr. Agarwal said.

The Company reported a 28.27% increase in revenues to Rs. 1659.03 cr; EBITDA declined 8.59% to Rs. 142.44 cr; profit after tax decreased to Rs. 15.96 cr. Even as EBITDA margin declined 578 bps to 8.59%, the margin was in line with the industry average and validates the viability of the Company even during the bottom of the industry downtrend. Around 30% of the output was exported and 60% sold in western India, where the plant is located. The new plant helped widen the product basket to value-added board varieties that are either being imported or being undersupplied.

Mr. Agarwal further added, that at N R Agarwal, we remained profitable during the last financial year when paperboard realizations trended lower. At peak, paperboard realized Rs. 41 per kg; by the close of the last financial year, realizations had declined to Rs. 37 per kg. This decline was precipitated by a global paperboard oversupply and cheaper imports.

“During this sectoral downtrend, we are seeing the beginning of an industry consolidation at two levels. At one level, small paperboard manufacturing units are exiting the business, unable to match declining realizations, improve end product quality or address debt repayment obligations. At the other level, some of the larger paperboard companies are acquiring large capacities. The result is that the manufacturing capacities are moving into stronger hands; besides, the exit of smaller players is leaving unaddressed demand in the regional markets,” he described.

At N R Agarwal, we perceive an opportunity in adversity. The longer the downtrend persists in the paperboard sector, there is a possibility of more sub-optimal mills going out of production, creating a growing opportunity for larger organized paperboard manufacturers. In view of this, we perceive the downtrend to be an attractive opportunity to grow our business: capital equipment manufacturers deliver faster around affordable costs; most manufacturers freeze their capital spending; the country’s paperboard consumption continues to grow.

NRAIL remains optimistic of prospects during the current financial year. The challenges of timely commissioning appear to be over; the priority will now lie in sweating the new unit at a consistently high utilisation, sustaining the highest quality standard for the highest realization and marketing the production around the lowest average logistical cost per km.

The Company expects to achieve Rs. 2200 cr in revenues during the current financial year, factoring the decline in realizations. When achieved, this would be an impressive 36% higher than the Rs. 1617 cr achieved by the Company in FY 2023-24. This validates the ability of the Company to change orbits without impairing the Balance Sheet and create a robust growth platform.

Web Title: N R Agarwal Industries targets INR 2,200 crore in FY25–26 revenue, producing half a million tons of paperboard at a single-location facility

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

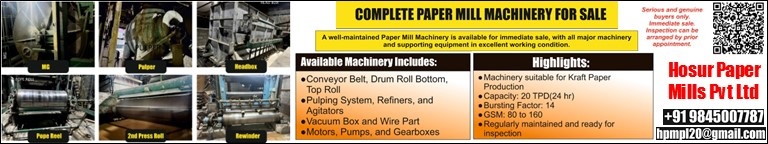

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)