Orient Paper has introduced a new alternative hardwood raw material for pulping at the lowest rates from local sources, along with 11 new SKUs across its product categories

Orient Paper has introduced a new alternative hardwood raw material for pulping at the lowest rates from local sources, along with 11 new SKUs across its product categories

Highlights of Annual Report for FY 23-24:

-Sales amounted to INR 832 crore and PAT was INR 6 crore during FY 23-24

-OPAL’s manufacturing plant is undergoing a complete revamp for more efficient production, with real-time inventory and demand forecasting

-Orient Paper increased its capacity by 36% in FY24, and modernised and digitalised several manufacturing processes such as the pulp-mill and paper-machine sections.

-OPAL embarked on a mission to become a water-positive and carbon-neutral paper company by 2027 and 2029, respectively

The Pulp and Paper Times

Orient Paper & Industries Limited (OPAL) is an Indian company with a legacy of leadership in making high-quality paper sustainably. For over 87 years, Orient Paper has proven that success and social responsibility go hand-in-hand. OPAL unwavering focus on sustainability has built a strong foundation for progress, making growth a natural outcome rather than the sole objective.

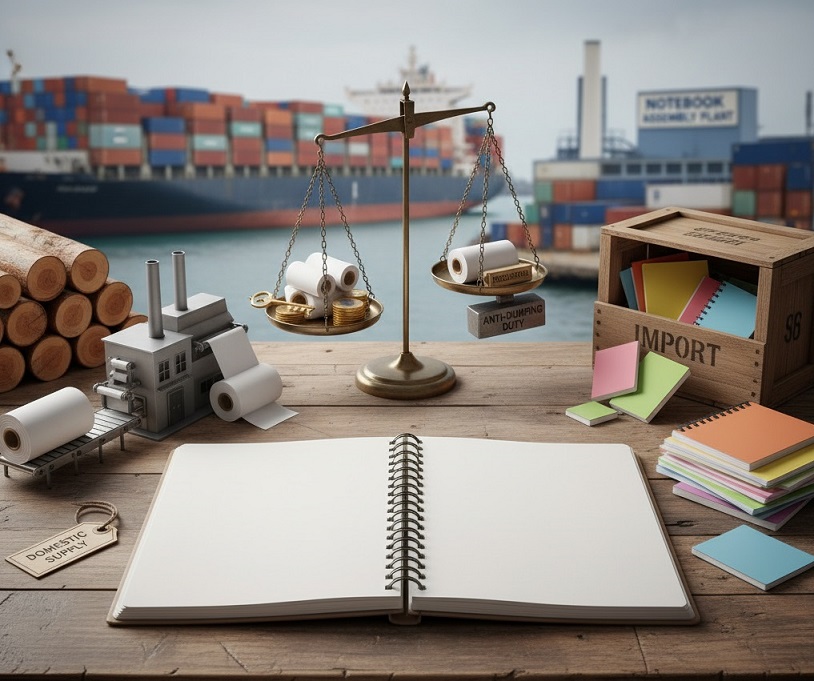

Mr. Ashwin J. Laddha, Managing Director & CEO at Orient Paper & Industries Limited, stated in the annual report for FY 23-24: “In the financial year 2023-24, the Indian paper industry faced macroeconomic challenges, including global price volatility, excessive imports, and tepid exports, which influenced the profitability of local manufacturers. Orient Paper responded with agility, shifting focus to the value-added domestic market. We have also initiated modernization and debottlenecking operations to boost production. Additionally, our manufacturing plant is undergoing a complete revamp for more efficient production, with real-time inventory and demand forecasting.”

“But there were challenges as well. We faced a few unforeseen downtimes and production stoppages during the plant modernization process and experienced pricing pressure in the market. Both factors led to a reduction in profitability. Sales amounted to Rs. 832 crore, and PAT was Rs. 6 crore during the year,” he said.

Mr. Laddha informed about the market dynamics and added that amidst global economic challenges such as geopolitical conflicts, recessionary pressures, and inflation, India has emerged as a sweet spot. In 2023, the global pulp industry experienced a significant decline in prices due to oversupply and weak demand, with hardwood pulp prices decreasing by approximately 32% and softwood prices by approximately 24%. India’s paper industry experienced a contraction of approximately 11%, from INR 1,020 billion in FY 2022-23 to INR 907 billion in FY 2023-24.

Orient Paper conducted on-ground research and in-depth consumer interactions to create real-world solutions that addressed evolving market demands. This strategy helped the company transition from a commoditised paper producer into a leading solution-provider. The shift towards a solutions-led, customer-centric business model has positioned us for long-term growth through innovation.

Operational constraints, already accounted for in OPAL’s modernization plans, slowed the Value-Added Products (VAP) segment sales from 75% in financial year 2022-23 to 61% of the product mix in the last year. However, these constraints presented a strategic shift. OPAL developed micro-markets strategy for non-VAP products by engaging with members across the value chain based on product features. The approach enabled us to tap into high-margin, niche categories.

The FY 23-24 saw Orient Paper experience a decrease in revenue by 11.8%. This decline is attributed to a combination of a 10% drop in realisations due to a market price correction and a marginal 1% reduction in sales volume caused by planned downtime for key projects such as the ECF bleaching system commissioned this year.

In FY24, Orient Paper doubled down on its transformation strategy, with a view to becoming a truly customer-centric organisation. To achieve this, it embarked on an ambitious project, ‘Mission Khushi’, which focuses on sustainable and responsible growth. Additionally, steps were taken to develop the value chain and build deeper connections with micro-markets through Hub Meets. Customer engagement was further enhanced via the Orient Stars digital platform.

During the year under review, Orient Paper introduced 11 new SKUs across its product categories of Writing and Printing, Wellness and Hygiene and Plastic Substitutes. Value-Added Products represented 61% of the company’s product mix. On the operations side, in the first phase of debottlenecking, Orient Paper increased its capacity by 36% in FY24, and modernised and digitalised several manufacturing processes such as the pulp-mill and paper-machine sections. Upgrading its operations led to a planned increase in downtime. The company's total W&P paper production amounted to 48,534 MT, while its tissue production amounted to 34,897 MT in FY24. Value-Added Products represented 61% of the company's product mix.

OPAL Introduced first time in India, A new alternative raw material hard wood as an alternative potential source of fibrous raw material by conducting numerous pulping studies in the R&D lab for its precise implementation in the plant. Pulping studies conducted on several different raw materials have benefited in analyzing the viability of the procured material and ensuring maximum output in terms of quality and production. This further contributes to the development of alternate sources of raw material. Studies of various species such as Eucalyptus, Sal (With Bark and Debark), Mix Hard Wood (Chilbul), Eucalyptus Centre Core, Bamboo, Subabul, Casuarina, Vineer Chips, Acacia, Pine Wood and Plywood chips done in the lab for better decision making in plant. Assam Bamboo has better yield, lower kappa no. and higher unbleached viscosity as compared to as Eucalyptus, Sal (with bark and debark), Mix Hard Wood (Chilbul), Eucalyptus Centre Core, Bamboo, Subabul, Casuarina, Vineer Chips, A new alternative raw material, Acacia, Pine wood and Plywood chips.

In raw material furnished a new alternative hardwood raw material percentage is increased subsequently to 20% as alternative raw material without impacting quality of pulp. Wood debarking capacity in the raw material yard increased to 500 MT/day. OPAL Introduced a new species “A new alternative raw material” for pulping at the cheapest rates from local areas. 28500 MT during the year.

“During the year, we embarked on a mission to become a water-positive and carbon-neutral paper company by 2027 and 2029, respectively. Through these initiatives, we are creating enduring value for future generations,” Mr. C. K. Birla, Chairman of Orient Paper & Industries Limited said in the Annual Report.

The company also laid out a blueprint to become a pioneering water-positive paper enterprise by FY27, and achieve carbon-neutral operations by FY29. This year also saw the highest-ever plantation, on ~19,570 acres, and an approximately 15% increase of renewables in its energy mix. Additionally, Orient Paper transformed its agroforestry programme by implementing Good Agricultural Practices (GAP) across 22,500 acres, benefitting 38,154 families.

The Company’s turnover for FY24 was Rs. 831.94 crores against Rs. 942.96 crores in FY23. Net profit after tax was Rs 6.23 crores this year. It invested Rs. 158 crores on capital projects during the year.

Future plan of action:

Upgradation of the Main Machine with Press section rebuild, Silent Drive, Steam and Condensate system and new Centricleaner for productivity and quality improvement.

Upgradation of Tissue #01 by replacing the inclined wire to crescent former to improve productivity and quality.

Pulp mill capacity upgradation from 330 to 400 TPD.

Upgradation of Recovery Island from 600 to 750 TPD

High-capacity drum chipper for better chips quality and productivity.

Turbine upgradation with extraction steam balancing for higher efficiency and reduction in coal consumption.

Planning to develop more new products on Main Machine, Tissue paper machines, and Specialty Paper machines for plastic to enrich the OPM products basket.

Planning to search and develop alternative fibrous raw material for better pulp strength and higher yield for cost-effective and availability of the material.

New Product Development:

-Developed Carry bag paper for the plastic substitution at the Main Machine after making numerous formulations and recipes in the R&D lab to achieve the functional properties of the carry bag.

-Developed Drawing book Cartridge Paper 100,110 & 120 GSM at the main machine.

-Thermal coating base paper developed at the main machine which succeeded by optimization of the sizing, and improvement in surface properties to attain all the required paper properties

Web Title: Orient Paper has introduced a new alternative hardwood raw material for pulping at the lowest rates from local sources, along with 11 new SKUs across its product categories

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)