Pakka: doubling the manufacturing volume and tripling turnover at the Ayodhya plant. Targeting order of 250,000 TPA and turnover of USD 1 Billion

Pakka: doubling the manufacturing volume and tripling turnover at the Ayodhya plant. Targeting order of 250,000 TPA and turnover of USD 1 Billion

- Pakka has embarked on the INR 675 Crore expansion with robust fundamentals

- Pakka reported a 3.85% increase in its wrap and carry paper production to 41,304 MT in FY23-24

The Pulp and Paper Times:

Pakka Limited is a renowned manufacturer of bagasse-based pulp, paper, compostable tableware and flexible packaging in India. Operating from an integrated facility in Ayodhya, Uttar Pradesh, your company’s products are gaining popularity due to their superior and customised quality. The production uses locally sourced sugarcane waste, which is then processed into paper, pulp and molded products. Moreover, Pakka has recently initiated the production of low-grammage kraft grades. At present, Pakka Limited is focused on the development of compostable packaging solutions.

As of 31st March, 2024, Pakka’s manufacturing facility was located in Ayodhya, Uttar Pradesh. The facility included a 130 TPD pulp mill capable of producing bleached and unbleached pulp, along with 3 paper machines with an installed capacity of 39,100 TPA. Additionally the facility featured 2 power plants generating 8.5 MW of power from biomass, a 140 MT chemical recovery plant and 23 production lines dedicated to manufacturing 14.5 TPD of compostable tableware. These manufacturing capacities contributed to your company’s competitive edge by providing economies of scale, enhancing competitiveness across market cycles.

During FY 23-24, Pakka generated a revenue of INR 404.74 Crore compared to INR 408.31 Crore in the previous year. However, Pakka incurred a net profit of INR 48 Crore, as opposed to a net profit of INR 51.46 Crore in the previous year.

In the FY23-24, Pakka derived 75% of its revenues from domestic operations in India, while the remaining revenue was generated over 31 countries. Export sales experienced a notable 4% growth in value, while domestic revenues saw a moderate decline year on year. Revenue streams were diversified, with 75% coming from paper sales, 11% from pulp, and 14% from compostable bagasse tableware.

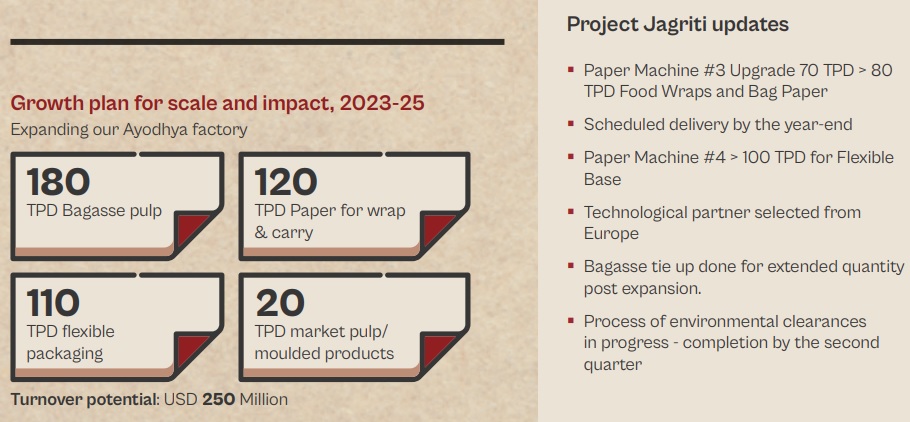

Mr. Pradeep Dhobale, Chairman of Pakka Limited, revealed in the annual report for FY 23-24, that, the coming 2-3 years are going to be transformative in the history of Pakka. The leadership has already articulated its vision of contributing to a cleaner planet at scale by doubling the manufacturing volume and tripling turnover at the Ayodhya plant. The global footprint being envisioned is of the order of 250,000 Tonnes per annum and turnover of USD 1 Billion.

Pakka’s customers for bagasse-based paper include renowned brands such as Borosil, RSPL Limited, Modern Laminators, Aditya Flexipack, Haldiram’s, Chai Point, Blinkit, Bikanerwala, Lite Bite Foods and others.

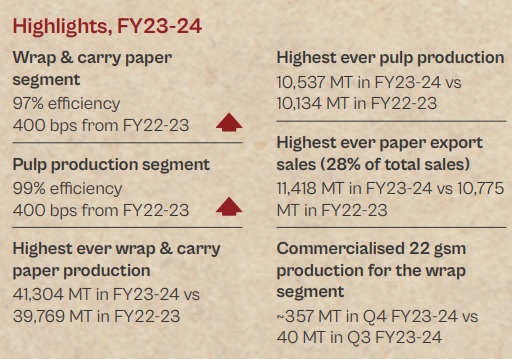

Pakka sustained manufacturing improvements made in FY22-23 during the last financial year as well. This validated that the improvements made in the previous year were not one-off; this endorsed that it has established a culture of manufacturing outperformance.

“This improvement was evident in the numbers. Your company reported a 3.85% increase in its wrap and carry paper production to 41,304 MT in FY23-24, a 3.97% increase in its pulp production to 10,537 MT in FY23-24, the highest paper exports as a percentage of sales (28%) at 11,418 MT in FY23-24 and commercialisation of the 22 gsm production for the Wrap segment,” Mr. Jagdeep Hira, Business Head of Pakka said in the annual report for FY 23-24.

Mr. Hira further informed that “Pakka continued to develop new paper grades, reinforcing your company’s respect for pushing the portfolio frontier. This approach generated various positive outcomes. The addition of these products helped enhance volumes, widen the portfolio and strengthen realisations. Your company reported a 6% volume export growth. There was improved bagasse pulp quality, decline in grammage and moisture variations across production batches, and enhanced customer traction. The PM1 reported 103% capacity utilisation in FY23-24 , PM2 climbed to 113% capacity utilisation and there was 104% capacity utilisation in PM3 . The improvements were sustained across the months, enhancing your company’s capacity to produce more at a lower per unit cost.

Pakka successfully developed the world’s first home compostable and recyclable paper-based flexible packaging during the year under review. This represents a landmark in the global flexible packaging sector. This Pakka development represents a decisive answer to a long-standing global pursuit of responsible packaging that could be completely composted and recycled.

Pakka’s home compostable solution ensures that its flexible packaging will completely biodegrade within 180 days, compared with alternatives that could take a few hundred years to completely decompose and disappear in the soil.

Pakka’s development has been successfully applied in the packaging of fast-moving consumer products like chocolates, granola bars, nuts and shampoos; this coverage will now be widened to a larger number of products of everyday consumption.

Taking this ahead:

At Pakka, this momentous product breakthrough will now need to be scaled. Pakka will need to complement the proof of concept with adequate manufacturing capacity that assures customers of sustainable supply. In Pakka’s Indian operations, this will warrant an expansion at three levels:

One, Pakka intends to increase its agro-based pulp capacity from 130 TPD to 180 TPD, which should increase annual pulp throughput by 16500 Tonnes. This larger pulp availability will provide a larger resource foundation with which to service the needs of a potentially new market for compostable and recyclable flexible packaging paper.

Two, Pakka intends to increase the capacity of wrap and carry products by 5000 TPA (in addition to the existing 40 ,000 TPA), widening the room for applications.

Three, Pakka will commission a greenfield flexible packaging capacity by 40 ,000 TPA, adequately synced with the pulp manufacturing capacity at the back-end, providing product and operational integration.

Mr. Ved Krishna, Non-Executive Vice Chairman of Pakka, says in the annual report for FY 23-24, that The resizing of our available capacities and introduction of a new downstream capacity represents the foundation of our reinvented organisation.

“Even as we are engaged in the largest expansion in our existence, it would be pertinent to indicate that the Pakka management will not compromise the quality of its Balance Sheet,

“Your company has embarked on the INR 675 Crore expansion with robust fundamentals, which are not likely to be irrevocably impaired or compromised if the expansion is marginally delayed,” Mr. Ved Krishna said.

Compostables:

Pakka is the largest organised brand for compostable bagasse tableware in India. It is the only Indian company in its space with captive access to captive bagasse-based pulp. The result is a secure resource access, extended value chain and pulp customisation opportunities in response to evolving market preferences.

“The principal message is that your company turned its business around to profit without a significant increase in revenue. This indicates the intrinsic profitability of demand through a widening supplier ecosystem. Added to this, your company’s manufacturing plant increased capacity utilisation from 28% to 55% (production rising from 170 Metric Tonnes a month to 280 Metric Tonnes a month by the end of the financial year) in addition to launching three machines. Besides, your company reduced finished goods losses by 600 bps following improvements in quality and operational efficiency. The complement of these three improvements helped your company turn the compostables operations around during FY23-24,” Mr. Satish ChamyVelumani, Business head, Compostables said.

On the challenges, Mr Satish added, that Pakka’s Chuk encountered erratic market demand and the inconsistent enforcement of government regulations on plastics and styrofoam. The result was that lower cost alternatives continued to disturb the demand and pricing balance of the market, putting a premium on Pakka to respond with speed. In view of this, the top line growth of 3% represents an achievement and achieving a financial turnaround in the face of this nominal production increase is an even bigger achievement.

“The other challenge was the movement in petrochemical prices that affected our competitiveness. It is no secret that petrochemical based packaging leverages superior economies of scale; this makes polymer-based tableware one-third cheaper than agro-based packaging. What continues to provide us confidence is that compostable packaging accounts for only a nominal share of the overall meal cost. In view of this, the cost of compostable tableware is not so expensive that it can deter purchase; on the contrary, it enhances considerable user pride and guest appreciation, which more than make up for the increased cost required to pay,” he said.

Web Title: Pakka: doubling the manufacturing volume and tripling turnover at the Ayodhya plant. Targeting order of 250,000 TPA and turnover of USD 1 Billion

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)