Paper Industry Rebound: ICRA anticipates 6-9% revenue growth in FY25, driven by packaging sector expansion and demand recovery

Paper Industry Rebound: ICRA anticipates 6-9% revenue growth in FY25, driven by packaging sector expansion and demand recovery

-Favourable demand sentiments to support the domestic paper manufacturing industry.

-The margins remained healthy in H1 FY2024 for the PWP segment and are likely to contract in H2 FY2024, due to falling realisations

-ICRA expects the paper industry’s volume growth to moderate to 2-5% in FY2024 compared to ~7% in FY2023

The Below article is written by Mr. Suprio Banerjee, Vice President & Sector Head - Corporate Ratings, ICRA Limited. ICRA Limited (formerly Investment Information and Credit Rating Agency of India Limited) was set up in 1991 by leading financial/investment institutions, commercial banks and financial services companies as an independent and professional investment Information and Credit Rating Agency. Views are personnel.

The Pulp and Paper Times:

The current domestic market share, in terms of volume of packaging paper (PP) is at around 60-65%, vis-a-vis newsprint (NP) and printing and writing paper (PWP), which is at around 30-35% for the industry on a consolidated basis. The paper mills, most of which have been using a wide spectrum of technologies (from age-old to the most modern), use a variety of raw material like wood, bagasse, wastepaper, bamboo, recovered fibre, wheat straw, etc. The per capita paper consumption in India is estimated at ~15-16 kg, against a global average of ~57 kg. ICRA expects the pace of demand for packaging board to outgrow PWP demand, given the rising penetration of specialised and conventional packaging against rising digitisation, which pose a threat for the PWP segment. However, the long-term demand outlook for paper in the domestic market remains favourable, given the low-domestic per-capita usage compared to the global standards.

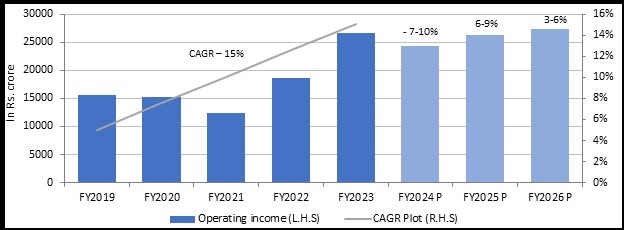

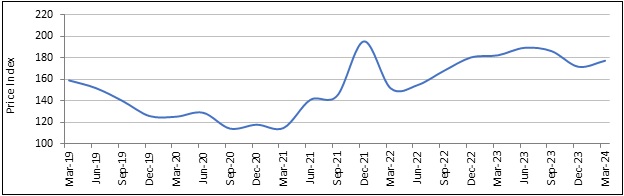

The Indian paper manufacturing industry witnessed two consecutive years of revenue contraction in FY2020 and FY2021, attributed primarily to the slowing demand for the NP/PWP segments, with rising digitation, especially in the newsprint segment, along with the impact of Covid-19, which stalled PWP usage following work from home (WFH) needs for corporates and online school/colleges. The industry revenues deep-dived by 2.5% and 18.3% during FY2020 and F2021 respectively. However, the revenues saw a nearly ~50% recovery in FY2022 over FY2021, albeit on a much lower base, as Covid receded with increased vaccination coverage and schools, colleges and offices reopened, thus showing an increased demand for the PWP segment.

The below chart exhibits the impact during Covid and the revival thereafter.

Exhibit 1: Trend in operating income (In Rs. crore)

Source: ICRA Research, company annual reports, Sample of 10 major listed paper companies in India

FY2023 saw a robust 42% revenue growth as the PWP segment saw lifetime high realisation levels, supported by pent up demand, post-Covid, as well as the high input cost regime, especially for pulp as well as imported coal.

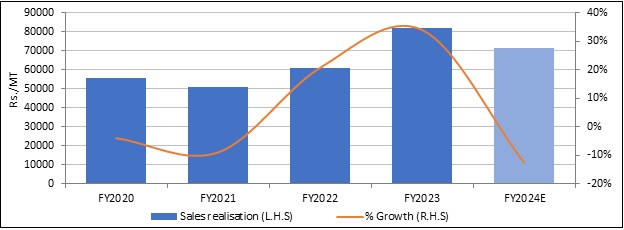

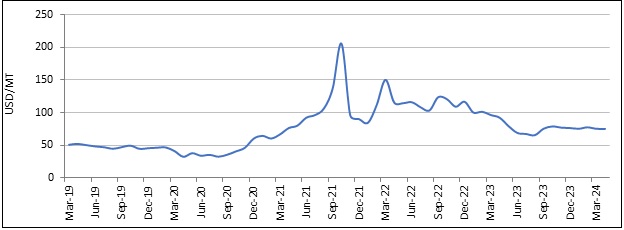

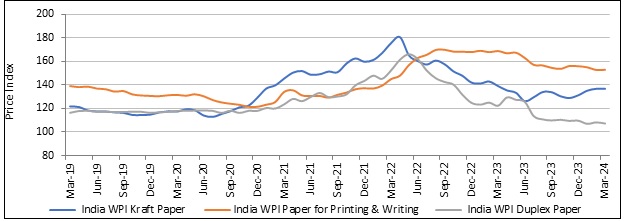

The exhibits below depict the movement of realization of different types of paper and the corresponding movement of pulp and imported coal, two key ingredients for paper manufacturing process. This in turn supported the overall topline and operating margins of the companies involved in the PWP segment. The realisation levels in packaging paper (over 60% of total demand) started falling from the second quarter of FY2023, with softening input prices and rising competition. The trend continued in the FY2024 as well, although some stabilisation has been seen from Q3 FY2024 onwards. The prices are expected to remain stable in the near term, however, much depends on the demand of paper coupled with global pulp, wastepaper and other raw material price trends.

Exhibit 2: Trend in overall sales realization levels (Rs/MT)

Source: ICRA Research, company annual reports

Exhibit 3: Trend in imported coal prices (USD/MT)

Source: Bloomberg

Source: Bloomberg

Exhibit 4: Price trend of Pulp and wastepaper

Source: Bloomberg

Exhibit 5: Price trend of various paper segments

Source: Bloomberg

Source: Bloomberg

With some moderation seen in the packaging paper segment, ICRA expects the paper industry’s volume growth to moderate to 2-5% in FY2024 compared to ~7% in FY2023. Given the expectation of healthy long-term demand for the packaging segment, mostly arising from e-commerce, food and food products, FMCG, textiles and pharmaceutical sectors and increasing penetration of specialised and conventional packaging, many paper manufacturing companies are planning to expand their board segment capacities. This would support the industry’s topline growth as we witness the gradual commercialisation of incremental capacity. ICRA estimates the industry revenues to contract by ~7-10% in FY2024 amid a sharp fall in realisations, followed by a rebound in FY2025, with an estimated growth of ~6-9% aided by the commercialisation of ongoing and incremental capacities (especially packaging segment) and improving demand conditions for the packaging segment.

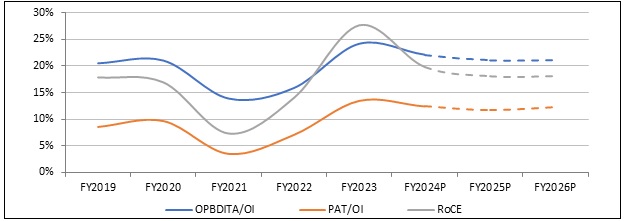

Exhibit 6: Trend in profitability metrics.

Source: ICRA Research, company annual reports, consolidation of 10 major listed paper companies in India

The cost structure for the industry is dominated by raw material (mainly wood pulp/wastepaper) and energy costs. Given the significant power consumption in the entire manufacturing process, the captive power generation facilities set up to meet the power requirements remain a key determinant for the profitability of a mill. The operating and net margins were ~24% and 13%, respectively, in FY2023 and is estimated to have contracted by 100-300 bps in FY2024. The margins remained healthy in H1 FY2024 for the PWP segment and are likely to contract in H2 FY2024, due to falling realisations. The margins for the packaging segment witnessed some pressure in H1 FY2024 on a YoY basis due to competition from imports as well as falling input prices. Some stabilisation was, however, seen from mid-Q3 FY2024. Within the packaging paper segment, Kraft paper was the most impacted, because being a relatively commoditised segment, it was exposed to the sharp movements in raw material prices. The overall EBITDA/tonne for the industry reached its peak levels in FY2023 and will moderate in FY2024 with the correction in realisations levels. ICRA expects the EBITDA per tonne to stabilise in FY2025.

The sample set’s operating margins in FY2023 improved significantly, owing to high realisation levels for the PWP segment compared to inputs costs and focus on backward integration. The margins are expected to moderate in FY2024 with a drop in realisation prices for the PWP and the packaging segment. However, on a medium-term basis the operating margins are expected to stabilise between 19-22% range, compared to 24% in FY2023.

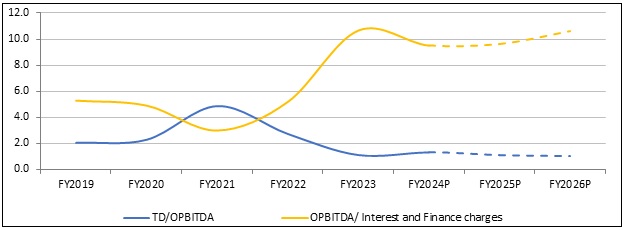

In terms of financial health, as reflected by the debt protection metrics, in FY2023, total debt/ operating profits before interest, tax, depreciation and amortisation (TD/OPBITDA) for the domestic paper manufacturing industry improved significantly from FY2022 levels, owing to sharp rise in topline and profitability levels. The ratio is estimated to have marginally weakened in FY2024 with expected moderation in profits. Given the ongoing and upcoming debt-funded capex undertaken by a few companies for capacity expansion in the packaging segment, the debt levels might remain elevated in the near term. The paper industry is expected to increase its manufacturing capacity and the capex is expected to remain in the range of 7-10% of the total sales. The credit metrics are likely to improve from FY2025, driven by the returns expected from the commercialisation of incremental packaging paper capacities.

Exhibit 7: Trend in debt coverage metrics.

Source: ICRA Research, company data, consolidation of 10 major listed paper companies in India

Source: ICRA Research, company data, consolidation of 10 major listed paper companies in India

The adoption of the New Education Policy (NEP) is likely to boost the demand for PWP, with increasing penetration of specialised and conventional packaging in sectors like FMCG, healthcare, e-commerce, pharmaceuticals and consumer industries pushing demand. Other key demand factors will include focus on innovative and attractive packaging and the shift from plastic to paper-based packaging in the FMCG and food & food product sectors.

With the ban on single-use plastics, there is a shift towards paper-based alternatives for items like bags, straws, cutlery, and packaging materials. This increases demand for paper products. Manufacturers may need to scale-up production to meet the increased demand, requiring investments in machinery and technology, thus ensuring that paper products meet the required strength, durability, and safety standards to effectively replace plastic items. Many Indian manufacturers have already announced their capacity enhancement plans to cater to increased demand in future.

However, upgrading production facilities to handle increased and diversified production demands can involve significant capital expenditure. Paper products may be more expensive than plastic alternatives, requiring efficiency improvements to maintain competitiveness. However, ensuring a consistent supply of sustainable raw materials can be challenging. The single-use plastic ban presents both challenges and opportunities for paper manufacturing companies. By leveraging on the increasing demand for sustainable alternatives, innovative investments and complying with environmental standards, the companies can capitalise on the shift towards a more eco-friendly future.

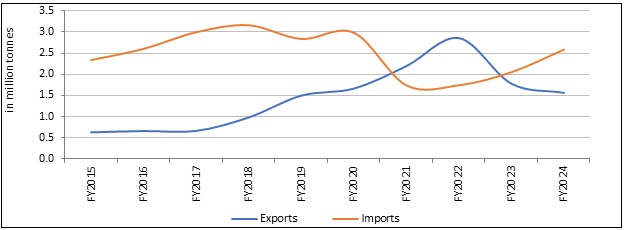

Challenges, however, will remain in form of rising digitisation, which poses long-term threat to the PWP segment. Stable supply of wood pulp from sustainable sources and reliable and cost-effective energy supplies are the other challenges. In terms of volume, India has been a net importer till FY2020 for past decade. However, the country turned a net exporter in FY2021 and continued to remain one till FY2022. A result of the declining demand amidst the pandemic on user-industries coupled with the rise of digitisation, which led to lower imports of paper. Since the domestic demand was weak, manufacturers tapped the exports markets, resulting in net exports for FY2021 and FY2022.

Exhibit 8: Trend in import and exports for last ten fiscals

Source: ICRA Research, Ministry of commerce and industry website

However, in FY2023, as the pandemic receded, with revival in demand from the PWP segment and opening of schools, colleges and offices, the trade gap narrowed, and India turned a net importer once again, as imports rose due to healthy domestic demand. Paper imports reached 2.6 million tonne in FY2024, a growth of 26% on YoY basis. The surge of 26% comes on top of a 18% increase in paper imports in the FY2023 over FY2022.

The primary reason for higher imports was free trade agreements with the Association of South-east Asian Nations (ASEAN) and Korea. Imports of paper from these countries do not attract any import duty, due to the agreement. However, one of the potential concerns can be dumping from Indonesia, since it is a part of ASEAN, and has surplus capacities available due to long-term forest concessions, supported by their local government, which enables lower raw material costs compared to domestic prices at present.

Secondly, China commands a lion’s share of the imports of paper and paper products into India. Under the Asia Pacific Trade Agreement (APTA), India provides import tariff concessions to China and other countries. The APTA is based on the margin of preference (MOP), signifying a reduced customs duty by a specific percentage. Further, China also has surplus capacities available in some grades wherein India becomes an attractive destination for re-routing their excess inventory, given trade restrictions imposed by the European Union and the US to protect their domestic markets. Thus, higher import figures and lower exports discourage Indian manufacturers to an extent. Despite India’s adequate domestic capacity to produce different grades of paper, any inflow of indiscriminate imports remains an area of serious attention. Moreover, there also has been significant investments by the Indian paper manufacturers to increase their capacities. Hence, the various paper grades imported into India need to be of good quality (creating undue price differentials) thereby providing a level playing field for Indian manufacturers.

In addition to these challenges, disruption in shipping routes through the disturbed Red Sea route leads to delayed shipment of wood pulp and other raw materials like wastepaper, which is used in manufacturing and also raises the overall shipping costs. The entities, however, have been adopting strategic measures, like early planning, stocking up for long lead inventories and navigating alternate sourcing destinations to mitigate these risks and ensure business continuity.

Maintaining environmental standards and meeting regulatory compliance norms is one of the other major challenges faced by manufacturers. The paper manufacturing industry is exposed to the environmental risks of air, land and water pollution, as discarded paper and paperboard make up a sizeable portion of solid municipal waste. Higher-than-permissible emissions could also have cost implications for the entities. Also, water treatment is extremely important because the pulping and bleaching process can release complex organic and inorganic pollutants that need to be properly treated. Further, being a labour-intensive segment, entities operating in the paper industry are exposed social risks related to the health, safety, and the overall quality of work-life balance for the workers as well.

Despite these hurdles, the long-term demand outlook for paper in the domestic market remains favourable. The increasing penetration of specialised and conventional packaging in sectors like FMCG, healthcare, e-commerce, pharmaceuticals and consumer industries, innovative and attractive packaging and the shift from plastic to paper-based packaging in the FMCG and food & food product sectors are major reasons which will keep pushing demand.

Challenges, however, will remain in form of rising digitisation, and import, which pose a long-term threat to the PWP segment. Finally, producing cost effective and requisite quality of paper to match domestic end consumer demand as well as grow its share in the export markets, while ensuring all regulatory compliance and environmental standards, remains the ultimate goal for the industry.

Web Title: Paper Industry Rebound: ICRA anticipates 6-9% revenue growth in FY25, driven by packaging sector expansion and demand recovery

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)