Consumption of paper and board in India is expected to grow over 35 million tons by 2035, says Mr Harsh Pati Singhania, JK Paper

Consumption of paper and board in India is expected to grow over 35 million tons by 2035, says Mr Harsh Pati Singhania, JK Paper

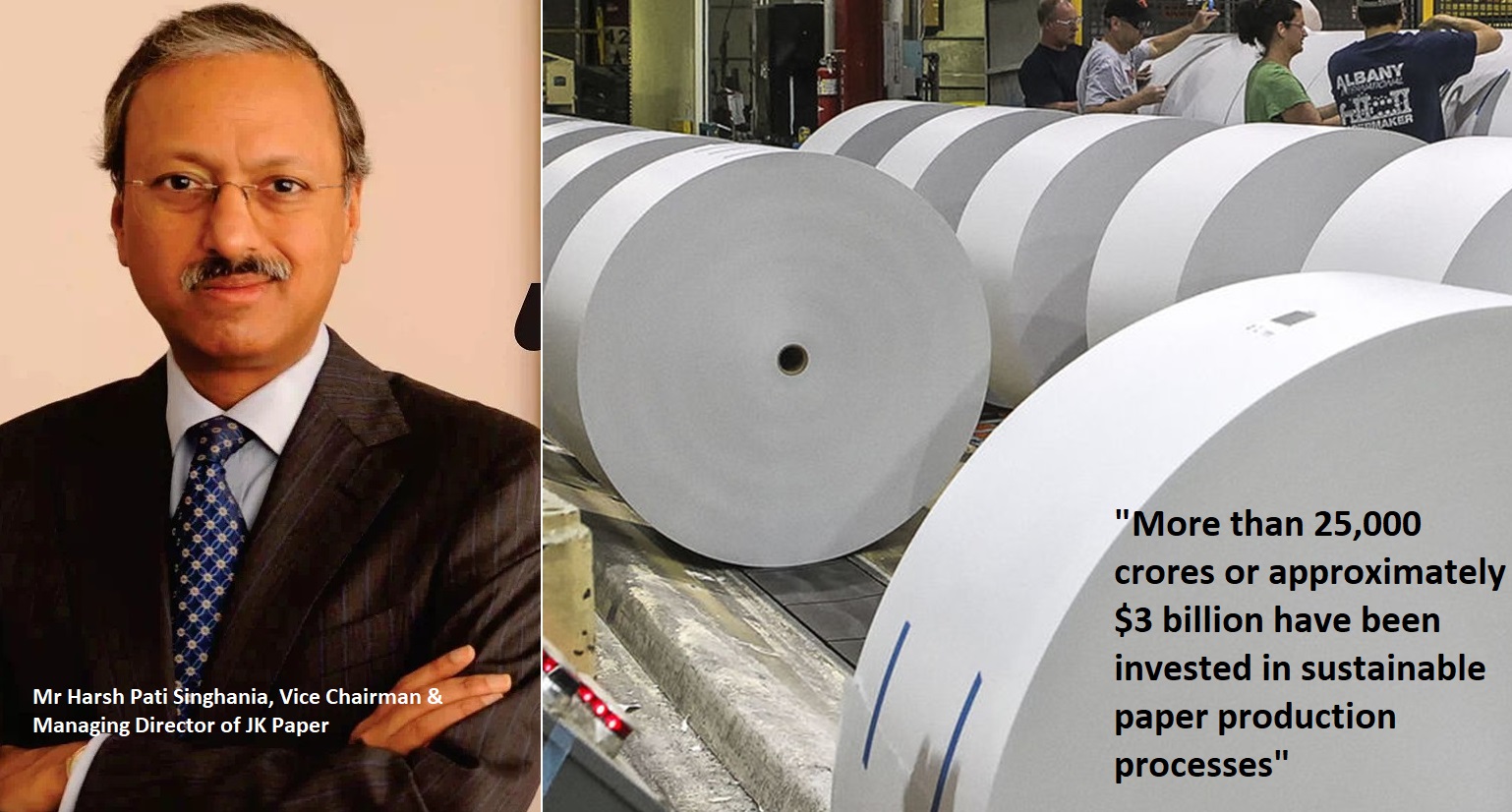

Mr Harsh Pati Singhania, Vice Chairman & Managing Director of JK Paper addresses the paper industry gathering during Paperex 2023

- About 50% of global paper demand is in Asia of which India is the fastest growing market in the world.

- Aqueous based coatings are increasingly replacing polyethylene packaging across various food categories.

- More than 25,000 crores or approximately $3 billion have been invested in sustainable paper production processes in the last few years alone.

- In India, an estimated 500,000 farmers are engaged in growing plantations of different species. On an average about 125,000 hectare are being brought under agro and farm forestry annually.

World economy is going through frequent disruptions and amidst such heightened uncertainty the Indian economy is exhibiting great resilience. Thanks to our leadership it is projected to be the only major economy to grow at a robust pace along with the subdued growth in most others which will propel India to be the third largest economy in the next few years. This scenario is replicated in the paper industry as falling demand in advanced economies especially in graphic paper segment has led to new capacity investments moving to Asia and in pulping to South America. For example, in the last two decades almost 60% of global new paper machine investments went into Asia Pacific region. Every type of modern fiber, paper and board making technology ranging from entry level solutions to state-of-the-art high-speed machines and high quality production lines have been deployed by the Asian pulp and paper producers.

Addressing at Paperex 2023’ inauguration session held in Gr. Noida, Delhi NCR, Mr Harsh Pati Singhania, Vice Chairman & Managing Director of JK Paper says, about 50% of global paper demand is in Asia of which India is the fastest growing market in the world expected to grow at about 4% to 5% compound till at least 2030. According to various studies, the consumption of paper and board in India is expected to grow to over 35 million tons by 2035 from approximately 22 million tons presently. Now there are several drivers for growth of the Indian paper industry. Greater emphasis on education and literacy by the government coupled with the growth in business and commerce and demand for better quality paper by environmentally conscious consumers are the major drivers in the writing and printing segment.

Demand for better quality packaging of FMCG products marketed through organized retail, booming ecommerce, rising healthcare spends, demand for over-the-counter medicines, and increasing preference for ready to eat foods are the major drivers for paperboard. The fiber and wood-based industry is in the centre of circularity, helping customers make more sustainable choices. Aqueous based coatings are increasingly replacing polyethylene packaging across various food categories with new products offering oil and water resistance, moisture and oxygen barrier and heat sealable capacities. In addition to meeting customer expectations, it also helps the industry gain a competitive advantage as paper and board are biodegradable and sustainable products.

He further added, “However, it is not simply enough to say that paper can be an alternate to plastics and other materials. Papers and boards must perform and meet the test of performance and price if we are to successfully succeed. Therefore, the need for the industry to innovate, to develop and find methods and technologies to be able to deliver this promise that consumers want. The industry is largely capable of meeting the requirements for domestic capacities as it has been doing in the past. I am happy to say, that the Indian paper industry is an excellent example of Atman Nirbhar. The industry right from the inception of over one and a half centuries has been producing paper in India and imports are restricted to certain varieties. So this we can take forward this whole agenda”

Integrated paper mills are also investing heavily in the latest technology available globally, whether it is state of the art pulp mills or high speed new generation paper machines. More than 25,000 crores or approximately $3 billion have been invested in sustainable production processes in the last few years alone. The Indian paper industry has agro-forestry routes, as has been mentioned, and strong backward linkages with the farming community from whom wood, which is the key raw material, is sourced.

Of the total demand for wood, Mr Singhania added that over 90% is sourced from industry driven agro and farm forestry sources with the rest coming from government and some other sources. Today, we can perhaps say that the Indian paper industry is wood positive, if not all mills. On an aggregate, they are. I can certainly say with a degree of pride that our company, JK paper is a wood and a carbon positive company. Today, substantial amounts have been spent by the paper industry on plantation research & development for production of high quality chronal saplings, technical extension services to improve agro and farm forestry, and handholding of marginal farmers.

In India, an estimated 500,000 farmers are engaged in growing plantations of different species. On an average about 125,000 hectare are being brought under agro and farm forestry annually, and cumulatively about 1.2 million hectare have been brought under such plantation. This has generated significant employment opportunities for locals in the farm and rural areas and has also supplemented significantly the income from farmers, something that you already mentioned.

The use of clonal development to bring farm forestry yield at par with the best in the world, and if I may say even better, has resulted in plantation activity increasing by over 54% in the last five to six years. In addition to sustainable farm forestry practices and responsible sourcing of raw material, the Indian industry has been making strides in efficient resource management through reduced energy and water consumption.

Mr Singhania said, in paper making, most of the industry actions are being done voluntarily, essentially on three key fronts, reduce energy intensity of business, increasing use of renewables and achieving water efficiency by reducing the water footprint. The paper industry is also in a strong position to make contributions towards achieving a net zero economy which our prime minister has talked about by increasing our share of renewables. The new paper machines with wider widths, faster speeds and more automation and sophistication have given a major fill up to the efforts in resource conservation, resulting in sharp reduction in specific unit consumption of resources needed. This is reflected in the work that is done by our mill where even after doubling of paper production, we still use the overall amount, the same amount of power and water. The pulp and paper market in India is clearly stepping into a new era.

The predicted growth in paper and paperboard consumption brings huge potential for the Indian industry, but also challenges that need to be tackled. The current projection of future demand as I mentioned, which will increase by 13 million tons in 10 to 12 years, will require new solutions. One of the major challenges faced by the industry is the sharp rise in import of various grades of paper. After a 25% jump in volumes in the last year, paper imports have risen further by 43% in the first half of this year alone. The surge in imports is mainly due to a threefold increase in imports of paper and paper board from the ASEAN region which arrived at zero import duty under a free trade agreement. While imports of all grades of paper have risen sharply, imports of unquoted writing and printing paper have witnessed the largest jump. Going forward, imports are expected to accelerate in view of the economic slowdown in China, the trade restrictions imposed by the US and European Union, and the large new paperboard capacities coming up in Indonesia and China. Even as the industry grapples with the issue of producing paper and paperboard at competitive prices, high cost of raw materials coming from demand from other wood based industry who have not been doing plantation and coupled with a significant increase in fuel costs and other inputs has resulted in a substantial increase in the cost of domestic manufacture of paper and paperboard, posing an additional headwind.

The waste paper recovery mechanism, while it is there, is not yet mature enough and the present recovery rate is barely 40%, which forces the industry to depend more on imports. Moreover, high logistic costs and high cost of capital have made the Indian market amenable to imports, leading to underutilization of domestic production capacities. While paper industries plantation activities have been going well, as I have mentioned, the overall raw material availability for wood based industries is not enough to meet the projected demand. The government needs to consider a policy that would enable wood based industries to have plantations established with raw material linkages by various industries.

“The industry on its part would also have to focus on recycling and use of other agri inputs, even though there are limitations to this. To be able to cater to the expanding market, the industry has to take measures to upgrade existing technology for better efficiency and quality. Greenfield capacity with high speed new generation machines would give a major boost to the efforts in this and in resource conservation. Technology suppliers can be sensible partners in evaluating the pros and cons when defining the best investment targets. I'm sure with the state of the art pulp and paper making technologies displayed at this paperx, we will be able to see a lot of new technology and find solutions to many of the issues facing the paper industry. These technologies also offer opportunities for lowering costs and becoming far more energy efficient, improving capacity utilization and improving the quality of Indian paper. Also, issues related to the environment, management and business practices that would come in with a new digital economy need to be addressed” he added.

In closing, I would like to wish all of you a very rewarding conference and exhibition and the success to the pulp and paper industry in India as it enters an era of rapid growth. Ladies and gentlemen, while we see sort of challenges coming from a digital economy, as you have heard from previous speakers and as people in the room will testify, we believe that paper will still remain the future. Thank you very much, ladies and gentlemen.

Web Title: Consumption of paper and board in India is expected to grow over 35 million tons by 2035, says Mr Harsh Pati Singhania, JK Paper

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)