Foreign packaging boards Manufacturers are already making moves to capture the Indian market by partnering with Importers and dealers to set up conversion units

Foreign packaging boards Manufacturers are already making moves to capture the Indian market by partnering with Importers and dealers to set up conversion units

RESET > RE-THINK > RESTART

-India’s Paper Industry has topped the charts in Asia for being the most volatile market since Q1 to Q3 of 2024

-In the state of Gujarat alone, it's estimated 30 % of the Paper mills from the existing running units will close the operations in the coming year.

-India finds limited success with 50-60 gsm exports to Africa but struggles to compete in higher gsm wood-free paper against mills based in Indonesia and the Middle East

-These virgin boards, mainly supplied by China and Indonesia, are more cost-effective and offer consistent quality which makes them the preferred choice.

The Article below is written by Mr Dipesh Laddha, Director of Kalpataru Papers LLP is based out of Dubai and having offices in India, Germany and Tunisia covering the MENA region and facilitating the Packaging and Specialized grades globally. Have been in the Paper Industry since 25 years and evolved with its network among the leading Paper mills, Leading convertors and Packaging solution providers across the Globe. Views are personal.

THE PULP AND PAPER TIMES

Current State of Indian Paper Industry and its important key statistics :

The Indian Paper Industry's current turbulence is indeed reshaping its framework. The post-COVID environment that has intensified financial pressures on the manufacturers, dealers, distributors and exporters from the Indian Paper Industry has put the Industry facing a dual edge situation: a) there seems a huge potential of consolidation of manufacturing capacities among the Paper manufacturing units or face severe downfall for those who are unable to adapt this dynamic shift of change.

The staggering fact that 32% of India’s 872 paper mills are financially distressed, running under capacities and are already in red mark loudly indicates they are on the verge of bankruptcy or will shut down soon. Most importantly this situation emphasises the need for a fundamental restructuring across the value chain of the Paper Industry as per the respective product profile by being technically advanced, collaborate in other regions of the domain to have a wider reach and also to sustain the competition faced by the imports from the neighbouring countries.

The Indian Paper Industry, like many other sectors is striving for sustainability, must recognize that its way forward involves more than just improving efficiencies—it requires a transformative thought process. While the logical & modern concept R3 (Reduce, Reuse, Recycle) offers essential guidance, the complex challenges faced by the Paper Industry calls for a deeper, strategic form of R3 (Reset, Re-Think, Restart) on regular intervals. This approach will highlight the need to keep identifying the evolving demands for the innovative products and unique approaches to ensure your own existence in the market.

India’s Paper industry contributes approx. 89,000 Crore revenue to the economy achieved from the installed production capacity of nearly 29.82 million tonnes of Paper considering all the grades produced in the country. Among these units approximate 35 % of the paper mills are facing underutilized capacities, resulting into bleeding of Capital, compounded by operational halts and leading to declining margin for the manufacturer and directly or indirectly impacting dealers & convertors in the chain. Additionally, The surplus production of almost all the grades of paper across the country has limited the accessibility of the mills and dealers to other states, making it harder to find new opportunities and hurting profits.

Outlook for Virgin Packaging Board, Recycled Packaging Board, Writing & Printing Paper and Speciality Grades in the last 2 quarters and the following 2 quarters:

Interestingly, India’s Paper Industry has topped the charts in Asia for being the most volatile market since Q1 to Q3 of 2024. The domestic prices did not remain stable nor sustainable for a longer time and specifically this chaos was prevalent in the recycled waste-based mills, who are in a hurry to reduce or increase the prices, influenced by the lack of study raw material and more pressure out of the desperation to get rid of surplus production in the segment.

Despite the sluggish & uncertain demand, the average prices of Printing & Packaging Grade in India are still above the Global Average Index price and the India’s Paper Industry was only fortunate that due to the surging shipping cost till the last quarter the imports have not been able to regain its dominance at the same speed as much they could have, other than the exception of specific product profile which lacks domestic production.

Virgin Packaging Board: Installed production capacity for virgin packaging board in India is around 2.78 million tonnes annually, while the printing industry, especially in mono cartons, consumes approximate 2.14 million tonnes per year. The supply-demand gap would still go narrower when considering those units that consume their own output for their own ancillary products. However, a significant threat comes from neighbouring Asian countries, where combined virgin board production has reached 2.65 million tonnes. These producers are offering much lower prices due to their efficient and large-scale production.

Additionally, customs duty benefits wherever applicable give imported Virgin Packaging Board a further price edge. Manufacturers outside India are already making moves to capture the Indian market by partnering with Importers and dealers to set up conversion units, easing the way for more imports of these packaging boards. This combination of competitive pricing and favourable trade terms makes imports an imminent challenge for India’s domestic mills.

Recycle Packaging Paper & Board:

The Indian paper industry, especially in the segment of recycled packaging boards and paper, has experienced significant challenges and disruptions following the COVID-19 pandemic. These issues have affected various sub-products, particularly Kraft paper and Duplex board manufacturing.

1. Excess Capacity with Lack of Innovation: Post-COVID, India has added a considerable amount of production capacity in recycled Kraft paper and Duplex board without major innovations in the product offering. This expansion was largely driven by the booming demand during the pandemic, but the industry is now struggling to maintain this growth as export demand has dwindled and the surplus production being offered in the domestic market in the cutthroat competition.

2. Regional Product Characteristics: What was previously a more nationally distributed and even internationally exported product has now become regionally focused product. Majority of the grades of Kraft & Duplex Board will be sold in the same state where it is produced or up to the level of neighbouring states only. Exports have become challenging for Paper mills producing Kraft Paper (corrugation grade) hence no choice left but to sell primarily within localized market. While for Duplex Board there is some support in Exports due to the huge capacities India has built but the mills setting up in the middle east and south Europe are poised to give the domestic mills more competition ahead.

3. Rise of International Competition: Numerous countries, some with a lower GDP than India, have invested in the Kraft paper manufacturing units, shrinking the export market further for Indian mills. The consumption / production of the Kraft has increased globally but being sourced from the local mills of those countries, the demand for Corrugated Kraft paper from India in the International market has gone down miserably, leading to an oversupply in the domestic market.

4. Decline in Raw Material Imports and Price Hikes: Another key issue is the reduction in the availability of imported raw materials, such as recycled wastepaper (OCC grades). Many Western countries are now directing their Paper waste collections to their own local production units instead of exporting, which has affected raw material availability in India to a certain level. Some parts in Middle East have implemented Export duty and making it more expensive for Indian importers and hence such mills have more dependency on the local wastepaper collection which is more volatile and of low quality compared to the imported grades. This has driven up the cost of domestic waste materials, squeezing the profitability of mills.

5. Severe Domestic Competition and Cash Flow Crisis: With many new capacities have started in the last two years, the industry is grappling with severe competition, leading to negative cash flows. These cash flow challenges are pushing numerous mills to the brink of closure. In the state of Gujarat alone, it's estimated 30 % of the Paper mills from the existing running units will close the operations in the coming year.

6. Duplex Board Segment Facing Similar Pressures: The Duplex board industry, while still managing some exports, is facing the pressure of the huge additional production capacities started recently. Like India, few countries in Middle East have also started Duplex Board production and are now actively participating to create the space in the market. This will not allow the prices to go up drastically rather it would push the product more to be sold in the local surrounding of the manufacturing units. The increased capacities in this segment will make survival more challenging, pushing mills to rely on the sales to domestic market, which is already becoming over-crowded.

Writing & Printing Segment:

The global shift in demand for woodfree (uncoated graphic) paper, driven largely by digitalization and changing consumption habits in Western countries and the Far East, is echoing in the Indian Paper Industry as well. With leading manufacturers in the developed countries transitioning to more sustainable alternatives like paper bags, the Writing & Printing paper segment is undergoing a very significant transformation in the desperate need to have more revolution to this product profile.

Indian Paper Industry got some protection due to high shipping costs, which resulted into limited imports and sustained local production. The new education law pumped up the consumption in the last year but however, as shipping costs stabilized and other Asian countries ramp up production, imports are expected to enter India at increasingly competitive prices. This shift could challenge Indian mills that rely on woodfree paper production, particularly in sustaining profitability within this segment. Mills producing recycled grades of woodfree paper will particularly remain more vulnerable.

Outlook for Exports for the Indian Paper Industry in terms of potential, price & demand for Indian products:

The Indian Paper Industry has shifted from being one of the major paper exporters during the pandemic and now being the importer in terms of international trade volume. Several factors have contributed to this decline, impacting both Indian paper mills and exporters who relied on exports from India and are now struggling due to this downturn.

In Asia, China leads the virgin packaging board market with efficient and stable pricing. For India, exports in this category are limited to high bulk board for the Tobacco industry and Sulphate Bleached Virgin Board (which China doesn’t produce) — Other standard grades from India are too expensive to compete internationally for the Packaging board segment.

China, despite being the world’s largest producer, faces weak demand for low-grade packaging while is focused and investing on virgin packaging board. For writing and printing paper, India finds limited success with 50-60 gsm exports to Africa but struggles to compete in higher gsm wood-free paper against mills based in Indonesia and the Middle East. The same challenge remains for the the cut size format.

In recycled paper and board, increased production capacity in the Middle East and Africa reduces India’s export opportunities. Additionally, some East African countries have imposed anti-dumping duties on brown paper imports, further limiting export volumes from India.

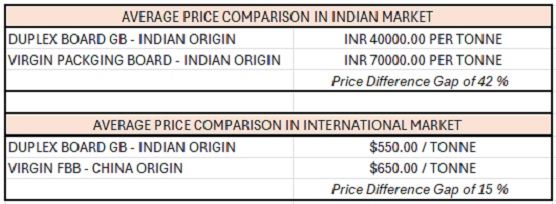

There is another interesting factor, when we compare the average price chart of International Market in the Packaging Board segment:

In the international market, the price gap between Recycled Grey Back Board and Virgin Packaging Board has become so small that customers are increasingly opting for virgin grades. These virgin boards, mainly supplied by China and Indonesia, are more cost-effective and offer consistent quality which makes them the preferred choice. This shift in preference is also contributing to a decline in exports of recycled board from India, as the competitive pricing of virgin grades undercuts the demand for recycled alternatives in global markets.

Despite these challenges, the Global Packaging Paper market is projected to grow at a compound annual growth rate (CAGR) of 3.1% from 2022 to 2026, assuming no major economic crises occur.

The Imports in the Paper Industry for the coming months and also the impact of Red Sea Crises for the Pulp & Waste Paper:

The recent stabilization in Middle Eastern conflicts has led major shipping lines to resume routes through the Suez Canal and the Red Sea, signalling a return to normalcy in global logistics. This shift is expected to reduce ocean freight costs for west-to-east trade, enhancing the availability of imports, including wastepaper, in the Indian market.

Wastepaper prices, known for their sensitivity to shipping costs, are likely to decrease as freight rates normalize. This trend can lead to increased imports of the raw material and price corrections in the domestic market in recycled paper grades during Q4 2024 and Q1 2025.

However, the Indian paper industry faces challenges from rising imports. Data indicates a 34% increase in paper and paperboard imports in FY24, with a significant surge from ASEAN countries due to zero-duty agreements.

The global pulp and tissue paper markets are experiencing notable shifts. Despite some mill closures in South America and the U.S., hardwood and softwood pulp prices are gradually decreasing. Pulp inventories are building up, suggesting a supply-demand imbalance. This accumulation may exert further downward pressure on prices. Fluff pulp and dissolving pulp maintain stable demand due to their specialized applications, such as in absorbent products and textiles. This stability contrasts with the volatility observed in other pulp segments

The demand in tissue paper industry in Asia is projected to grow by approximately 38–40% YoY. This surge is driven by increasing demand for hygiene products and the establishment of new manufacturing facilities across Asia, the Middle East, and Africa.

The situation demands more caution, more agility and updated information as each and every product in the domain are impacting in a different way to the manufacturers, to dealers and to the importers.

Web Title: Foreign packaging boards Manufacturers are already making moves to capture the Indian market by partnering with Importers and dealers to set up conversion units

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)