ITC-PSPD continues to make structural interventions to reduce dependence on imported pulp, foray into the fast-growing premium moulded fibre products

ITC-PSPD continues to make structural interventions to reduce dependence on imported pulp, foray into the fast-growing premium moulded fibre products

- Significant increase in in-house pulp production was achieved through strategic interventions, Industry 4.0 initiatives and improved wood mix.

- Capacity utilisation of the chemical pulp mill at the Bhadrachalam unit touched a record high during the year

- Market standing continues to be driven by product mix enrichment and diversification of the customer base

The Pulp and Paper Times | 2023

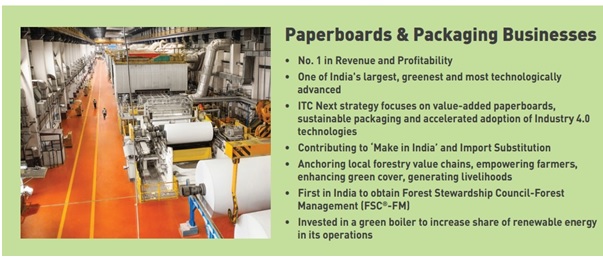

Amidst heightened inflationary pressures, ITC- Paperboards, Paper and Packaging business delivered robust performance during the year leveraging its integrated business model and strong end-user engagements. Structural interventions across the value chain including, inter alia, developing high yielding clones, augmenting value added paperboard & in-house pulp manufacturing capacity, product & process innovation, digital interventions including Industry 4.0 and creating superior distribution infrastructure continue to provide the Business sustainable competitive advantages.

ITC-PSPD fortified its clear leadership in the Value Added Paperboard (VAP) segment through innovation focused on developing customised solutions for end-use industries and maintaining best-in-class customer service levels. The Business is also the industry leader in the eco-labelled products segment as well as the premium recycled paperboards space.

ITC’s Paperboards and paper division is confident of further consolidating its leadership position in the Indian Paper and Paperboards industry leveraging recent investments in innovation platforms anchored on the development of sustainable products and cutting-edge digital technologies to set new benchmarks in customer satisfaction, operational excellence and sustainability.

The Annual Report of ITC for FY 22-23 says, that paperboards and paper division continues to ramp up its sustainable products portfolio and achieved appx. two-fold increase in revenue over the previous year. The ‘Filo’ series of sustainable solutions viz. ‘FiloBev’ (for cups), ‘FiloServe’ (for QSR, bakeries, food retail) & ‘FiloPack’ (packaging for sweets and deep freeze applications), continued to witness strong traction in both domestic and international markets. The ‘Omega’ series viz. ‘OmegaBev’ and ‘OmegaBev Vio’, certified compostable by Central Institute of Petrochemicals Engineering & Technology (CIPET) and also registered with the Central Pollution Control Board (CPCB), continued to increase its franchise with large eco-conscious brands.

The Paper & Paperboards division continues to make structural interventions to reduce dependence on imported pulp, enabling substantial reduction in operating costs. Significant increase in in-house pulp production was achieved through strategic interventions, Industry 4.0 initiatives and improved wood mix. Capacity utilisation of the chemical pulp mill at the Bhadrachalam unit touched a record high during the year.

The Business is stepping up investments in this fast-evolving space which holds immense growth potential, supported by the R&D capabilities of ITC’s Life Sciences & Technology Centre and through external collaborations with global specialists.

The report further said, the demand for Paper & Paperboards grew at about 6-7% in FY 2022-23 driven by robust growth across most end-user segments. Sequential moderation was witnessed during the second half of the year, primarily due to inventory pipeline adjustments by export customers and relatively lower offtake by domestic customers towards the end of the year. Cost of key inputs remained elevated with global pulp prices witnessing unprecedented highs during the first half of the year on account of global supply chain disruptions, geopolitical tensions, adverse weather events, higher power and chemical costs.

However, pulp prices moderated in the second half of the year due to subdued Chinese demand, recessionary conditions in Europe and progressive normalisation in supply chain operations. Chemical prices, which were also at record highs, moderated towards the end of the financial year, while remaining elevated over pre-pandemic levels. Coal supplies were adversely impacted by supply chain disruptions and prioritisation of domestic supplies to thermal power plants. The Indian Rupee depreciated against the US Dollar during the year which further impacted cost of imports.

ITC-PSPD continues to procure its wood requirements from sustainable sources. Research on clonal development has resulted in introduction of high-yielding and disease-resistant clones that are adaptable to a wide variety of agro-climatic conditions which aid in increasing farmer income whilst securing greater consistency in earnings. In this context, your Company’s Life Sciences & Technology Centre is engaged in developing higher yielding second generation clones with enhanced pest and disease resistant attributes.

Augmentation of the Bleached Chemical Thermo Mechanical pulp production facility has been completed during the year. The project for augmenting chemical pulp capacity is also nearing completion. These initiatives will further enhance substitution of imported pulp, enhance support to Indian farmers and enable reduction in operating costs.

During the year, ITC-PSPD delivered robust performance in the Specialty Papers segment. Market standing continues to be driven by product mix enrichment and diversification of the customer base. The domestic industry continues to remain under pressure on account of cheap imports from China. Anti-dumping duty on Décor paper continues to provide a level playing field for domestic industry, further enhance ‘Make in India’ opportunities & foster domestic value chains and enable import substitution. A strong distribution network, efficient supply chain and customised product portfolio leveraging cutting-edge innovation capabilities based on superior customer insights, provide structural competitive advantages to the Business to further consolidate its market standing in the fast growing Décor segment.

Forest Stewardship Council-Forest Management

ITC-PSPD has the distinction of being the first in India to have obtained the Forest Stewardship Council-Forest Management (FSC®-FM) certification, which confirms compliance with the highest international benchmarks of plantation management across the dimensions of environmental responsibility, social benefit and economic viability. Till date, your Company has received FSC®-FM certification for close to 1.5 lakh acres of plantations involving over 25000 farmers. During the year, nearly 4.3 lakh tonnes of FSC®-certified wood was procured from these certified plantations. Your Company sustained its position as the leading supplier of FSC®-certified paper and paperboards in India.

Initiatives such as bund plantation and scaling up plantations in new catchment areas in Odisha and Chhattisgarh have enabled procurement of more than 10,000 MT of wood from these areas, with further potential for increasing cost-effective access to fibre in the future.

Moulded Fibre Products

During the year, ITC set up a wholly owned subsidiary, ITC Fibre Innovations Limited, to foray into the fast-growing premium Moulded Fibre Products (MFP) space. Towards this end, construction of a state-of-the-art MFP manufacturing facility in Badiyakhedi, Madhya Pradesh, is underway. Customers are increasingly seeking solutions that are bio-degradable, substitute single use plastic and meet stakeholder and regulatory expectations across industries including food serving and delivery, pharmaceutical, beauty and electronics. The raw materials for such products are sourced from environment-friendly, renewable, natural fibres such as wood, bamboo etc. The MFP business will leverage your Company’s expertise in fibre value chain, manufacturing excellence and strong sustainability credentials to rapidly scale up business going forward.

Web Title: ITC-PSPD continues to make structural interventions to reduce dependence on imported pulp, foray into the fast-growing premium moulded fibre products

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)