Shipping Shockwave: US East Coast to India ocean freight rates for recovered fibre shipments soar by $400, with delivery times stretched to 65 days

Shipping Shockwave: US East Coast to India ocean freight rates for recovered fibre shipments soar by $400, with delivery times stretched to 65 days

The Bureau of International Recycling (BIR) Report Highlights Red Sea Crisis Fallout: Shipment Delays, Freight Surge, US Recovered Fiber Impact, and European Market Slowdown

- The Red Sea crisis adds another challenge to the mix

- A few vendors have stopped accepting new orders from India

- The significantly higher increase in shipping costs to Indian ports compared to other Asian destinations put India out of the market

- US recovered paper exports to Asia were expected to increase owing to challenges in European markets

- Delivery uncertainties have become a major concern for buyers of European paper

The Pulp and Paper Times | 2 Feb 2024:

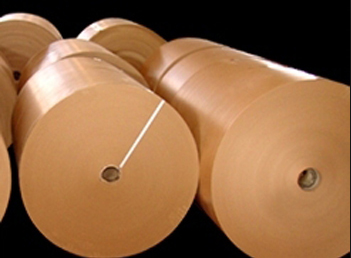

The USA has been experiencing intense demand for recovered fibre despite shipments being slowed by wintry weather in some areas. Domestic containerboard and paper mills had increased demand for OCC and mixed paper, causing pressure on premiums. Recovered fibre generation improved owing to additional OCC and mixed paper accumulated during the year-end holidays, although winter storms impacted some of this material. Prices for OCC and mixed paper have risen significantly over the past year.

Export orders have also strengthened, with rising prices for bulk grades and delays in shipments owing to Red Sea slowdowns affecting freight rates. US recovered paper exports to Asia were expected to increase owing to challenges in European markets. Europe has traditionally accounted for a significant portion of Asia’s recovered paper imports, making the USA an attractive alternative source.

The global recovered paper market is facing significant challenges owing to the situation in the Red Sea. Suppliers and buyers in Asia - particularly in South East Asia - have been struggling to settle recovered fibre import deals, especially from Europe and the USA, in recent weeks. Mills in the region have reduced purchases of European brown grades over recent months and have turned to local collections owing to slow domestic packaging demand and weak exports to China.

Delivery uncertainties have become a major concern for buyers of European paper: transit times have been extended by at least two weeks, making it difficult to plan procurement. Sellers have reported risks of cancelled orders and revoked vessel space bookings for recovered paper cargoes owing to container shortages and intense competition for lower shipping rates.

European recovered paper offers have increased in recent days in South East Asia, leading to an unusual price decline despite supply constraints. This drop is attributed to available volumes being diverted from India to South East Asia.

The Red Sea shipping crisis has caused a significant supply crunch in the Indian recovered paper market, leading to surging prices for domestic collections. Some suppliers have either cancelled recovered paper imports ordered in December or have asked clients to bear additional shipping costs, while a few vendors have stopped accepting new orders from India.

Ocean freight rates for recovered fibre shipments from the US East Coast to India have surged by US$ 400 per 20-foot container, equivalent to an additional US$ 20 per tonne for the material. Delivery times for US shipments to India have extended to 65 days, causing further challenges for buyers in the market.

OCC prices in the UK have decreased significantly for several reasons, including inflated ocean freight rates and rerouted ships keeping more supply within domestic markets.

Reduced export buying and decreased domestic consumption in Europe are also influencing these price drops. European containerboard and cartonboard production has reached historically low levels, with containerboard mills operating at 80-85% capacity.

Weak domestic demand and declining exports have also affected cartonboard demand in Europe, with an envisaged 16.4% decline in 2023 expected to be followed by 3.8% growth in 2024, according to Fastmarkets.

Reports on the Red Sea/Suez Canal shipping crisis suggest that elevated rates are expected to continue, with shipment delays and equipment shortages also projected, especially in Asia. Transportation company C H Robinson has recommended at least four weeks’ advanced booking time for upcoming trades.

Europe has been particularly impacted by increased freight rates resulting from the crisis, and rate hikes in India (effective from January 20) range from US$ 1000 to 1500 per container. Limited volumes of European OCC are thought to be moving through the Red Sea route.

European suppliers have negotiated cheaper surcharges for shipping recovered paper to South East Asia in response to the Red Sea disruption. Sellers were previously facing surcharges of US$ 500-1000 per container, equivalent to US$ 20-40 per tonne for recovered fibre on this route.

RISI’s Paper Packaging Monitor Europe report for December highlights a list of delayed recycled containerboard capacity projects, coinciding with weak demand and oversupply challenges in the European packaging sector. The five largest containerboard producers in Europe in 2023 were Smurfit Kappa Group, with a 12% market share and 6.04 million tonnes of annual capacity, followed by DS Smith at 7.2%, SAICA at 6.7%, Mondi at 5.2% and Hamburger at 4.7%.

The oversupply in the European packaging sector has been exacerbated by several hundred thousand tonnes of new capacity coming on stream. Additionally, the global oversupply of packaging papers has attracted overseas suppliers looking to gain market share by offering competitive prices in Europe. Consequently, downward price pressure is expected to persist in the European containerboard and cartonboard markets until conditions tighten enough to support price increases.

General market overview

The final two months of last year seemed to confirm a positive trend for finished product and recovered paper demand in Asia and Europe. Prices were increasing slightly despite a shipping cost increase of around US$ 200 which had been announced for January 2024 - a week before the Red Sea vessel attacks and the “war surcharge” applied by shipping lines.

Domestic market prices in Europe had been almost the same as those for export and a downtrend had not been expected for the coming months.

The surcharge of between US$ 1000 and US$ 3000 per container suddenly applied by the shipping lines blocked the loadings between the final week of 2023 and the opening week of 2024. Amid this temporary interruption, mills in Italy and elsewhere in Europe confirmed prices and volumes to ensure regular supply in the case of a rapid resolution of the Red Sea issue and a resumption of shipping, which would lead to increased competition in the form of Asian demand. This uptrend vanished a few weeks after the start of the Red Sea attacks as finished product demand and prices fell 5 to 10% when compared to their levels of the previous two months.

The significantly higher increase in shipping costs to Indian ports compared to other Asian destinations put India out of the market as sales prices had to be 30 to 40% higher than for other countries in Asia in order to be competitive.

A temporary lack of containers caused by longer shipment transit times initially created a worry for the mills in India and elsewhere in Asia but this lasted only a couple of weeks as the local recovered paper market dropped at the end of January. At the same time, more material was available in Europe despite decreasing local recovered paper demand.

China, the main engine of the Asian economy, seems unlikely to see a recovery in the near future, with low consumption, higher costs and a lack of orders for finished product creating a fight for survival across the entire industry.

Web Title: Shipping Shockwave: US East Coast to India ocean freight rates for recovered fibre shipments soar by $400, with delivery times stretched to 65 days

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)