Imposing duties on paper imports is like a double-edged sword; each ton of imports provides recycling opportunities for the domestic industry, says Mr. Mehul Mehta, president of FPTA

Imposing duties on paper imports is like a double-edged sword; each ton of imports provides recycling opportunities for the domestic industry, says Mr. Mehul Mehta, president of FPTA

-Paper Mills are forced to sell their products at lower prices to maintain their production cycles and clear their inventorie,

-Apart from this excess capacity domestically, imports have also increased competition among manufacturers, driving down prices and squeezing profit margins”

-The difference in domestic and international prices can and will open flood gates of imports into India.

-Imported Waste paper buyers may face higher costs and increased competition for available waste paper, impacting their procurement strategies”

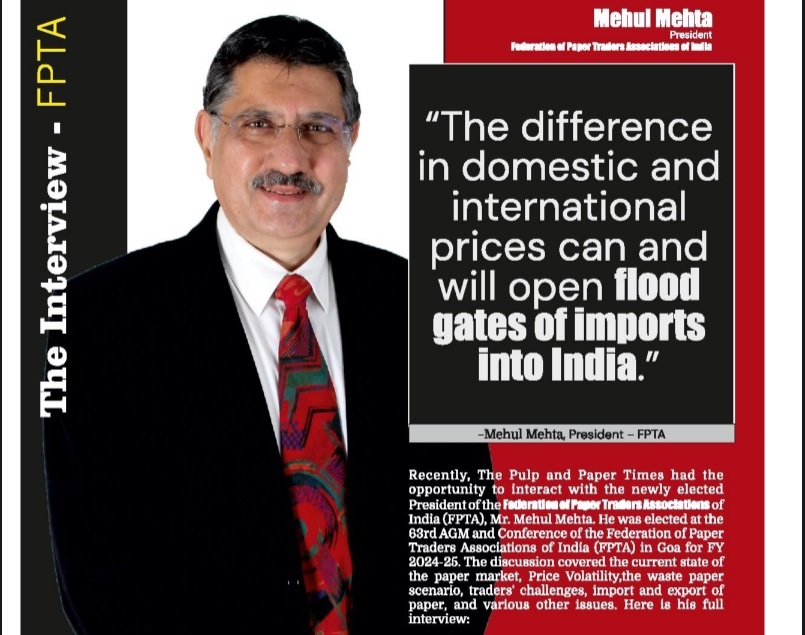

Recently, The Pulp and Paper Times had the opportunity to interact with the newly elected President of the Federation of Paper Traders Associations of India (FPTA), Mr. Mehul Mehta. He was elected at the 63rd AGM and Conference of the Federation of Paper Traders Associations of India (FPTA) in Goa for FY 2024-25. The discussion covered the current state of the paper market, Price Volatility, the waste paper scenario, traders' challenges, import and export of paper, and various other issues. Here is his full interview:

The Pulp and Paper Times:

Q: Give us a small introduction to Federation of Paper Traders Associations of India (FPTA)

"The Federation of Paper Traders’ Associations of India (FPTA) is the apex body representing the interests of paper traders across the country. Established in 1959, FPTA aims to unify India’s paper-based trade by promoting the intrinsic value of paper as a renewable and sustainable material. The organization works to enhance the competitiveness of the paper industry by advocating for favourable legislative and regulatory conditions and spreading best practices.

The FPTA comprises of 37 affiliated member associations, representing over 6,000 paper traders. It offers a range of services to its members, including seminars, training courses, annual technical and business sessions, and regular communications to keep members informed about industry developments.

The FPTA is dedicated to fostering a positive image for paper, ensuring resource efficiency, and securing a sustainable future for the paper industry in India.

Q: Being elected for FPTA’s incoming president, what are the major challenges you think are hurdling paper trade?

"There are several challenges being faced by the trade which manifest in several ways:

Unhealthy competition leading to price difference: Companies often engage in aggressive pricing strategies to outdo each other, which can lead to unsustainable profit margins.

Unsecured Credit and Defaults: The issue of unsecured credit and payment defaults is a significant concern. It hampers cash flow and creates financial instability within the trade community and this could also lead to potential bad debt.

Matching Targeted Volumes: Achieving the targeted sales volumes consistently is a challenge due to market volatility, supply chain issues and pressure from the principals.

Inconsistent Price Movements: The paper trade is highly susceptible to price fluctuations, which can disrupt planning and profitability.

Supply Issues: Ensuring a steady supply of quality products from manufacturers is crucial to maintaining volumes and service to the customer in ever-shifting market dynamics.

International Benchmarking of Business Models: Adopting best practices from global leaders in the paper trade can help us enhance our business models and stay competitive.

Environmental Concerns and Sustainability Expectations: Meeting the growing demand for sustainable practices and products is vital. We must innovate to reduce our environmental footprint while maintaining profitability. However, this adds to the cost.

Regulatory Changes and Import Policies: Navigating the evolving regulatory landscape and staying compliant with import policies are crucial.

Requirement to Maintain Large Inventory and Its Cost: Maintaining a large inventory to meet market demand can be costly. The storage, management, and potential obsolescence of inventory add to the financial burden, necessitating efficient inventory management strategies.

Addressing these challenges require collective effort from all stakeholders even in the industry. By fostering a culture of collaboration rather than competition, focusing on quality and sustainability, and prioritizing long-term goals over short-term gains, we can create a healthier and more resilient paper trade and industry."

Q: Being a reputed paper association, what is your quick review of the present paper trade market scenario? About demand and supply dynamics of various paper grades, especially Coated, uncoated woodfree, duplex, Newsprint, and Kraft paper segments.

Earlier market volatility was visible in different grades at different times. The current paper trade market scenario is highly volatile across all grades uniformly, primarily due to demand, geopolitical tensions and conflicts. These disturbances have significant implications for both the demand and supply dynamics across various paper grades, including coated, uncoated woodfree, duplex, newsprint, and kraft paper segments.

The end supplies also largely depend on various aspects which are controlled by large conglomerates for supply of wood, pulp, energy and specialty chemicals.

Import of Raw Materials & Export of Finished Products: The instability in supply chain caused by conflicts has disrupted the import of raw materials, resulting and increased costs Similarly, export of finished paper products has also affected by leading to delays and increased transportation costs, container shortage and longer transit periods.

Demand Fluctuations: The demand for different paper grades is also influenced due to digitisation both in government and private sectors. For instance, the demand for writing and printing paper may decline, while the demand for packaging materials like kraft paper might increase due to a surge in e-commerce activities as people avoid physical stores.

Price Volatility: The combined effect of disrupted exports and imports, along with fluctuating demand, leads to significant price volatility in the market. Businesses find it challenging to set stable prices for their products, which affects their profitability and long- term planning. The difference in price between domestic and international mills is also a key factor.

Segment-wise summary:

Coated Paper: During Q1 and Q2, the volumes were sluggish and supply pressures were witnessed.

Uncoated and Woodfree Paper: During Q2 volumes have substantially dropped and domestic mills have slashed the prices substantially due to (a) lack of demand and (b) competition from foreign mills.

Duplex & Kraft: Excess capacity and decline of exports

Newsprint: Decline in demand, reduction of pages by newspaper and structural changes in media houses coupled and growing prominence of social media insta-delivered information/news.

However, overall, we see a robust demand for most of the grades in India to grow on year- on-year basis.

Q: Excess Capacity and Export decline have hit hard to Kraft and Duplex segment across India. Do you think both factors are the main reason behind a sluggish market or the organic growth of 6 to 7% per annum vanishing or reducing due to recession, inflation and war?

Yes, both excess capacity and export decline have significantly impacted the Kraft and Duplex segments across India, contributing to the sluggish market. However, these are not the only factors at play. The organic growth rate of 6 to 7% per annum is also being affected by a combination of recession and inflation.

Excess Capacity: The overproduction in the Kraft and Duplex segments – both in the recycled and virgin grades - has led to a surplus in the market. Apart from this excess capacity domestically imports have also increased competition among manufacturers, driving down prices and squeezing profit margins. Companies are forced to sell their products at lower prices to maintain their production cycles and clear their inventories.

Export Decline: The decline in exports is another critical factor. Global demand for Kraft and Duplex segments has been fluctuating due to economic uncertainties and trade restrictions. In addition, new capacities being added in Asia. This decline in exports reduces the market reach for Indian manufacturers, leading to an oversupply in the domestic market and further exacerbating the issue of excess capacity.

Q: In the last few years, we found that paper traders are more inclined toward backward integration by setting up their own paper mills to control better margins. How do you see the future picture in terms of pricing? Do you think this backward integration will provide healthy competition?

For a paper trader diversifying backward setting up a mill is very difficult as capital investment is huge and return on Investments (ROI) cycle is very long. In recent years, the trend of few paper traders moving towards backward integration by establishing their own paper mills is noticed, albeit with mixed success ratio.

While backward integration by paper traders is likely to lead to more stable and competitive pricing, it also has the potential to drive healthy competition within the industry. However, more than the backward integration by individual paper traders, collaborative efforts of paper traders would help to control margins more effectively, ensure a stable supply with a more resilient market environment.

Q: Govt. of India has brought the Import of Paper under Paper Import Monitoring System (PIMS) in 2022, Do you think that regulating the paper import may lead to market monopoly by some paper manufacturers in the future?

The Government of India’s introduction of the Paper Import Monitoring System (PIMS) in 2022 aims for better monitoring and control over the quality and quantity of paper entering the country. This regulatory measure had sparked a debate on the need for its implementation.

Continuous government oversight and regulatory measures can help prevent/mitigate risk of market monopolies thereby ensuring fair competition.

However, the volumes and value of total imports of all grades of paper into India are way smaller than of other commodities for which import monitoring systems and policies are required to be in place and put in place accordingly.

Q: There is a huge demand for writing and printing paper which is driven by the education sector, and the growth of the eCommerce sector which is creating opportunities. And on the other hand, even today, per-capita consumption of paper in India is low. Is the paper sector, which is expecting to yield high returns in the next five to 10 years, carefully calibrating the prices of paper?

Yes, the paper sector is indeed carefully calibrating the prices of paper to navigate the current market dynamics and capitalize on future growth opportunities. The demand for writing and printing paper is significantly driven by the education sector and the burgeoning eCommerce industry, both of which are creating substantial opportunities for growth. However, the relatively low per-capita consumption of paper in India presents both a challenge and an opportunity for the industry.

Education Sector: The education sector remains a major consumer of writing and printing paper. With increasing literacy rates and government initiatives such as Sarva Shiksha Abhyaan and Beti Padhao Programs to promote education, the demand for paper in this sector is expected to remain strong. Currently over the last few months the volumes have dipped due slow pace in fully implementing New Education Policy (NEP).

eCommerce Growth: The rapid expansion of the eCommerce sector has led to a surge in demand for packaging materials viz. FBB, SBS, Duplex Boards, Kraft and Thermal grades. This trend is likely to continue as more consumers shift to online shopping.

Per capita paper consumption in India is currently at a low of 16 kg as against the global average of 57 kg. Per capita paper consumption in India is projected to increase over time with increasing levels of literacy, higher growth of organised retail and need for packaging, replacement of single-use plastic and overall economic development.

Increase in prices of paper is definitely expected over the next few years. However, the calibration of prices for domestic mills would also be dependent on prices of pulp and international prices of finished paper. The difference in domestic and international prices can and will open flood gates of imports into India.

Q: One of the largest paper-making giants, Asia Pulp and Paper (APP), has received a land allotment letter to set up one of India's most extensive paper manufacturing infrastructure (1.2 million MTA). APP will produce WPP, Tissue and Packaging Grades in India; what is your view on this massive investment? Will the local market of these grades experience a slowdown? How do Indian paper mills compete in these grades?

The presence of global giant coming back to India with a massive investment would have significant impact in the domestic market. There would be immediate reduction on dependencies on imports on all the grades they manufacture, as a local producer, in India. Undoubtedly, it would increase competition in the Indian market.

May I respond in two ways. Firstly, entry of APP will increase competition as already indicated. However, it is also opportunity for local manufacturers to further elevate their standards and innovations by focussing on quality, service and sustainability in this evolving market landscape.

Secondly, we feel with the growth path towards Vikasit Bharat 2047 which India has embarked upon, the increase in domestic consumption would absorb the additional production capacity APP is bringing.

Q: How would you evaluate the waste paper market, European Union is planning to ban or partially ban waste paper to other countries, new big capacities are coming up in the US, Europe and Southeast Asia which are to consume waste paper majorly. How do you assess all this development for a waste paper buyer, if you could shed a light?

The EU’s ban on waste paper exports will likely lead to a reduction in the global supply of waste paper. This could create supply constraints for countries that rely heavily on imported waste paper for their recycling needs. With a decrease in supply, the prices of waste paper are expected to become more volatile. Buyers may face higher costs and increased competition for available waste paper, impacting their procurement strategies.

New Capacities in the US, Europe, and Southeast Asia: The new capacities coming up in these regions are expected to consume a significant amount of waste paper. The establishment of new recycling facilities in the US, Europe, and Southeast Asia will lead to regional shifts in the waste paper market.

Waste paper buyers will need to diversify their sources and exploring alternative suppliers and regions can help ensure a steady supply of waste paper together with investing in advanced recycling technologies and efficient waste management practices can enhance the quality and yield of recycled paper.

Q: According to FPTA’s past president Mr. Aseem Bordia, every ton of finished paper imported into the country provides 5-7 times the fibre for remaking paper. The suggestion of providing protection (in terms of imposing safeguard, anti-dumping, and countervailing duties on imports) to domestic manufacturers is totally illogical and merits no consideration at all. How do you view this claim and support it?

I agree with Mr. Aseem Bordia’s perspective that every ton of imported finished paper into the country would provide opportunities to the domestic industry for recycling.

Imposing safeguard, anti-dumping, and countervailing duties on imports is like double- edged sword. On one hand it is of prime importance of protecting domestic manufacturers if their balance sheet shows cash losses and on the other hand by non-implementation of these measures help maintain competitive pricing in the domestic market which would help important sectors viz. education, FMCG and exports of printed books which is growing by leaps and bound. It is essential for all the stake holders to consider the broader implications.

Q: How does FPTA evaluate the sustainability of the Indian Paper Industry? What challenges and opportunities might surface in the coming future?

The Federation of Paper Traders’ Associations (FPTA) evaluates the sustainability of the Indian Paper Industry by considering various factors such as resource efficiency, environmental impact, and market dynamics. One of the biggest opportunities for the industry is to replace single-use plastics with paper products. If the Indian Paper Industry can successfully advocate for and implement a ban on single-use plastics, the demand for paper products is likely to surge, potentially outstripping supply. There are at least 5 to 6 specialty paper mills that would be commencing production in the next 18-24 months.

However, in the same breath the industry faces huge challenge of acute shortage of wood and fibre remains a primary hurdle hindering growth. The Indian Paper industry has already started working and manufacturing with alternate fibre sources like agricultural residues. Additionally, water conservation and energy efficiency are also critical.

Furthermore, government should take initiatives in allocating waste land to paper mills for tree plantations which can provide dual benefit of green cover which helps carbon credit as well as a sustainable source of fibre.

The transition also presents several challenges to the industry. The industry would need to scale up production capacity, ensure to upgrade quality standards to match plastics, and innovate to meet diverse consumer needs. In the same breath, it is also for the FMCG to convert their packaging to accept the alternative to plastics, that is paper.

Balancing these challenges with the opportunities will be crucial for the industry’s long- term sustainability

Q: Any message for the paper industry.

“As a fellow paper trader and incoming president of the FPTA, would request the industry to:

• Embrace sustainability and environmental responsibility

• Invest in innovation and technology

• Foster collaboration, knowledge sharing and continuous support to the paper fraternity

• Address challenges proactively to ensure growth and prosperity

• Work towards adoption of standardization of test parameters of various grades of paper and boards for easier evaluation of quality

• More active participation in paper trade events and supporting “Paper Day”

• Lastly, Live and Let Live”

Web Title: Imposing duties on paper imports is like a double-edged sword; each ton of imports provides recycling opportunities for the domestic industry, says Mr. Mehul Mehta, president of FPTA

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)