Anti-Chinese sentiments may work in favour of Paper Manufacturers; Hike in Import Duty possible

Anti-Chinese sentiments may work in favour of Paper Manufacturers; Hike in Import Duty possible

New Delhi | 23th June | The Pulp and Paper Times:

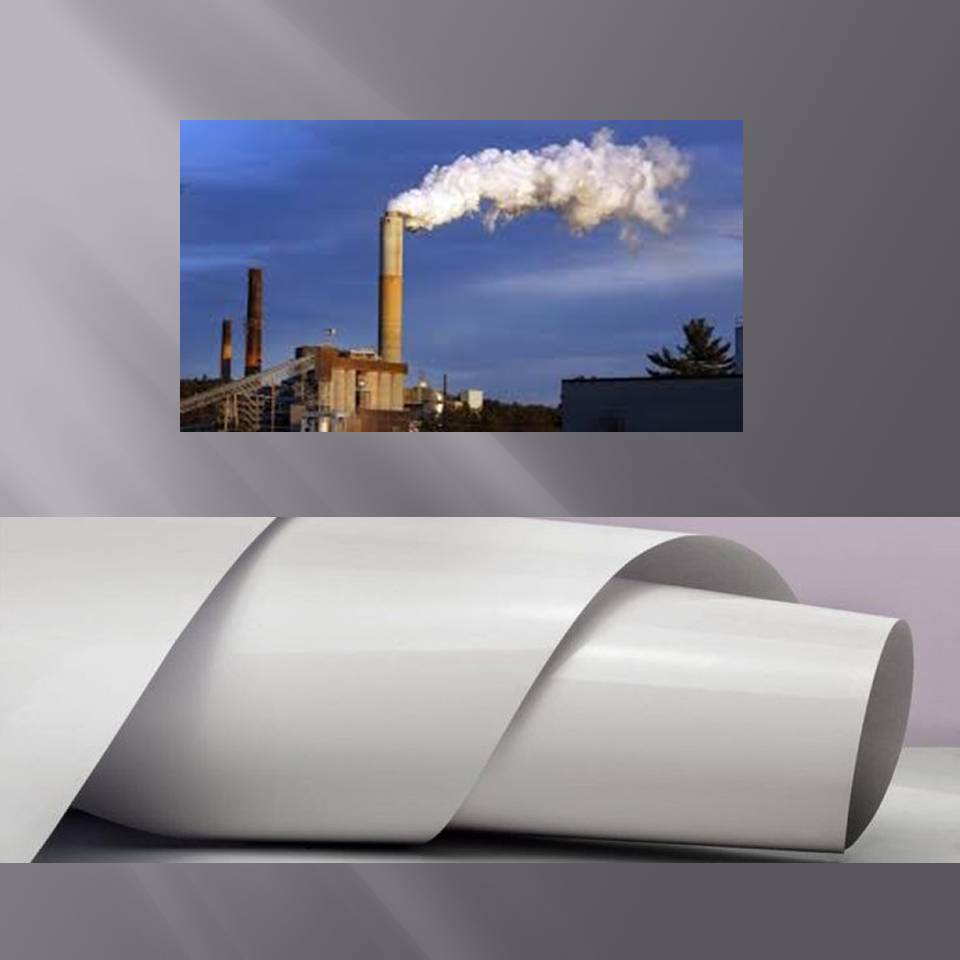

The long-pending demand of the paper industry to hike the import duty from 10 percent to 20-25 percent may see the light soon. The recent brutal confrontation between Indian and Chinese soldiers on the LAC is simmering the anti-Chinese sentiments among the countrymen. The current situation may flow the wind in favour of Paper mills owners. According to Media reports, Government may soon impose an additional 10 to 15 percent import duty on coated paper and paperboard in order to combat Chinese import.

China is one of the major exporters of coated paper to India. According to the latest directorate general of commercial intelligence and statistics (DGCI&S) data, Rs 1,773-crore worth paper imports have landed from China in April-February (11 months) period in FY20, against Rs 1,831 crore in the entire 12 months of FY19. Similarly, against an import of Rs 1,830 crore from ASEAN in FY19, imports of paper have gone up to 1,870 crore in the first 11 months of FY20.

In good news for the paper sector and likely relief for local manufacturers, Zee Business has learnt from its Commerce Ministry sources that import duty may soon be hiked to 20-25% in this segment. Also, a ban may be imposed on cheap Chinese imports as well.

"As of now, the import duty stands at 10%. India imports goods from China to the tune of nearly 70 crore dollars. Noteworthy, in the past week, nearly 10% rally has been seen in the paper products in China," Zee Business Research Analyst Ashish Chaturvedi said.

It is believed that the Government is all set to fine-tune the import duty structure as well to have a quick review of all ‘Free Trade Agreement’ (FTA). The import of coated paper and paper board under HSN code 4810 to India is pushing Indian paper mills out of competition in front of global paper manufactures.

China and Indonesia are using this opportunity to push their excess inventory to India at very low prices, AS Mehta, president, Ipma, told FE. “We have urged the Centre to hike basic customs duty on paper import to 25%. Again, the paper should be placed in the Negative List for all existing and future FTAs (free trade agreements),†he says.

Indian Government also is measuring a few more steps to address the import surge issue. According to a letter issued by Department of Promotion of Industry and Internal Trade (DPIIT) to the Ministry of Commerce on 6 Jan 2020, recommends a complete ban of import of stock lot under HSN code 4810 (coated paper and paper boards).

DIIPT further recommends in the letter that the Paper import monitoring system (PIMS) in line with the steel import monitoring system (SIMS) to be implemented for closer monitoring of imports under HSN code 4810.

The letter also says ‘Review of a provision of all FTAs where items under ITC HSN code 4810 was offered for negotiation, particularly ASEAN and Korea. For all future as well as under negotiation FTAs, the items under HSN code 4810 to be kept in the exclusion / negative list’.

Paper mills in India are feeling the pinch from both demand and supply sides, after the market compression due to Covid-19 and the menace of cheap paper imports from China and ASEAN. In exasperation, the major paper mills have written to the Union government seeking that the import tariff walls on paper are up 25% from the present 10% to stop the avalanche of cheap paper imports from China.

Web Title: Anti Chinese sentiments may work in favour of Paper Manufacturers Hike in Import Duty possible

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)