Rules of Origin: Paper Import is likely to go down bringing relief to the domestic manufacturers

Rules of Origin: Paper Import is likely to go down bringing relief to the domestic manufacturers

The Government of India has notified the Customs (Administration of Rules of Origin under Trade Agreements) Rules, 2020, which will come into force from 21st September 2020. These Rules (CAROTAR 2020) will apply to imports into India of goods at preferential rates of basic customs duty under free trade and other trade agreements and seek to curb the misuse of the Rules of Origin under the FTAs by requiring the importer to submit detailed information about the imported goods while importing under claim of preferential rate of duty.

Here is detailed views of Mr. Satya Pal Gupta, Former President- FPTA & Chairman- Narsingh Dass Group, Narsingh Dass Group is a multifarious trading group, renowned and much admired in the paper industry. With its core business aimed to create an efficient flow of goods between manufacturers and consumers of paper, paperboard & related products, the group has risen consistently to be one of the most trusted business houses of its kind in India.

New Delhi | 2nd September 2020 | The Pulp and Paper Times

Trade can be a key factor in economic development. The prudent use of trade can boost a country's development and create absolute gains for the trading partners involved. Trade has been touted as an important tool in the path to development by prominent economists. However, trade may not be a panacea for development as important questions surrounding how free trade really is and the harm trade can cause domestic industries to come into play.

India, over the years and under various political regimes post-independence has entered into bilateral/ multilateral trade agreements with several countries. India's experience with such trade agreements has been one mainly sided, that its trade deficit has only widened. China accounts for half of India's trade deficit – while Chinese imports into India have grown 26 percent year-on-year, India's exports to China grew barely 13 percent. All the more it has been noticed that Chinese products are routed through other countries and it has increased post the agreements. Products of other countries too were found to be routed through third countries to avail concessional rate of duties.

These agreements can be broadly identified as follows:

Free Trade Agreements (FTA)

Preferential Trade Agreement (PTA)

Comprehensive Economic Cooperation Agreement (CECA)

Comprehensive Economic Partnership Agreement (CEPA)

India has a trade agreement named SAPTA (SAARC Preferential Trading Arrangement) with South Asian countries where the PRD for imports of Paper & Paperboards from the signatory countries has been agreed as Zero.

India has a trade agreement named ASEAN-India CECA with ASEAN (Association of South East Asian Nations) countries where the PRD for imports of Paper & Paperboards from the signatory countries has been agreed as Zero.

India also has a CEPA agreement Republic of Korea (South Korea) where the PRD for imports of Paper & Paperboards has been agreed as Zero.

India also has a trade agreement named Asia Pacific Trade Agreement (Formerly Bangkok Agreement) with China and four other countries and the reduction in tariff agreed upon for imports of not only Paper & Paperboards but a range of other products as well has been notified vide Notification No. 50/2018-Customs dated 30th June 2018. Just to name one HSN Code 4802, a reduction of 30 percent on the basic customs duty has been notified.

Similarly, India has signed agreements with several other countries where concessions to the Basic Customs Duty applicable to Paper & Paperboards have been agreed upon.

The chief objective behind the signing of the trade agreements was to increase bilateral trade and also increase the scope of the same. The agreements entered into were done after years of skillful negotiations and much bargaining between the countries and concessions granted to each other. It also leads to the introduction of a concessional rate of duty, much lower than the normal Basic Customs Duty and called as Preferential Rate of Duty (PRD).

The advantage of PRD lies more with the exporting country rather than the importing country. PRD effectively reduces the Basic Customs Duty thereby reducing the cost of the imported goods making it cost-effective against the domestically produced goods. It increases competition in the market. Domestic manufacturers have to continuously innovate and upgrade to remain competitive.

There have been times when the domestic manufacturers feel threatened in losing their market shares when importers bring in goods in increased quantities at low prices taking advantage of PRD, to increase their market shares and protect their revenues in their home markets.

To consider the impact of Basic Customs Duty as against the Preferential Rate of Duty the comparison chart is given below for HSN Code 4802. The normal Basic Customs Duty for various products under Chapter 48 is 10 (ten) percent.

Under Normal Duty Under Preferential Rate of Duty

(ASEAN & Rep. of Korea) China

Cost of goods 100 100 100

Basic Customs Duty@

10% 10

Preferential Rate of Duty@0% 0 7

110 100 107

Social Welfare Surcharge@10% 1 0 0.7

IGST @12% 13.20 12 12.92

Total 124.20 112 120.62

(Note: Custom Duties for ASEAN is as per ASEAN-India CECA, for the Republic of Korea is as per Rep. of Korea-India CEPA, and for China, it is as per Asia Pacific Trade Agreement – Notification No. 50/2018-Customs dated 30th June 2018 permitting a 30% reduction to Basic Customs Duty and hence 7%)

The above chart clearly proves that goods brought under the PRD have a definitive advantage over goods imported by paying the normal rate of duty.

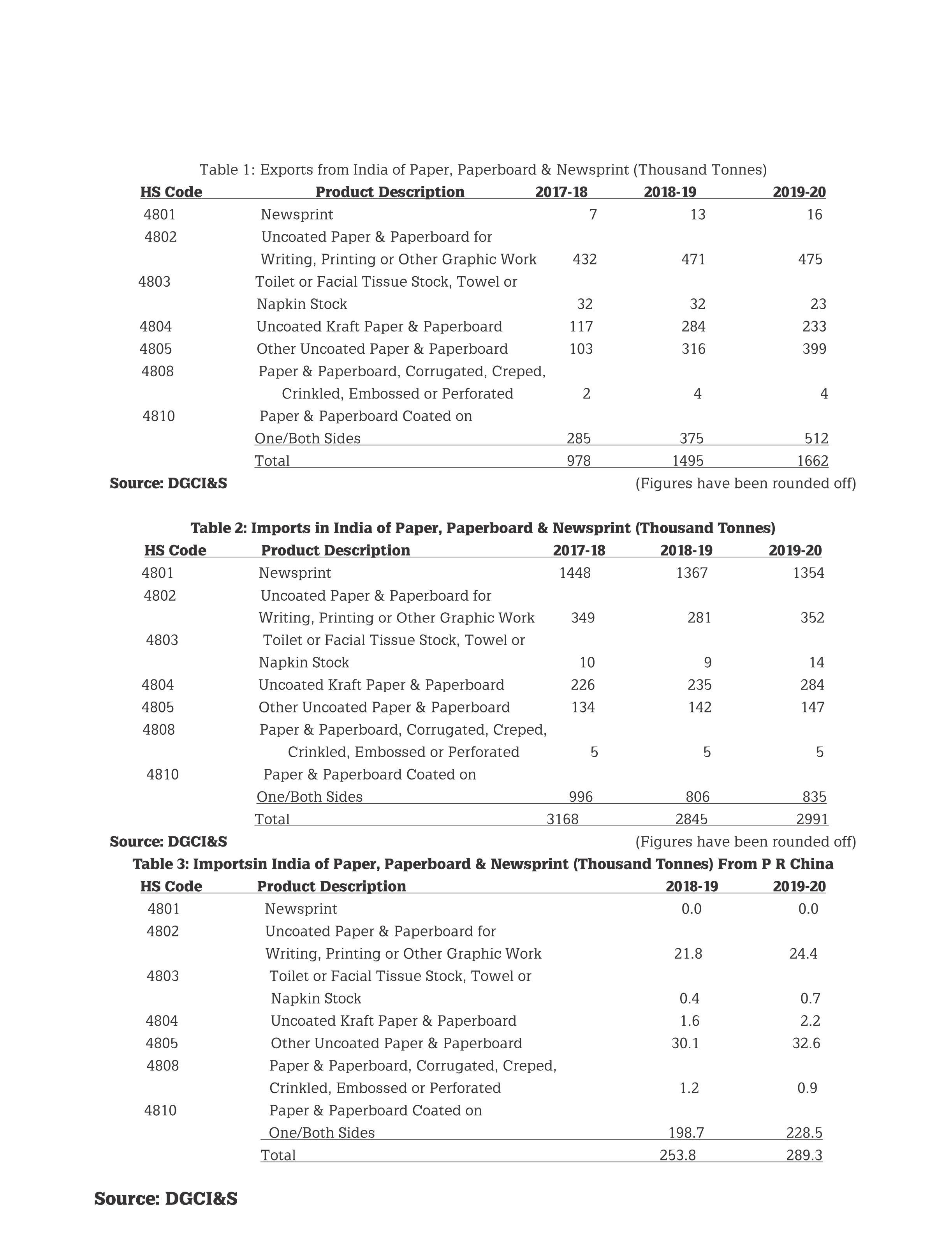

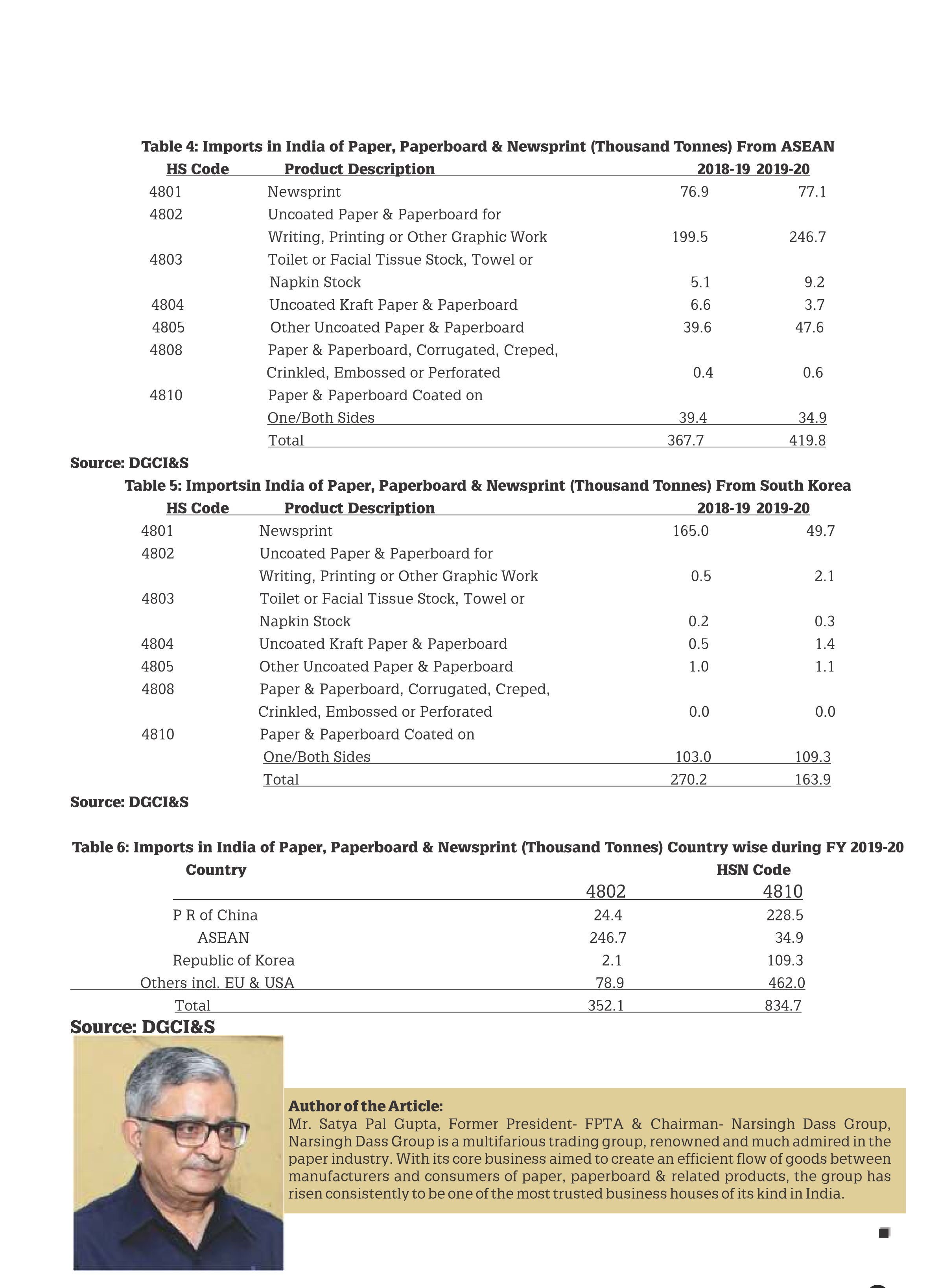

India in FY 2019-20 imported 2991K metric tonnes of paper and paperboards out of which 1354K – 45.2% was for 4801, and the remaining 1637K consisted of 4802 -11.8%, 4803 – 0.5%, 4804 -9.5%, 4805 – 4.9%, 4808 – 0.2% and 4810 – 27.9%. (Refer Table 2)

When the share of Newsprint (4801) is excluded, China’s share in the total imports comes to 17.7%, ASEAN comes to 20.9%, and the Republic of Korea comes to 6.97%. (Refer Table 3-5)

What is more significant is the share of ASEAN in imports of 4802 which comes to 70.1%, whereas for 4810 China’s share comes to 27.4%, ASEAN – 4.2%, Republic of Korea – 13.1% and Other countries including European Union and USA come to 55.3%. (Refer Table 6)

It is pertinent to note that the domestic manufacturers over the years have been feeling threatened by the large-scale imports due to the advantage of the PRD structure. The domestic manufacturers in order to protect their interests approached the appropriate authorities (Directorate General of Trade Remedies -DGTR) for the imposition of Anti-Dumping Duty and were successful in their effort. Anti-Dumping Duty was imposed on imports of Coated Papers originating from the Peoples Republic of China, European Union and USA vide order dated Dec 26, 2018. Anti-Dumping Duty was also imposed on imports of Uncoated Copier Paper originating from Indonesia, Thailand and Singapore vide order dated Oct 30, 2018. (Refer Table 3-6 for quantities imported from these countries.)

The Government of India, Ministry of Commerce & Industry on January 31, 2020, came out with Notification No. 45/2015-2020 prohibiting imports of stock-lots of paper and paperboards into the country. It was one more step by the Government of India to provide the domestic paper manufacturers protection as well as a level playing field.

The Government of India, Ministry of Finance, came out with Notification No. 81/2020-Customs (N.T.) on August 21, 2020, specifying the new rules of origin for imports into India. These rules are called Customs (Administration of Rules of Origin Under Trade Agreements) Rules 2020.

Shri Piyush Goyal, Union Minister for Commerce and Industry, Government of India, addressing the ASEAN-India Business Council virtual meet on August 27th, 2020 pleaded for ensuring the sanctity of the rules of origin and observed that lax implementation of the rules of origin has also led to Chinese goods coming into India through some ASEAN nations at preferential tariff rates. The statement and observation of the Minister concerned are very clear, unambiguous, and self-explanatory.

These rules are primarily meant for importers of goods who claim a Preferential Rate of Duty (PRD) in terms of a trade agreement.

Understanding the recent changes in the rules of origin is not simplistic, one needs to keep in mind the present-day geopolitical conditions, bilateral relations between India and neighboring countries, recent changes made by the Government of India for procurement by the government departments, e-commerce, and withdrawal of permission to operate in India to a large number of apps and websites of a neighboring country.

There could be three logical reasons for the Government of India, political, economic and commercial, and legal and financial, behind bringing the change in the rules of origin.

There is a popular movement to boycott Chinese products and prevent China from reaping economic benefits at the expense of India raging across the nation. India needs to contemplate actions on both the diplomatic and political front. The crucial significance of trade deals has dawned on India now more than at any other time. The loss to the government exchequer by avoidance, misdeclaration, and taking wrongful benefit of the Preferential Rate of duty are some of the other issues which weigh heavily.

The change in rules of origin for genuine importers is more an issue of increased compliance. But for importers who were taking undue benefit by misdeclaration, and avoiding payment of actual customs duty it is a red-light warning.

The volume of imports is likely to go down bringing relief to the domestic manufacturers. The prevention of misdeclaration and rightful payment of customs duty will save the government revenues and provide a level playing field to the domestic players.

A word of caution. The impact of Covid-19 continues with no timeline visible for it to fade away. Reduction in business activity, contraction in demand, and with soft advertising and commercial printing down, the pressure on prices to move south shall continue to persist. There would be exporters abroad willing to share the burden of the increased taxation partly or wholly to hold on to their market shares. The domestic paper industry needs to have the right strategy to take benefit in the changed scenario.

Web Title: Rules of Origin Paper Import is likely to go down bringing relief to the domestic manufacturers

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)