With subdued economic growth expected globally over the next year or two, more paper & board likely headed towards India and other SEA nations as long as it can, says Mr. Brian McClay of TTOBMA

With subdued economic growth expected globally over the next year or two, more paper & board likely headed towards India and other SEA nations as long as it can, says Mr. Brian McClay of TTOBMA

Key Points of the Interview:

-China’s imported pulp buying has been very subdued since early March as paper machines there run at close to half speed and more domestic pulp supply has become available”

-The high availability of domestic wood has helped increased China’s pulp production significantly and softened global pulp markets

-We expect pulp pricing should remain relatively low through 2026 but about 10% higher than 2025

In an exclusive conversation with The Pulp and Paper Times, Mr. Brian McClay, Chairman of TTOBMA—a privately held pulp and paper competitive intelligence and net-price indices provider with offices in Fort Mill, South Carolina (USA); Montreal, Canada; Shanghai, China; and Dubai, UAE—delves into the intricate challenges and opportunities within the global pulp market. He sheds light on the growth of the pulp and paper sector in South Asia, future trends, pulp price prospects, new capacity expansion in China, and wood consumption patterns. Additionally, Mr. McClay highlights the current market scenario for pulp and the possible impact of tariffs imposed on imports from Canada and Mexico by USA. His invaluable insights offer a deep understanding of the nuanced landscape of the industry. Here is his full interview.

The Pulp and Paper Times:

Q1: Please give us a brief introduction to TTOBMA.

TTOBMA is a global pulp & paper market intelligence services provider. It publishes monthly transactions-based, net-pulp-price indices for major grades and markets and for recovered paper and tissue in North America. It also reports daily/weekly resale pulp & paper prices in China and weekly prices in some other markets. The company offers a full suite of market analytical services and products (monthly reports, videos, infographics and more) that track and forecast demand, supply and prices, all available on its mobile app. It also offers online trading Marketplaces in North America and China.

I started the company, then called TerraChoice Market Services Inc., in October 1997 after a long career at the Canadian Pulp & Paper Association (CPPA) here in Montreal. Our first Market Pulp Monthly report was published April 1998. In May 2016 (now called TTOBMA – for Trade Tree Online and Brian McClay & Associates), first transactions-based, net-price indices published for NBSK, SBSK and BHK in North America. The company’s head office is now in Fort Mill, South Carolina, USA and we have branches in Montreal, Canada; Dubai, UAE; and in Shanghai and Qingdao, China.

Q2: How do you analyze the current market scenario for pulp? The Red Sea crisis, increased freight costs, and forex rate fluctuations have impacted pulp prices in the Indian subcontinent. What economic factors in Asia do you think will determine the pricing of WPP in the coming months?

Pulp pricing is still under downwards pressure in most markets with BCTMP the weakest and fluff pulp the strongest. China’s imported pulp buying has been very subdued since early March as paper machines there run at close to half speed and more domestic pulp supply has become available, recently including BSK and fluff. BHK prices in China now around $500 CIF Port and NBSK $700, both down ~$100 since then.

Pulp markets in Europe for which we include Turkey, the Middle-East and North Africa, are also exceptionally quiet. Very limited commercial engagement now as some well pulp-stocked buyers wait for prices to get closer to China levels.

North America’s pulp market is relatively stable, especially for Canadian NBSK now priced around $900 on a delivered mill basis. The tissue business is strong and Nordic NBSK suppliers face a 10% US import tariff (as do LatAm BEK suppliers).

Little near-term improvement is expected with an increasing number of countries in recession or close to it, on-again, off-again tariffs starting to disrupt trade flows, in particular, away from India and back to China until August 12 when the 90-day US-China tariff truce expires.

Moreover, with imported BHK China prices now below cash costs of higher-cost domestic mills, demand for imported pulp could revive there in a restocking phase, with a stronger CNY/USD helping somewhat.

Together, these two forces should lead to a better-balanced pulp market and rising prices starting Q3 in China and later elsewhere. While a weakening USD would help, continuing tariffs/logistics uncertainty adds downside risk.

Q3: The U.S. has imposed a 25% tariff on imports from Canada and Mexico, and a 145% tariff on Chinese goods. As Canada is a major pulp producer exporting to the U.S., do you anticipate that paper mills in Canada, China, and Mexico will seek new export markets? What trends are emerging from these tariffs? How do you think this tariff war will shape the South Asian and Indian paper industries?

With one exception, there are no US tariffs on pulp and paper imports from Canada since they are USMCA-compliant. That is, they are made from materials, labour, etc., wholly sourced in North America under the Terms of Origin conditions of the United States, Mexico, Canada (USMCA) trade agreement. The one exception is tissue paper with a high BEK content of over 50%. Canada and the US have matching 25% import tariffs on such paper.

Canada’s roughly 2 million tonnes of Premium Reinforcement NBSK exports to the US in 2024 (same to China) accounted for over 80% of America’s total NBSK imports. More than 70% of it gets used in premium tissue and especially paper towels, which account for 37% of total US tissue paper consumption. Much of that tissue is produced on thru-air-dry (TAD) machines that need hi-tensile NBSK to perform best.

With no real alternative supply, it seems unlikely that the imposition of US import tariffs on Canada NBSK would change this situation much other than increasing costs for consumers.

However, Canadian BHK exports to the US would be a risk in a higher-tariff world since there is plenty of LatAm BEK arriving in North America with more on the way.

As for South Asia and India markets, they should expect more low-cost, high quality paper & board heading there way from China and Indonesia where capacity continues to soar and consumption remains weak.

China’s exports of coated paper & paperboard reached almost 5 million tonnes in 2024, rising 15%/y since 2020. Its 2024 exports to India topped 400k tonnes, 4 times higher than in 2020. With new Ivory Board capacity this year and next in China, Indonesia, Europe and the US, along with subdued economic growth expected globally over the next year or two, more paper & board likely headed towards India and other SEA nations as long as it can.

Q4: What are the key trends in the pulp industry that you are currently monitoring, including new forms of pulp by application? Which trend do you believe will have the most significant impact on the future of the pulp market?

The most disruptive trend in the pulp industry is the magnitude of recent and continuing paper and wood pulp capacity growth in China. The high availability of domestic wood has helped increased China’s pulp production significantly and softened global pulp markets. A key China question is how much wood can continue to be redirected to pulp mills from construction/other end-uses. China produced 26 MM mt of pulp in 2024 but may be close to exhausting its domestic wood supply, especially if construction improves. Some bank analysts expect this could start as early as late 2026. (That may be a reason why several China-based companies have recently announced plans for more pulp/paper projects in Indonesia and Vietnam.)

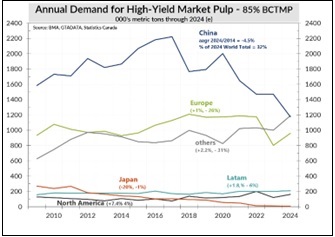

Rising China pulp production, especially integrated APMP, is having its biggest impact on international BCTMP producers. China’s 2024 demand for imported BCTMP plunged to under 1.2 million tonnes, a million tonnes lower than its 2017 peak (figure 1 – High Yield Pulp Shipments by Destination.)

BCTMP prices in China began to disconnect from other grades in Q4 2023 (figure 2) and at this year’s average $450 level, virtually all suppliers are in the red. Add to that the ramping up of Phoenix Resources International’s 2-line 850k t/y Hardwood BCTMP mill in West Tarakan, Indonesia since November 2024, and it seems likely there will be more significant market-related downtime and perhaps some permanent BCTMP mill closures before year end.

Another trend we follow closely is the continuing substitution of softwood pulp with hardwood. In 2024, roughly 60% of market pulp was hardwood and 40% softwood vs. the reverse in 2000. With BSK supply reductions a significant risk due to high costs and aging assets (requiring significant future CapEx) many BHK suppliers, customers, equipment providers, etc. are working on ways to replace more BSK, particularly in emerging markets tissue.

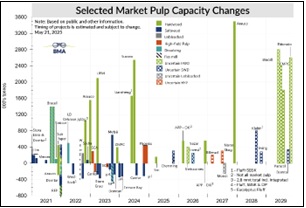

While there are several softwood capacity expansion projects under consideration in Canada and Brazil (blue bars on Figure 3), TTOBMA expects further softwood capacity closures over the next few quarters in North America and Europe due primarily to high wood costs with little if any prospect of that changing any time soon.

There is no shortage of BHK capacity expansion projects later this decade, although there is a noticeable gap during 2025-2027. So, BHK will continue to gain share over softwood and NBSK will continue to shrink to specialty-grade status and be priced as such, with NBSK’s price premium over BHK continuing to rise over the medium-term.

In the near-term, BSK supply is at heightened downside risk with forest fires raging early this season on the Canadian Prairies and the 2025 Atlantic Hurricane season starts June 1, which is forecasted to be more active-than-average in the US South, which accounts for about 80% of the world’s fluff pulp.

Q5: Molded fiber products, manufactured using wood fiber technology, are rapidly penetrating the market and becoming a significant segment. Do you think this could impact pulp availability in the near future?

Molded fiber products are seeing significant growth and of increasing interest to pulp suppliers, especially BCTMP but current volumes are small. We estimate that of the roughly 8 million tonnes of cellulose used to produce MFP, about 400k is wood pulp and about 40k tonnes are BCTMP. TTOBMA expects that could double by 2030 with world MFP demand growing about 7%/y.

Q6: A trend is emerging in the industry where a few A-grade mills in India have significantly reduced their reliance on virgin wood fiber by increasing the use of recycled paper. Do you think high wood costs and cheap imported paper are driving this shift? How do you think this will impact their quality and profitability in the long term?

Switching to more recovered paper (RCP) and away from pulp is probably not a long-term solution. Internationally trade RCP was freed up significantly after China’s Operation National Sword (ONS) policy to effect Jan 1, 2018 essentially banning the import of RCP. China’s annual RCP imports had recently been as high as 28 million tonnes. However, with world graphic paper consumption declining 5%+/y, its current 25-30% of total RCP, will continue to decline. Moreover, recovery rates for OCC are now over 80% in many developed markets, and includes diminishing virgin pulp fiber content. With global demand for containerboard growing about 2.5%/y through 2030. It is likely that RCP’s demand/supply balance and pricing could trend higher the rest of this decade.

Q7: The pulp market is experiencing shifting dynamics due to changes in global trade patterns and geopolitical factors. Changes in trade agreements, tariffs, and economic policies can have significant implications for pulp pricing, demand, and supply chain dynamics. What major changes do you forecast for the South Asian region?

As mentioned earlier, the region should expect more low-cost paper from new machines in China and Indonesia and persistent risks of logistical disruptions depending primarily on US tariffs. We expect pulp pricing should remain relatively low through 2026 but about 10% higher than 2025 and that they will average 25% higher in 2027 reflecting the lack of new capacity being added over that period 2025-2027 and the likelihood of further capacity closures.

Q8: The European Union Deforestation Regulation (EUDR) mandates that products must be deforestation-free, produced in compliance with relevant laws, and accompanied by a due diligence statement containing precise geographic coordinates. How would you describe the state of the pulp market following the implementation of the EUDR?

While the EUDR is scheduled to come into force December 20, 2025 there is still plenty on uncertainty about its impact. In late May the European Commission released its risk list classifying countries as low, standard or high risk of deforestation. Canada, Chile, India, the US and Europe are considered low-risk while Brazil, Uruguay and Indonesia are considered standard risk and will face more onerous reporting requirements?

Germany has reportedly requested that a zero-risk category be added that would exempt those listed from essentially any compliance.

It seems most pulp suppliers have prepared themselves to comply with the EUDR but others are still uncertain. Preparedness is probably highest amongst EU and LatAm producers. Canada is mixed with Eastern Canada better prepared than those in the West but very little NBSK from Canada still goes to Europe.

There is risk that some American fluff pulp producers would have issues meeting the EUDR’s reporting requirements given their dependance on many, small woodlot owners. The US exported close to 1 million tonnes of BSK to the EU in 2024 and most of that was fluff. However, the EUDR does have one relevant exemption and that is for products under HS code 9619 [Sanitary towels (pads) and tampons, napkins (diapers), napkin liners and similar articles, of any material]. So, if for any reason US fluff exports to the EU get EUDR-limited, there would be opportunities for non-EU hygienic products makers to export more US-fluff based products to the EU.

Q9: In the context of India, 2025 could be a challenging year due to the potential price softening of imported paper resulting from increased pulp availability through expansion in the pulp segment. Please share your opinion on this.

FBB prices in China are now around $450 with the industry already running around half speed. There is more new capacity starting up this year and another 1.2 mmt/y IB line is scheduled to start up in Indonesia early next year. Price pressure in India from low-priced imports will likely continue for an extended period.

Q10: The Indian paper industry has emphasized enhanced plantation activities to secure raw materials and compete with international businesses. How does TTOBMA evaluate pulp or fiber production in India and its efforts to become self-sufficient in pulp generation?

I regret to say that we do not have a solid understanding of pulp and fiber production in India but we plan to develop one.

Q11: Do you think that mergers and acquisitions in global pulp production could lead to a monopolistic market for paper manufacturers in the near future?

No, we think pulp markets remain diversified enough (top 5 BSK and BHK producers account for around one-half of total supply) so that market forces should continue to dictate pricing movements that TTO’s net-price indices accurately reflect.

Q12: How do you foresee the growth of the paper and pulp market in FY25–26 amid the decline of the Chinese paper market?

Visibility is clouded now by on-again, off-again US tariffs and the uncertainty that feeds. Global economy slowing as consumers and businesses ‘wait and see’. Oversupply, relatively low prices and periodic market-related paper downtime and more permanent paper capacity closures are likely to continue.

Web Title: With subdued economic growth expected globally over the next year or two, more paper & board likely headed towards India and other SEA nations as long as it can, says Mr. Brian McClay of TTOBMA

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)