India moves to Impose Anti-Dumping Duty on Virgin Multi-Layer Paperboard Imports from China and Chile

India moves to impose Anti-Dumping Duty on Virgin Multi-Layer Paperboard imports from China and Chile

- DGTR recommended the imposition of anti-dumping duty for five years under the lesser duty rule.

- Duties will be imposed equal to the lesser of the dumping margin or injury margin

- The final decision now rests with the Central Government, which is expected to issue a notification in due course.

The Pulp and Paper Times | Delhi

In a significant step aimed at safeguarding the domestic paper industry, the Directorate General of Trade Remedies (DGTR) has recommended the imposition of anti-dumping duty on imports of Virgin Multi-Layer Paperboard from China PR and Chile. The recommendation comes after an extensive investigation initiated on the basis of a petition filed by the Indian Paper Manufacturers Association (IPMA), which argued that cheap imports were causing material injury to Indian producers.

The development, if implemented by the Central Government, will have far-reaching consequences for India’s packaging sector, domestic producers, and trade relations.

Background of the Case

The IPMA, representing key domestic players such as Aditya Birla Real Estate Ltd (formerly Century Textiles & Industries Ltd), Emami Paper Mills Ltd, JK Paper Ltd, ITC Ltd, and Tamil Nadu Newsprint and Papers Ltd, filed the application before DGTR under the Customs Tariff Act, 1975 and the Anti-Dumping Rules, 1995.

The complaint alleged that producers from China PR and Chile were dumping Virgin Multi-Layer Paperboard into India at prices below normal value, thereby undercutting the domestic industry and creating distortions in the market. DGTR initiated the investigation covering the period of injury and examined extensive data on imports, costs, production, prices, and market shares before arriving at its conclusion.

Product Under Consideration

The product under investigation, Virgin Multi-Layer Paperboard, is a white, wood-pulp-based board made of multiple layers bonded together. It is predominantly used in food, beverage, pharmaceutical, and FMCG packaging.

The product includes:

• Folding Box Board (FBB)

• Solid Bleached Sulfate Board (SBS)

• Cup Stock Paper/Board

• Liquid Packaging Board

The relevant grades fall in the 140–450 GSM range.

However, the investigation excluded:

• Recycled paperboards

• Coated/uncoated cigarette boards

• Two-side coated artboard imported for printing

• Multi-layer boards laminated with plastic, aluminium, or other metals used in liquid packaging

This distinction was crucial, as stakeholders argued over overlaps between packaging boards and high-quality printing boards.

Arguments by Interested Parties

For Exclusion

Several importers and user industries made submissions requesting that certain categories of paperboard be excluded from the scope:

• Coated Artboard: Claimed to be different from FBB, used for graphical printing rather than packaging. Imported artboard was said to be priced 20–30% higher than virgin multilayer boards.

• Cup Stock: Stakeholders argued that Indian producers’ cup stock failed to meet international standards, forcing import reliance despite higher prices. Imported cup stock was noted to be priced at a premium of 10–25%.

• Cigarette Boards: It was claimed that FBB used for cigarette packaging had different specifications, higher GSM, and higher import prices, and therefore should not be treated as equivalent to standard packaging boards.

Domestic Industry’s Stand

The IPMA countered these arguments, emphasizing that:

• The product under consideration is primarily used for packaging and not as a raw material for manufacturing.

• The impact of anti-dumping duties on end-users, particularly FMCG, food, and pharma companies, would be minimal.

• Cigarette boards are technically distinct from FBB and already priced higher, justifying their exclusion.

• Domestic producers possess sufficient capacity to cater to the domestic market even if exports were to increase.

DGTR’s Findings

The Authority, after examining evidence from both sides, arrived at the following conclusions:

• Dumped imports increased during the injury period, with landed prices consistently below domestic cost of sales.

• Domestic producers suffered price undercutting, forcing them to sell below cost in order to compete.

• Costs of sales rose by 37%, while selling prices increased by only 19%, eroding margins.

• Inventories surged 67%, reflecting unsold stock and volume injury.

• Imports from other countries such as Belgium, Brazil, USA, and Russia collectively accounted for just 4.5% of imports—below the significance threshold.

The DGTR noted that while product exclusions were valid for certain categories (such as liquid packaging material with four or more layers), the core grades under investigation fell squarely within the definition of Virgin Multi-Layer Paperboard.

Anti-Dumping Duty Recommendation

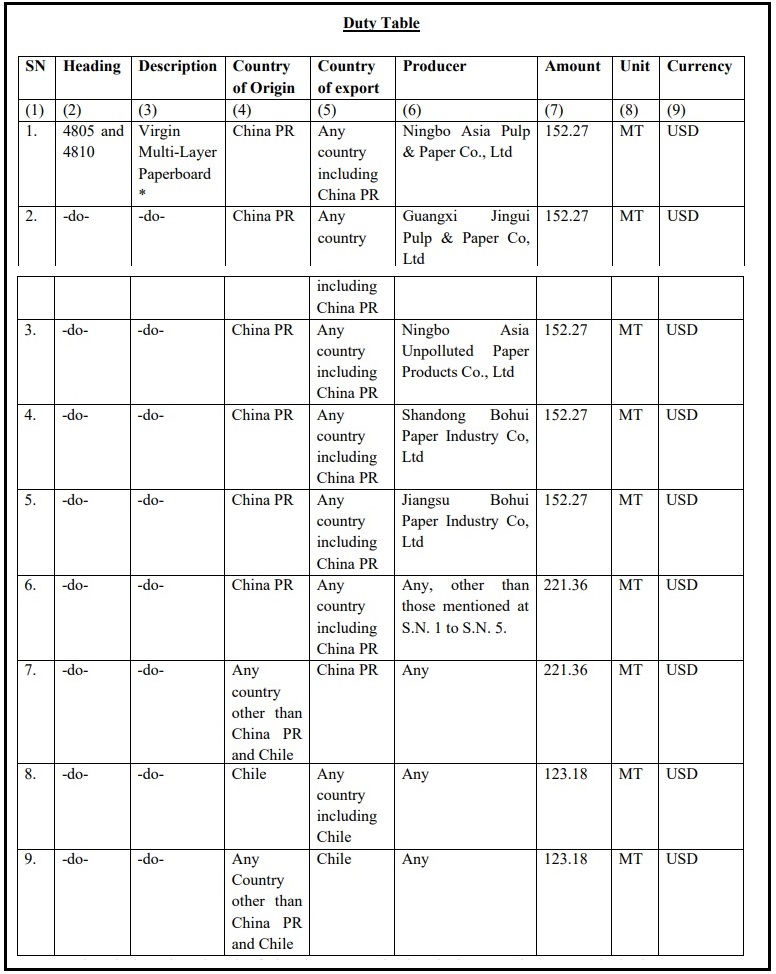

Having established dumping, injury, and causal link, DGTR recommended the imposition of anti-dumping duty for five years under the lesser duty rule. This means duties will be imposed equal to the lesser of the dumping margin or injury margin.

The recommended duties are:

• China PR:

-USD 152.27 per MT for specified producers (Ningbo Asia Pulp & Paper Co. Ltd, Guangxi Jingui Pulp & Paper Co. Ltd, Shandong Bohui Paper Industry Co. Ltd, Jiangsu Bohui Paper Industry Co. Ltd)

-USD 221.36 per MT for other exporters

• Chile:

-USD 123.18 per MT for all producers and exporters

The final notification will be issued by the Central Government, bringing the duties into force.

The case underlines India’s willingness to deploy trade remedies to protect vulnerable sectors from unfair practices. With imports from China in particular under scrutiny across multiple product categories, this move adds to the series of anti-dumping measures targeting Chinese goods.

Conclusion

The DGTR’s recommendation marks an important intervention in India’s fast-growing packaging sector. By proposing duties on dumped imports of Virgin Multi-Layer Paperboard from China and Chile, the Authority has sought to correct market distortions and support domestic manufacturers.

If implemented, the duties will remain in place for five years, offering Indian producers protection while ensuring fair competition. At the same time, the minimal impact on downstream industries suggests that the measure strikes a balance between safeguarding local manufacturing and maintaining affordable packaging solutions for consumer goods.

The final decision now rests with the Central Government, which is expected to issue a notification in due course.

Web Title: India Moves to Impose Anti-Dumping Duty on Virgin Multi-Layer Paperboard Imports from China and Chile

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)