Kraft Paper: Demand Trends, Growth Outlook, and Input Cost Perspectives

Kraft Paper: Demand Trends, Growth Outlook, and Input Cost Perspectives

The Pulp and Paper Times

The imposition of a 50% tariff in certain trade segments risks creating a trade imbalance, which could push up container freight rates - Mr Hardik Patel, Director - Om Sree Papertek

Kraft Paper Market Update – South India

The Kraft paper market in South India is currently experiencing relative stability, a welcome change after months of muted demand. With the festive season approaching, the market is witnessing a gradual uptick in activity as buyers begin building stock for the peak demand period ahead. Traditionally, this time of year sees increased procurement in anticipation of heightened consumption, and this year is no different.

This revival in demand comes as a relief to the industry, especially since the market has remained relatively subdued over the past few months. One of the most notable developments is price stability. For the first time since 2020, Kraft paper prices have remained steady for more than two consecutive months. This sustained stability can be attributed to concerted efforts by mills to maintain consistent pricing, which in turn has helped restore buyer confidence and encourage market activity.

On the raw material side, imported waste paper prices have stayed largely stable. However, ongoing global trade uncertainties, coupled with fluctuations in the US dollar exchange rate, pose a potential challenge. A stronger dollar increases import costs, impacting overall production expenses for mills dependent on imported waste paper.

The domestic waste paper market too has shown stability in recent weeks, as the absence of significant upward movement in imported prices has provided some breathing space to local converters and manufacturers. However, there is a need for caution. The imposition of a 50% tariff in certain trade segments risks creating a trade imbalance, which could push up container freight rates. This may ultimately lead to upward pressure on prices in the coming weeks.

Looking ahead, the Kraft paper market is expected to experience a modest upward trend as the core festive season nears. This is likely to be driven by two primary factors:

1.Rising Waste Paper Prices – An increase in rates for both imported and domestic waste paper will directly influence production costs.

2.Monsoon Impact on Collections – Seasonal rains often disrupt the collection and supply of waste paper, tightening raw material availability and pushing up prices.

In summary, while the current market environment is stable and optimistic, mills and corrugators should remain vigilant. The combination of seasonal demand, supply-side concerns, and external trade factors suggests that prices may edge higher in the short term. Strategic procurement and inventory planning will be key to navigating the weeks ahead.

The pace of recovery will depend on macroeconomic conditions, retail sentiment, and end-consumer purchasing power – Mr. Pankaj Mishra, Head of Sales &Marketing, Vamshadhara Paper Mills Ltd (Sennars)

Market Overview

In FY 2024 to date, the Indian Kraft Paper market has been navigating a particularly challenging landscape. The sector continues to struggle with a clear supply-demand imbalance, primarily driven by an oversupply situation. This excess production capacity, combined with subdued consumption levels across key end-use sectors, has kept market sentiment under pressure. Additionally, the availability of domestic raw materials has remained inconsistent, leading to frequent operational disruptions for many mills. Price volatility in the Kraft paper segment has further intensified the difficulties, squeezing margins and making long-term planning more complex. As a result, most paper mills are finding it increasingly difficult to sustain operations at optimal capacity, with several operating at reduced output to avoid further inventory build-up.

Price / Local Waste Paper Price and Demand

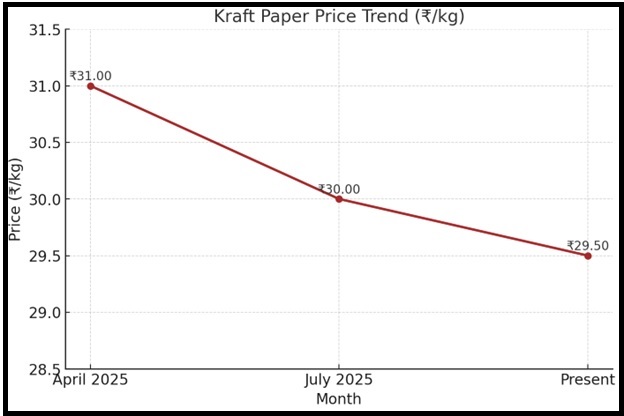

Between April 2025 and July 2025, Kraft paper prices saw a noticeable downward trend, coinciding with a slight decline in market demand. In April 2025, the basic price stood at ₹31.00/kg. By the present date, some mills are offering between ₹29.50/kg and ₹30.00/kg, reflecting the overall market softness. Last week, many mills across India, have started insting the corrugaters for a price increase in an effort to recover part of the cost escalation.

At the same time, the price of local waste paper—an essential raw material—has increased, a cost that all mills have been compelled to absorb. This combination of rising input costs and stagnant selling prices is adding to the financial strain, making cost management and operational efficiency critical focus areas for the industry.

Demand/Festive Seasons

Demand/Festive Seasons

Looking ahead, the Indian Kraft paper market is expected to witness moderate demand improvement during the upcoming festive season, particularly from e-commerce packaging, FMCG, and consumer durables. Historically, the third quarter of the financial year sees increased order volumes as distributors and converters build inventory ahead of festival-driven consumption.

However, the pace of recovery will depend on macroeconomic conditions, retail sentiment, and end-consumer purchasing power. Persistent challenges—such as raw material price volatility, elevated waste paper costs, and intense competition—are likely to keep margins under pressure in the short term. Mills with efficient operations, flexible pricing strategies, and strong downstream relationships will be better positioned to capture incremental demand during this period.

If the seasonal demand uptick aligns with stable input costs, the industry could see short-term relief. Nevertheless, sustainable growth will require a structural balance between production capacity and actual market consumption.

Web Title: Kraft Paper: Demand Trends, Growth Outlook, and Input Cost Perspectives

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)