Pulp and Paper Market Analysis, Trend, and Forecast

Pulp and Paper Market Analysis, Trend, and Forecast

Paper companies have increased prices during FY22 starting from the year's third quarter. Price hikes continued in the June quarter, while another round of Rs 3-4 per kg hike was taken in September 2022. Further Wood based mills have announced a price hike recently in Nov’22 /Dec’22.

The below article on the present state of Indian Paper Market is written by Mr Anil Singh, who is currently working as Chief Marketing Officer - with Vishal Group of Companies. Has 23 years of work experience and had the opportunity to work with companies like Trident Limited, Hindalco Industries Limited (An Aditya Birla Group Company), MRF Limited, and Genus Paper & Boards Ltd at various levels from Branch Manager, Regional Manager, Vice President, and Chief Marketing Officer. Views are personal.

11 December 2022 | The Pulp and Paper Times

India is the 15th largest paper producer in the world. India has emerged as the fastest-growing market when it comes to consumption, posting a 10.6% growth in per capita consumption of paper in 2021.

The India Paper and Paperboard Packaging Market was valued at $ 10.77 Bn in 2021 and is expected to reach $ 15.69 bn by 2027, registering a CAGR of 6.63% during the forecast period of 2022-2027.

Paper Industry was characterised as the 'sunset industry' amidst growing digitalisation, the paper industry might not be on a downfall, in fact, data and analysts suggest that the companies are growing and various catalysts will push the growth further in the near future.

Until a few years ago, the paper industry’s prospects looked in danger with growing digitalisation. Now, rich share valuations are reflecting the strong growth prospects of the industry. Paper stocks have been among the top performers in 2022 on the back of robust demand, consolidation in the sector, stable margins, and the ban on single-use plastic. JK Paper, West Coast Paper, Andhra Paper, Seshasayee Paper, and TNPL scrips have nearly doubled.

Tide has turned for the paper industry and the plastic ban provides another shot in the arm. Then the global supply of pulp was hit because of the COVID pandemic, production costs rose due to the Russia-Ukraine war, and burgeoning energy costs coupled with the short supply of coal. As per CCEA (Cabinet Committee on Economic Affairs) guidelines, the preference for Coal allocation in India is for the Power sector, and getting allocation to run captive power plants is challenging for small and medium-sized paper mills.

The Wholesale Price Index of paper and paper products across India during the financial year 2022 was over 137. The price index value of paper and paper products increased by about 37 percent from the base year of 2012. The country saw an overall increase in the price index over the years from the financial year 2013.

The factors affecting price increase or drop are components that influence the market, including freight shortages, price increases (both for sea freight for imported raw materials, chemicals, and local freight for the transportation of goods), and Mill closures (some short-term during lockdowns and others permanently).

The raw material is a constraint for mills whether it is agro, wood, or recycled waste paper.

Also, import costs of white cuttings (waste for making paper) recycled by mills to produce the papers have increased. Secondly, prices of pulp in the global market are near record highs. Thirdly, demand—domestic and export—for printing and writing papers has outstripped supply.

The reasons attributed for the paper hike are "unprecedented pressure on supply chains, spiralling shipping costs, soaring energy prices and security-of-supply concerns due to the uneven economic rebound and the release of pent-up demand after the pandemic and the current geopolitical situation."

Paper is measured in grams per square metre (GSM). The higher the GSM, the heavier and thicker the paper.Generally,the higher the GSM lower is the price.

Paper companies have taken multiple price hikes in the last few months amid a rise in input costs, mainly in energy, chemicals, and packaging expenses owing to geopolitical crisis and logistical issues. This is due to higher operating costs, such as rising input costs and higher-quality environmental standards. An additional factor driving the current paper prices is supply not being able to keep up with the growing demand.

According to a market report, all grades of paper are on the rise. Wood pulp is up 25% in 2021, averaging $250 per ton.

Papermakers can’t absorb these costs without passing them along. So, prices are skyrocketing across the industry. Paper companies had raised prices by around 6-15%.

Several businesses already facing lots of hits to their budget, this is one more wrench because paper is essential. Its usage covers many different facets. For those that handle print and mail in-house with in-plant, they are already facing more expenses.

Furthermore, the depreciation of INR (from 75.5 to 82 INR to USD in the last 120 days) has resulted in a steep cost increase for all imported raw materials.

On the other hand, prices of other grades of paper such as Kraft, used in packaging or corrugated boxes, are swinging up and down. Demand for kraft paper and corrugated boxes has turned sluggish due to overcapacity.

“Several packaging paper grade units are now functioning only 4-5 days a week. The situation is in contrast to printing and writing paper.

Currently, The situation on the import front has eased and prices of waste paper cuttings have eased.

JK Papers Ltd in a press release said it had its best quarterly result ever for the June quarter with its profit after tax (PAT) rising by 152 percent year-on-year. Similarly, West Coast Paper’s PAT was up eight times and that of Emami Paper Mills has increased 68 percent.

Information and Broadcasting Minister Anurag Thakur told the Lok Sabha some time ago that newsprint imports had declined to 5.97 lakh kg last fiscal from 6.48 lakh kg in 2020-21 and 12.96 lakh kg in 2019-20 and 2018-19.

“Demand for printing and writing paper is higher than supply. There is demand from publishers and educational institutions, for exports and through government tender. Exports are substantially high than in the pre-Covid period,

Paper sales are expected to grow at a CAGR of 8-9% over the next five years. "The implementation of National Education Policy (NEP) should lead to huge demand with changes in education policy and curriculum."

Fully integrated paper companies are doing well such as JK Paper, West Coast Paper, Andhra paper,Trident Paper, Satia, and Kuantum Paper are doing exceedingly well.

Paper companies have increased prices during FY22 starting from the year's third quarter. Price hikes continued in the June quarter, while another round of Rs 3-4 per kg hike was taken in September 2022. Further Wood based mills have announced a price hike recently in Nov’22 /Dec’22.

As Covid-19 gripped the world and India, the last two years have been a journey like no other for the Writing Printing Paper segment both nationally and globally.

Children got trained in E-learning, Zoom, WhatsApp, Teams, WebEx, etc, and submission of assignments through online mode.

With the huge demand and all-time high pricing for the WPP grades in the domestic market encourages the import of Wood free uncoated paper in reels and can be a spoiler for the domestic market.

Although the high price for WPP has been due to the increase in bleached pulp cost which has been passed on to consumers.

Pulp prices have reached record highs due to supply-side challenges. Both NBSK and BEK stood at record highs in July 2022, not just in prices delivered to China, but also in the US and Europe.

Pulp demand is facing now downside risk. China world’s largest consumer of market pulp is witnessing a recession in the economy, a slowdown in property, zero covid policy. Globally recessionary trends were paused due to Covid now being fuelled by rising interest rates, high energy prices, high unemployment, and the Ukraine war with the threat of nuclear war.

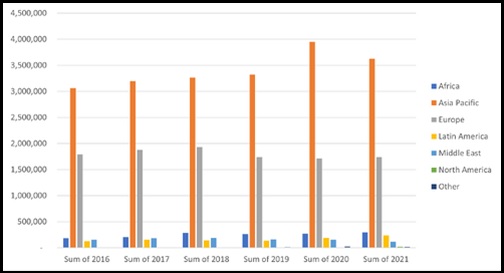

Globally Pulp capacity is expected to grow in the near future as depicted in Fig.1

Softening prices, and new supply growth to outpace demand growth.

With global demand for paper and board under threat and large volumes of new capacity ahead, we expect new supply growth for market pulp to outpace demand growth in 2023 and for market conditions to be looser extending into 2024.

Although there is enough domestic demand fuelled by State textbook tenders for improvement of literacy levels in India. Globally there is a recessionary trend due to which South East Asian & other foreign mills are pushing their products to India at a lower price which is giving customers printers/publishers an option and threat for wood-based mills to maintain to sell their monthly production in the Indian market at a competitive price. In Q3 FY22-23 exports of uncoated wood-free& packaging grades had also hit due to highly competitive prices from foreign mills.

The Q2 FY22-23 GDP numbers released on 30th Nov show that the momentum the Indian economy gained post-pandemic remains firmly in place notwithstanding global uncertainties.

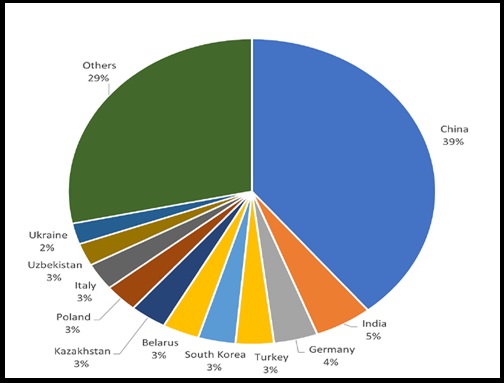

Russia exported around 6 million tons of pulp and paper products in 2021, with close to 40% of the flow arriving in China’s market, as seen in Figure 3. With a deep look at Russia’s export product structure, market pulp still dominates its export portfolio compared to other grades, as illustrated in Figure 4.

A majority of this exported market pulp is shipped to the Asian Pacific market – primarily China, as seen in Figure 3.

Since Russia’s invasion of Ukraine began in late February, Europe (Russia's second-largest trading partner) has followed NATO and imposed significant sanctions on Russian products. As the sanctions have expanded, the trade of forest products between Russia and the western world has virtually ceased.

With western countries implementing numerous sanctions on Russia, two of the largest populated countries—China and India—still refuse to position themselves between Russia and the west, with clear strategies to take advantage of the situation in order to develop their own domestic economies. Both China’s and India’s economies have experienced a fiber and energy shortage – and the recent energy agreement between Russia and India has already improved India’s energy strategy countrywide.

However, the major obstacle for Chinese suppliers is not the technology challenge, but the soft skills to trade internationally, which is relevant to the cost of capital, international trading skills, support from financial institutions, and the main key: human resources. These are the major drivers that have slowed the globalization of Chinese suppliers and India can take advantage of this front for exportproducts to the world and lower their raw material cost by having Russian fibre and energy sources.

(The writer is the Chief Marketing Officer of Vishal Group views are personal.)

Web Title: Pulp and Paper Market Analysis, Trend, and Forecast

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)