Khanna Paper, Century Pulp & Paper issue advisories on Revised GST Slabs; Prepare for possible base price adjustments

Khanna Paper, Century Pulp & Paper issue advisories on Revised GST Slabs; Prepare for possible base price adjustments

GST Revision for Paper Sector to Take Effect from September 22, 2025

The Pulp and Paper Times

The Goods and Services Tax (GST) Council’s recent decision to revise rates for the paper sector is set to create ripples across manufacturers, traders, and end-users. With dual implications—Nil GST on certain categories of paper and an increase to 18% on others—the industry is preparing for operational and pricing adjustments. Dealers have been cautioned to carefully manage billing, pass on the correct GST rates to customers, and await further government clarification on end-use categorization. Industry leaders Khanna Paper Mill and Century Pulp and Paper have issued advisories, highlighting compliance requirements and the potential impact on base prices due to non-availability of input tax credit. Stakeholders now look to the government for clear guidance to ensure smooth transition when the new rates take effect from 22nd September 2025.

In a significant development for the paper industry, Khanna Paper Mill and Century Pulp and Paper have issued communications to their dealers regarding the revision of Goods and Services Tax (GST) rates, effective 12:00 AM on September 22, 2025. The changes follow the decision of the GST Council in its meeting held on 3rd September 2025, and the subsequent government notification dated 17th September 2025.

Specific Changes under Chapter 4802

According to Khanna Paper Mill’s circular:

• Uncoated paper and paperboard used for exercise books, graph books, laboratory notebooks, and notebooks: GST reduced from 12% to Nil.

• Other uncoated paper and paperboard of a kind used for writing, printing, or other graphic purposes (other than the above): GST increased from 12% to 18%.

The company cautioned dealers that since the Government has yet to issue clarification on how to establish end use, it is important that they:

• Do not wrongly assume all uncoated paper is Nil rated.

• Align billing and pass on the correct GST to customers.

• Prepare for possible base price adjustments once clarification comes.

Action Points

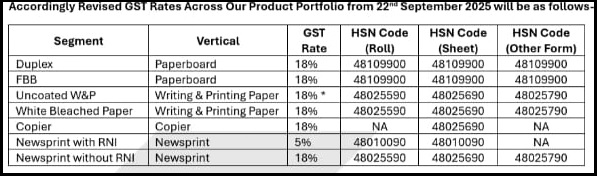

Khanna Paper Mill clarified that all dispatches made up to 21st September 2025 will continue to be billed at the existing GST rates. From 22nd September 2025 onwards, revised GST rates will be applied as per the above product categories and HSN codes.

For supplies falling under Nil GST (exercise book/notebook category under Chapter 4802), the company said it will await Government clarification. Once the mechanism is notified, the base price will be suitably adjusted to account for the non-availability of Input Tax Credit.

The mill further instructed dealers to ensure all pricing sheets, customer communication, and billing systems are updated accordingly, stressing that the revision is crucial for compliance and timely execution.

Echoing the development, Century Pulp and Paper also communicated to its dealers: “This refers to recent changes in GST %. As you are aware that GST rate on Paper and Board shall be 18% in place of 12% effective from 22nd Sept'25 (mid night). Hence all pending orders (incl paper used for Notebook, Exercise book, Laboratory book & Graph book under HSN Code 4802) will be billed @18% GST from 22nd Sept onwards. Pl take note of the same and communicate to the Market accordingly.”

Century further added: “In case of any further notification / changes from Government, we will fully comply with them and keep you posted on it.”

Uncoated Paper Trade (HSN 4802) – Emerging Imbalance Post GST Reform

Talking to The Pulp and Paper Times, Mr. Ashish Bandi, Director of Jayant Marketing, said, The trade of Uncoated Paper (HSN 4802) is witnessing severe disruption following the GST reform announcement dated 3rd September 2025.

●Educational Book Publishers have advanced their seasonal procurement of paper to ensure dispatches are completed before 22nd September, as the GST hike from 12% to 18% would otherwise inflate their costs by an additional 6%, making textbooks more expensive.

● In contrast, Notebook Manufacturers, caught in a state of regulatory confusion, have directed suppliers to withhold dispatches. This is because they will be required to reverse the Input Tax Credit (ITC) availed up to 21st September, which in effect increases their effective paper cost by nearly 12%.

This dual pressure—preponed demand on one side and supply standstill on the other—has created a drastic imbalance in the paper trade ecosystem, adversely affecting the entire value chain.

Web Title: Khanna Paper, Century Pulp & Paper issue advisories on Revised GST Slabs; Prepare for possible base price adjustments

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)