Indian Paper Industry: Challenges, Opportunities, Trends, and the Future by Mr. Rajat Sarkar of Resourcewise

Indian Paper Industry: Challenges, Opportunities, Trends, and the Future by Mr. Rajat Sarkar of Resourcewise

- Kraft/Containerboard faces significant challenges, including a 68% surge in imports over the past two years, primarily from ASEAN countries.

- Investments in the tissue sector are on the rise, targeting both local consumption and international markets

- Imports from China have skyrocketed by 181% over the past two years, while those from ASEAN countries have surged by an astounding 247%.

The article below is exclusively written by Mr. Rajat Sarkar, who is currently working as Research Manager ( Asia Pacific) at Resourcewise, a leading business intelligence consulting firm that supports the industry's best practices with a unique combination of rich marketplace data, powerful analytics, and expert consulting. Rajat leads the data research and validation for the Asia Pacific region, covering India, China, Indonesia, Japan, Korea, and rest of Asia. He ensures the accuracy, reliability, and timeliness of data and insights that inform clients' decisions and actions.

The Pulp and Paper Times

India's pulp and paper market is undergoing a significant transformation driven by a mix of economic, demographic, and technological factors. For professionals in the paper industry, understanding these changes is crucial to capitalize on the various opportunities and navigate the many challenges that lie ahead.

Overview of the Indian Pulp and Paper Market

India remains one of the world's fastest-growing economies, with an estimated GDP growth rate of 8.2% for FY 2023–24, and projections of 6.5% to 7% for FY 2024–25. This robust economic performance is driven by sectors like manufacturing, mining, and services, despite global economic uncertainties and geopolitical challenges.

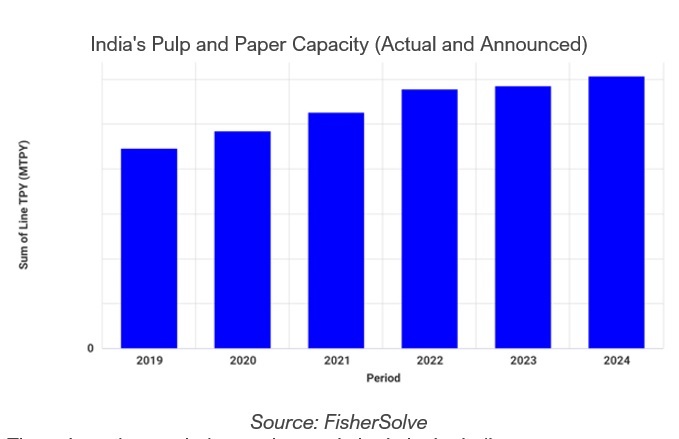

India's paper production capacity has also seen consistent growth. The industry, driven by rising demand for paper products such as packaging materials and hygiene products, is projected to expand at a CAGR of approximately 6% to 7% from 2020 to 2025.

The pulp and paper industry plays a vital role in the Indian economy, offering employment opportunities to over 500,000 individuals. Its labour contributes approximately 1.6% to India's total GDP.

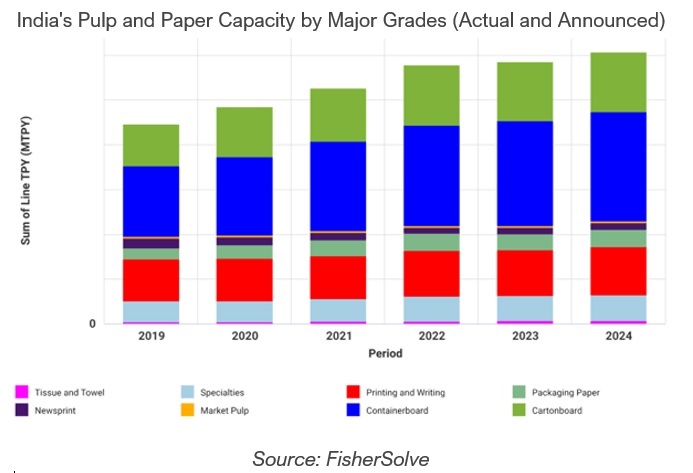

Growth in Different Grades

Writing, printing, and copier grades are performing fairly well compared to other paper grades, a trend not seen often in major producing countries. The steady demand reflects the essential nature of these products in education and business operations.

Here’s a breakdown of some of these grades:

• Writing and Printing - While demand is growing in India, other Asian markets like China are experiencing low demand and oversupply. This has led to higher import volumes at competitive prices, which pose challenges for the domestic WPP market. However, price corrections in market pulp and waste paper are promising and can support local producers.

Rising literacy rates, especially in rural areas, have fueled the demand for writing and printing paper. The growing emphasis on education and learning will continue to drive the consumption of these grades.

An example of this is the implementation of India’s New Education Policy (NEP) in the 2023-2024 academic year, which has positively influenced the demand for printing paper. Highlights of the NEP include extended schooling period, higher education reforms, universal access to school education, foundational literacy and numeracy, and more. This revamped syllabus and grade system restructuring present opportunities for paper producers.

Producers must prioritize upholding the quality and availability of printing and writing grades to meet market demands and exceed expectations. By aligning their strategies with the NEP, producers can effectively cater to the evolving educational landscape.

• B&P/Cartonboard - The Indian packaging-coated board sector is witnessing strong performance, driven by rising demand stemming from lifestyle consumption growth. However, the recycled coated board segment is experiencing overcapacity due to the commissioning of several large projects in recent years, coupled with only moderate export activity. Meanwhile, virgin board producers face challenges competing against low-cost imports, which are exerting pressure on their market positioning and profitability.

• Kraft/Containerboard - The Indian kraft paper market is experiencing growth fuelled by rising demand in packaging and e-commerce, reflecting an increased preference for eco-friendly materials. The sector benefits from innovations such as moisture-resistant and high-strength kraft paper, catering to diverse applications like transportation and food packaging. However, it faces significant challenges, including a 68% surge in imports over the past two years, primarily from ASEAN countries.

Domestic producers are also grappling with overcapacity from new installations, high raw material costs, and outdated machinery in some mills. Despite these hurdles, the market remains promising due to its sustainability focus and the shift away from single-use plastics. Investments in technology and efficiency improvements are seen as critical for maintaining competitiveness in this evolving market.

• Tissue and Specialty - These grades are performing very well, with demand exceeding supply. In the upcoming quarters, they will be a focal point, potentially generating better business for producers. High import volumes from China and other Asian countries pose a challenge for domestic producers.

The demand for tissue products, whether for household or commercial use, has also seen significant growth. Items such as toilet paper, paper napkins, and kitchen towels are becoming increasingly popular. While a large portion of the demand for paper napkins currently leans towards MG paper due to its cost-effectiveness, there is a noticeable shift towards soft tissue products. This change is primarily driven by a heightened awareness of hygiene practices and an increase in disposable incomes.

Investments in the tissue sector are on the rise, targeting both local consumption and international markets. Leading companies are spearheading these efforts with new projects and advancements. These investments showcase the potential for growth in the tissue industry and present opportunities for innovation and expansion.

However, it’s important to note that global factors such as recent conflicts, the Red Sea crisis, and US port strikes have negatively impacted the market. Therefore, the market dynamics remain volatile and difficult to predict.

An Overview of India’s Challenges

Navigating the dynamic landscape of the Indian pulp and paper market is not without its difficulties. Here are some of the key challenges that industry stakeholders must address to ensure sustainable growth and competitiveness.

High Raw Material Costs

One challenge India’s fine paper and packaging board producers are grappling with is high raw material costs. Be it waste paper, imported pulp, or wood chips, the cost pressures are significant.

The rise in raw material expenses has prompted producers to increase the prices of their final products. Fine paper and recycled board in particular have experienced notable price surges. While this adjustment is essential for sustaining profitability, it also presents a hurdle in terms of market acceptance.

Containerboard Sector Issues

India's containerboard sector (kraft grades) has also been facing several challenges recently, including surplus capacity, volatile raw material scenarios, and outdated machinery.

The adoption of advanced and efficient machinery is essential for overcoming some of these issues as it can help optimize their operations and remain competitive. Despite the current challenges, the future prospects for containerboard in India are promising. The domestic market is growing, and with the right strategies, producers can capitalize on opportunities in this sector.

Container Freight Rates

Soaring container freight rates have also significantly contributed to the demand for price hikes in board mills. The increased shipping costs have subsequently impacted the overall supply chain, necessitating adjustments in product pricing.

To address the challenges posed by increasing freight rates, producers need a range of strategies at their disposal. These include optimizing shipping routes, engaging in negotiations for improved contracts with logistics providers, and harnessing technology to enhance visibility across the supply chain.

High Imports of Paper and Paper Products

The Indian paper industry is grappling with a significant challenge from imported paper. According to the latest data from the Directorate General of Commercial Intelligence & Statistics (DGCI&S), the volume of paper and paperboard imports in India surged from 1.145 million MT in 2021-22 to 1.436 million MT in 2022-23, reaching 1.929 million MT in 2023-24. This represents an increase of over 68% in just two years.

Notably, imports from China have skyrocketed by 181% over the past two years, while those from ASEAN countries have surged by an astounding 247%. The duty-free import of paper into India has made domestic paper production uncompetitive, posing a serious threat to the sustainability of the Indian paper industry.

Opportunities to Capitalize On

Despite the challenges, the Indian pulp and paper industry is ripe with opportunities for growth and innovation. By capitalizing on emerging trends and strategic investments, stakeholders can navigate the evolving landscape and achieve long-term success.

Surge in Demand for Packaging Board Sector

India's future for packaging paper and board grades looks promising, driven by increasing urbanization, e-commerce growth, and a rising demand for sustainable packaging solutions. The shift from single-use plastics to paper-based alternatives further boosts the sector. With government initiatives promoting eco-friendly practices, domestic production is expected to grow. Advancements in technology and automation will enhance efficiency and quality in manufacturing. Export opportunities may also rise as global markets seek cost-effective, sustainable options. However, raw material availability and environmental compliance will remain critical challenges for sustained growth.

Booming Flexible Packaging Market

India’s flexible packaging market is booming, driven by a growing middle-class population and increasing export demands. The shift towards convenience, hygiene, and sustainability enhances its appeal. This growth presents significant opportunities for producers, enabling them to expand their product offerings and customer base.

Flexible packaging offers several advantages, including durability, lightweight properties, and extended shelf life. These benefits make it ideal for perishable items and other consumer goods. Innovations like resealable closures and sustainable materials are shaping the future of flexible packaging. These trends align with consumer preferences for convenience and eco-friendliness.

Decor and Absorbent Kraft Grades

With the real estate market growing steadily, décor and absorbent kraft grades have significant potential. These grades are essential for interior design and construction applications.

India's décor paper market is poised for robust growth over the next decade, driven by increasing demand from furniture, interior design, and construction sectors. The market is expected to grow at a CAGR of 6–8%, supported by rising disposable incomes and urbanization. Laminates and surface finishes account for a significant share of consumption, with imports currently fulfilling around 60% of demand. Domestic production capacity expansions and technology upgrades are likely to reduce reliance on imports and enhance competitiveness.

Emerging Trends and Consolidation

Emerging trends to watch out for in the next few years in India's market include:

• Increasing demand for paper products: There is a growing demand for paper and paper-based products in India. This trend reflects the essential nature of paper in various applications, from packaging to education.

• Market fragmentation and consolidation: The Indian pulp and paper market is highly fragmented, with many small-sized mills operating in clusters like Morbi and Vapi. However, there is a trend towards consolidation with inefficient and low-profit mills closing. Consolidating production into larger capacities optimizes resources and enhances efficiency, providing a competitive edge in the market.

• Structured waste paper collection system: A more structured and organized waste paper collection system, similar to those in Europe and the US, holds significant potential for India. Reducing dependency on imported waste paper and OCC can enhance the sustainability and cost-efficiency of the industry.

The Future of India's Pulp and Paper Industry

The future of India’s pulp and paper industry is bright, with numerous opportunities for growth and innovation. From expanding product lines to adopting advanced technologies, producers have several avenues to explore.

Focusing on sustainability, efficiency, and quality will be key to unlocking these opportunities and driving the industry forward. However, despite the promising outlook, the industry faces several challenges, including high raw material costs, supply chain disruptions, and market fragmentation.

Addressing these challenges requires strategic planning, investment, and collaboration. Producers must remain agile and proactive, anticipating and responding to these challenges effectively. To thrive in this dynamic market, producers should focus on:

• Investing in advanced machinery and technology.

• Enhancing supply chain management and efficiency.

• Expanding product lines to meet evolving market demands.

Web Title: Indian Paper Industry: Challenges, Opportunities, Trends, and the Future by Mr. Rajat Sarkar of Resourcewise

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)